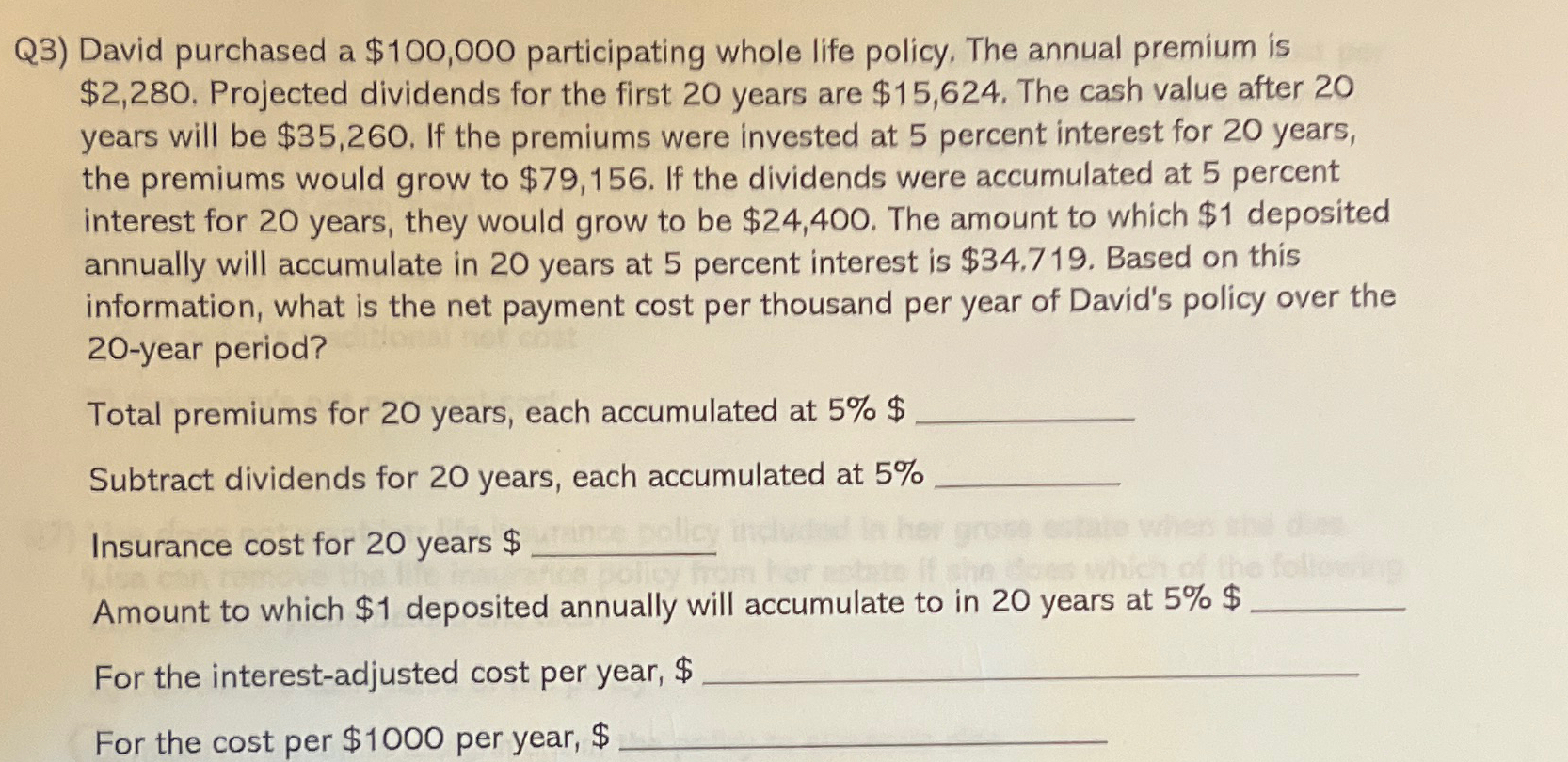

Question: Q 3 ) David purchased a $ 1 0 0 , 0 0 0 participating whole life policy. The annual premium is $ 2 ,

Q David purchased a $ participating whole life policy. The annual premium is $ Projected dividends for the first years are $ The cash value after years will be $ If the premiums were invested at percent interest for years, the premiums would grow to $ If the dividends were accumulated at percent interest for years, they would grow to be $ The amount to which $ deposited annually will accumulate in years at percent interest is $ Based on this information, what is the net payment cost per thousand per year of David's policy over the year period?

Total premiums for years, each accumulated at $

Subtract dividends for years, each accumulated at

Insurance cost for years $

Amount to which $ deposited annually will accumulate to in years at

For the interestadjusted cost per year, $

For the cost per $ per year, $

Answer ALL Blanks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock