Question: Q 3 . On April 3 , trader M , SHORTED two ( 2 ) gasoline futures for delivery month May for the market price

Q

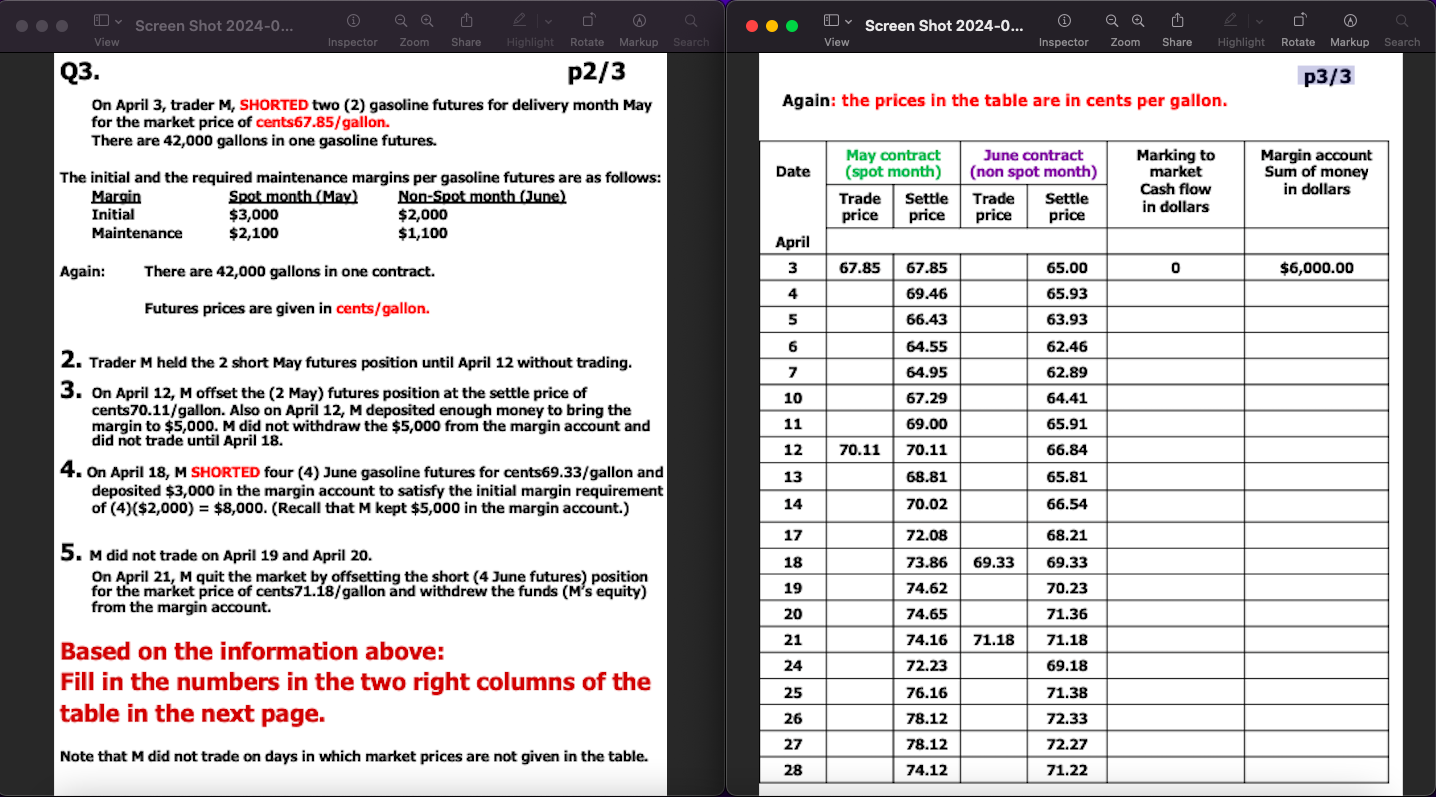

On April trader M SHORTED two gasoline futures for delivery month May

for the market price of centsgallon

There are gallons in one gasoline futures.

The initial and the required maintenance margins per gasoline futures are as follows:

Margin

Initial

Spot month May

NonSpot month June

Maintenance

$

$

$

Again: There are gallons in one contract.

Futures prices are given in centsgallon

Trader held the short May futures position until April without trading.

On April M offset the May futures position at the settle price of

centsgallon Also on April M deposited enough money to bring the

margin to $ M did not withdraw the $ from the margin account and

did not trade until April

On April M SHORTED four June gasoline futures for centsgallon and

deposited $ in the margin account to satisfy the initial margin requirement

of $$Recall that kept $ in the margin account.

M did not trade on April and April

On April M quit the market by offsetting the short June futures position

for the market price of cents gallon and withdrew the funds Ms equity

from the margin account.

Based on the information above:

Fill in the numbers in the two right columns of the

table in the next page.

Note that M did not trade on days in which market prices are not given in the table.

Again: the prices in the table are in cents per gallon.

PLEASE RESPOND IN THE TABLE FORMAT THAT IS ON THE IMAGE

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock