Question: Q 3 . Risk Management. A junior manager from the risk management department calls you and asks you to help him analyze several portfolios from

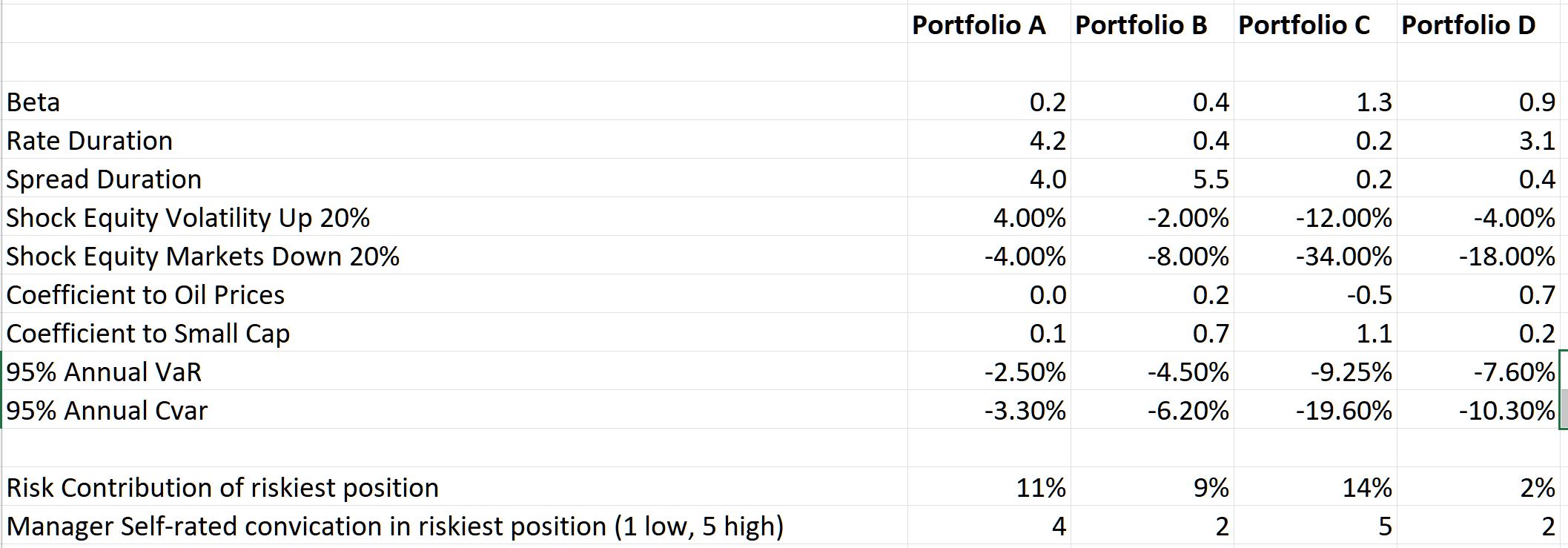

Q Risk Management. A junior manager from the risk management department calls you and asks you to help him analyze several portfolios from managers all around the world. They send you a spreadsheet marked exhibit Annoyingly the junior risk manager doesnt know a lot about the actual composition of the portfolios beyond the risk metrics spit out the firms risk system. Given that youre so approachable, they thought they would ask you first before addressing the portfolio managers directly. For funds AD they send you general risk metrics. Most of them youre familiar with, but they remind you that the coefficient to oil prices and to small cap is from a regression model, and is kind of like a beta to that specific factor instead of markets generally. Similarly, the risk contribution of the riskiest position is the of total risk that the riskiest position represents all positions together of the risk of the book while manager conviction is a rating of how much of an edge the manager believes she has in that position how strongly they believe the position will perform well

A For portfolios AD what most likely does each one have in it eg what particular types of stocks, fixed income and derivatives do they have Try to be as specific and detailed as possible.

D If you were looking to provide feedback to the PMs about low hanging fruit to improve the portfolios, where would you start? Why?

E The management wants to compute a stress scenario based on trump tariffs. This is equity markets down credit spreads wider by Rates up by What is the effect on each portfolio? Which portfolios do you think are most at risk of the stress scenario not correctly capturing all the risk?

Get me someone with credit background to answer this question perfectly.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock