Question: Q 4 . ( 1 7 points ) On January 1 of this year, JKL Corporation purchased an aircraft at a purchase price of

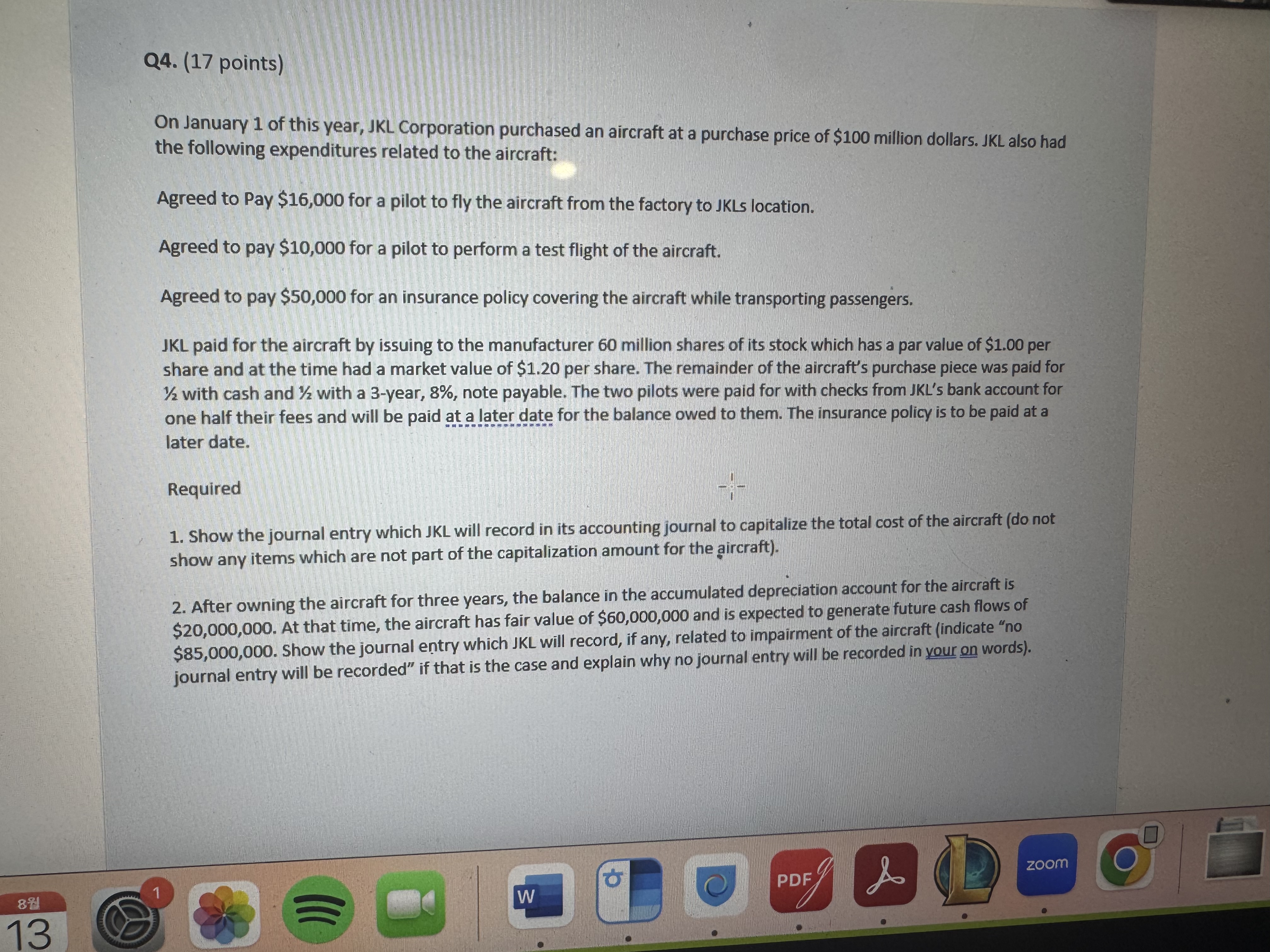

Q points On January of this year, JKL Corporation purchased an aircraft at a purchase price of $ million dollars. JKL also had the following expenditures related to the aircraft: Agreed to Pay $ for a pilot to fly the aircraft from the factory to JKLs location. Agreed to pay $ for a pilot to perform a test flight of the aircraft. Agreed to pay $ for an insurance policy covering the aircraft while transporting passengers. JKL paid for the aircraft by issuing to the manufacturer million shares of its stock which has a par value of $ per share and at the time had a market value of $ per share. The remainder of the aircraft's purchase piece was paid for with cash and with a year, note payable. The two pilots were paid for with checks from JKLs bank account for one half their fees and will be paid at a later date for the balance owed to them. The insurance policy is to be paid at a later date. Required Show the journal entry which JKL will record in its accounting journal to capitalize the total cost of the aircraft do not show any items which are not part of the capitalization amount for the aircraft After owning the aircraft for three years, the balance in the accumulated depreciation account for the aircraft is $ At that time, the aircraft has fair value of $ and is expected to generate future cash flows of $ Show the journal entry which JKL will record, if any, related to impairment of the aircraft indicate no journal entry will be recorded" if that is the case and explain why no journal entry will be recorded in your on words

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock