Question: Q 4 On 3 1 Dec 2 0 2 2 , ABC Co . Ltd ' s shareholders contributed $ 5 0 0 , 0

Q

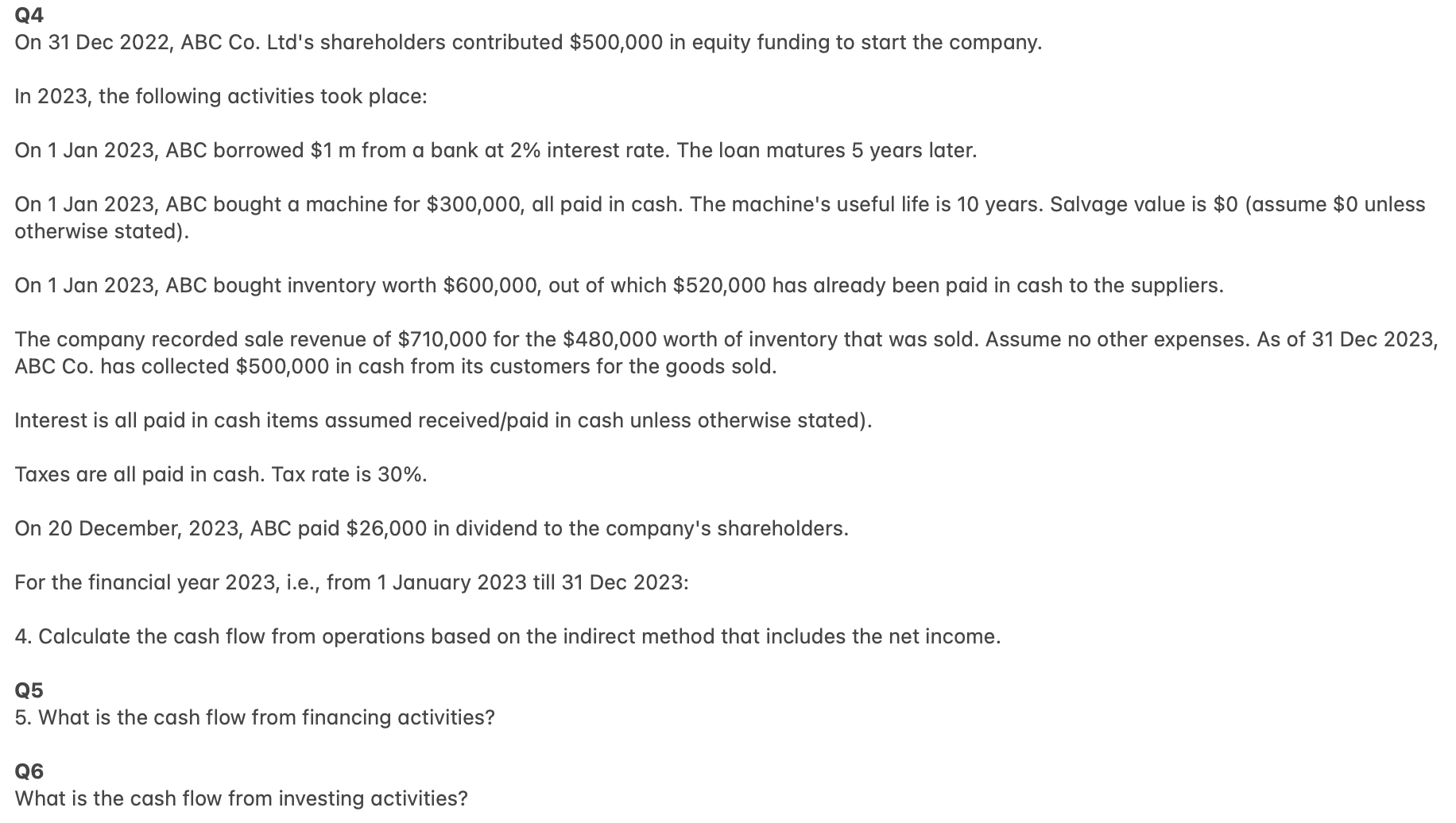

On Dec ABC Co Ltds shareholders contributed $ in equity funding to start the company.

In the following activities took place:

On Jan ABC borrowed $ from a bank at interest rate. The loan matures years later.

On Jan ABC bought a machine for $ all paid in cash. The machine's useful life is years. Salvage value is $assume $ unless

otherwise stated

On Jan ABC bought inventory worth $ out of which $ has already been paid in cash to the suppliers.

The company recorded sale revenue of $ for the $ worth of inventory that was sold. Assume no other expenses. As of Dec

ABC Co has collected $ in cash from its customers for the goods sold.

Interest is all paid in cash items assumed receivedpaid in cash unless otherwise stated

Taxes are all paid in cash. Tax rate is

On December, ABC paid $ in dividend to the company's shareholders.

For the financial year ie from January till Dec :

Calculate the cash flow from operations based on the indirect method that includes the net income.

Q

What is the cash flow from financing activities?

Q

What is the cash flow from investing activities?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock