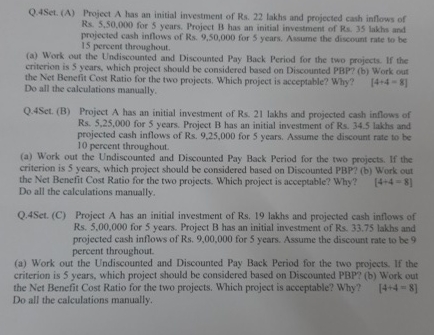

Question: Q . 4 Set. ( A ) Project A has an initial investment of Rs . 2 2 lakhs and projected cash inflows of Rs

QSet. A Project A has an initial investment of Rs lakhs and projected cash inflows of Rs for years. Project B has an initial investment of Rs lakhs and projected cash inflows of Rs for years. A stsume the discount rate to be Is percent throughout.

a Work out the Undiscounted and Discounted Pay Back Period for the two projects. If the criterion is years, which project should be considered based on Discounted PBPb Work out the Net Benefit Cost Ratio for the two projects. Which project is acceptable? Why? Do all the calculations manually.

QSet. B Project A has an initial investment of Rs lakhs and projected cash inflows of Rs for years. Project B has an initial investment of Rs lakhs and projected cash inflows of Rs for years. Assume the discount rate to be percent throughout.

a Work out the Undiscounted and Discounted Pay Back Period for the two projects. If the criterion is years, which project should be considered based on Discounted PBPb Work out the Net Benefit Cost Ratio for the two projects. Which project is acceptable? Why? Do all the calculations manually.

QSet. C Project A has an initial investment of Rs lakhs and projected cash inflows of Rs for years. Project B has an initial investment of Rs lakhs and projected eash inflows of Rs for years. Assume the discount rate to be percent throughout.

a Work out the Undiscounted and Discounted Pay Back Period for the two projects. If the criterion is years, which project should be considered based on Discounted PBPb Work out the Net Benefit Cost Ratio for the two projects. Which project is acceptable? Why? Do alf the catcutalions manuaffy.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock