Question: Q. 4 Why do we use a blended IRR, instead of using different risk regimes / return requirements for different time periods? A. It is

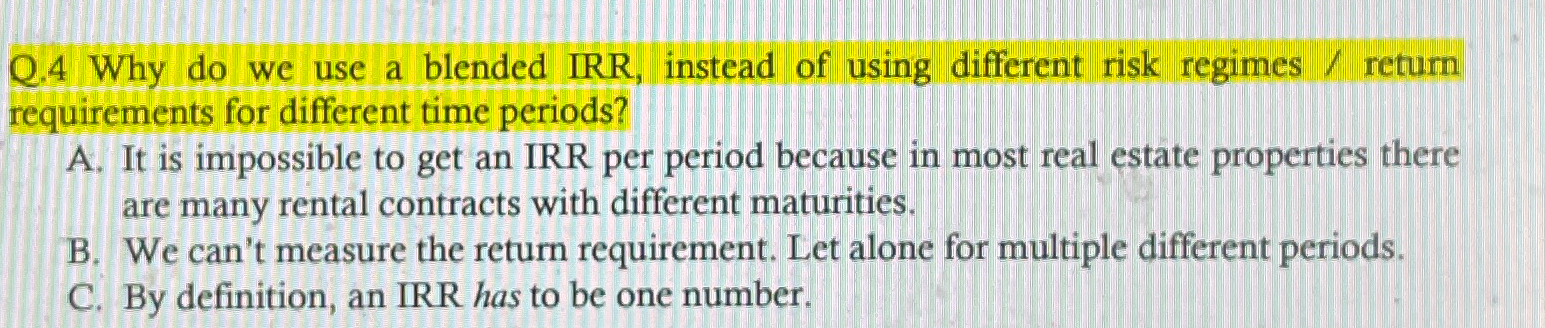

Q. 4 Why do we use a blended IRR, instead of using different risk regimes / return requirements for different time periods?\ A. It is impossible to get an IRR per period because in most real estate properties there are many rental contracts with different maturities.\ B. We can't measure the return requirement. Let alone for multiple different periods.\ C. By definition, an IRR has to be one number.

Q. 4 Why do we use a blended IRR, instead of using different risk regimes / return requirements for different time periods? A. It is impossible to get an IRR per period because in most real estate properties there are many rental contracts with different maturities. B. We can't measure the return requirement. Let alone for multiple different periods. C. By definition, an IRR has to be one number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts