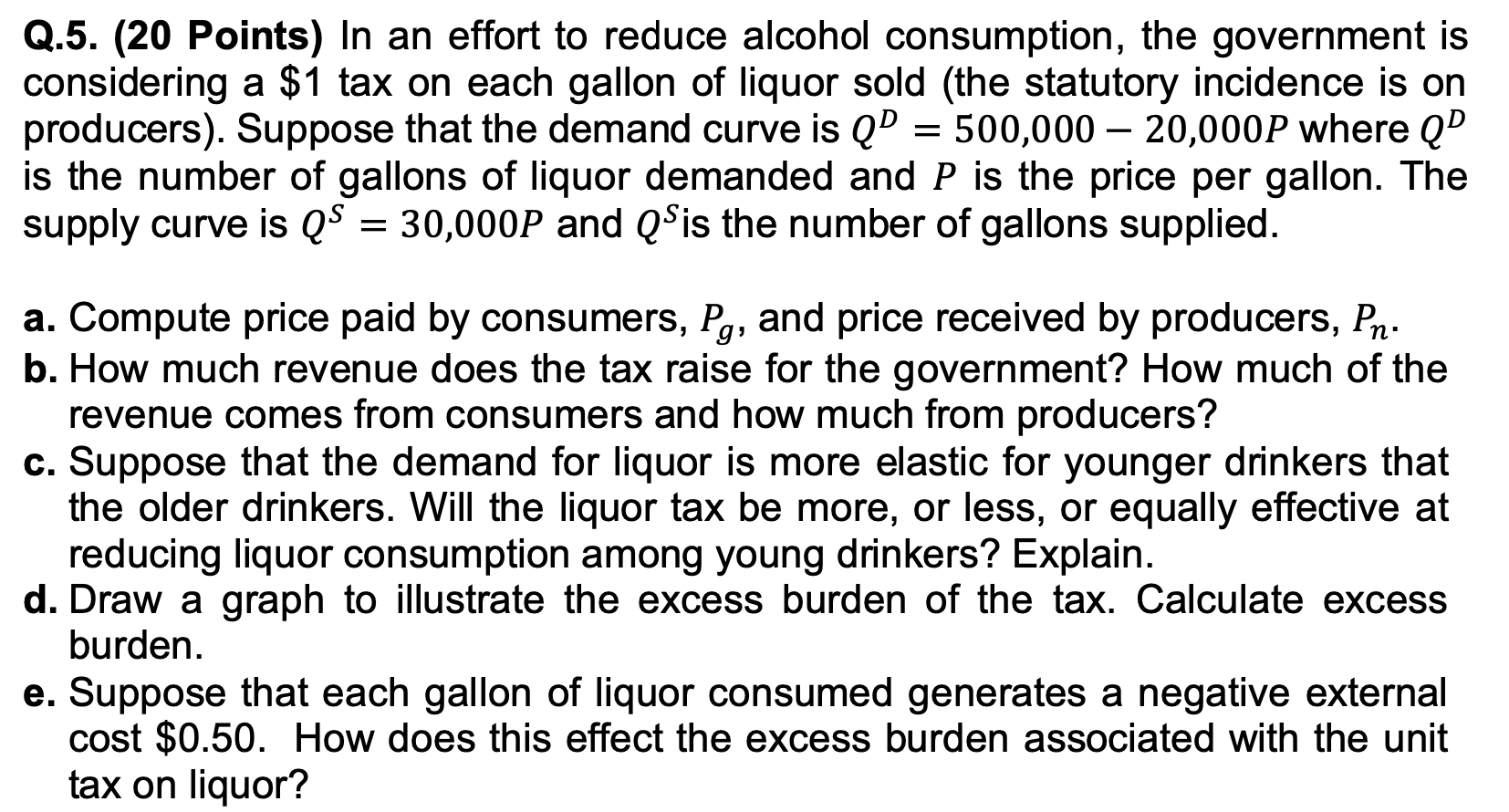

Question: Q . 5 . ( 2 0 Points ) I n a n effort t o reduce alcohol consumption, the government i s considering a

Points effort reduce alcohol consumption, the government

considering $ tax each gallon liquor sold statutory incidence

producers Suppose that the demand curve where

the number gallons liquor demanded and the price per gallon. The

supply curve and the number gallons supplied.

Compute price paid consumers, and price received producers,

How much revenue does the tax raise for the government? How much the

revenue comes from consumers and how much from producers?

Suppose that the demand for liquor more elastic for younger drinkers that

the older drinkers. Will the liquor tax more, less, equally effective

reducing liquor consumption among young drinkers? Explain.

Draw a graph illustrate the excess burden the tax. Calculate excess

burden.

Suppose that each gallon liquor consumed generates a negative external

$ How does this effect the excess burden associated with the unit

tax liquor?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock