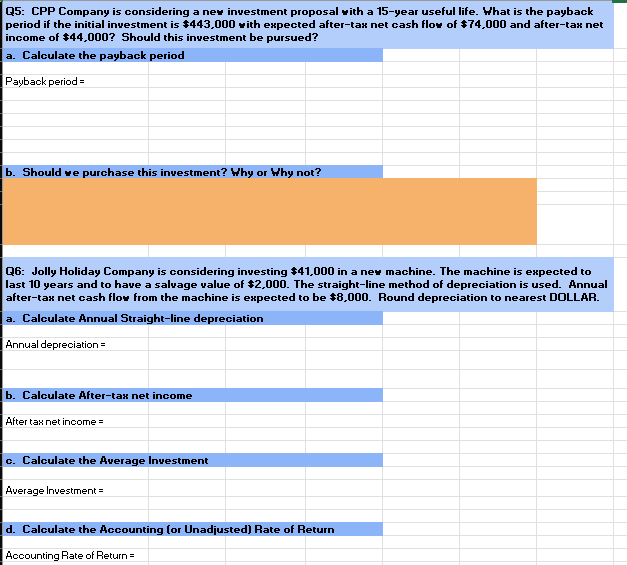

Question: Q 5 : CPP Company is considering a nev investment proposal with a 1 5 - year useful life. What is the payback period if

Q: CPP Company is considering a nev investment proposal with a year useful life. What is the payback

period if the initial investment is $ with expected aftertas net cash flow of $ and aftertan net

income of $ Should this investment be pursued?

a Calculate the payback period

Payback period

b Should ve purchase this investment? Why or Why not?

Q: Jolly Holiday Company is considering investing $ in a nev machine. The machine is expected to

last years and to have a salvage value of $ The straightline method of depreciation is used. Annual

aftertas net cash flow from the machine is expected to be $ Round depreciation to nearest DOLLAR.

a Calculate Annual Straightline depreciation

Annual depreciation

b Calculate Aftertas net income

After tax net income

c Calculate the Average Investment

Average Investment

d Calculate the Accounting or Unadjusted Rate of Return

Accounting Rate of Return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock