Question: Q 5 ( cross hedging, basis risk, minimum variance hedge ratio ) An airline expects to purchase 2 million gallons of jet fuel in 1

Qcross hedging, basis risk, minimum variance hedge ratio

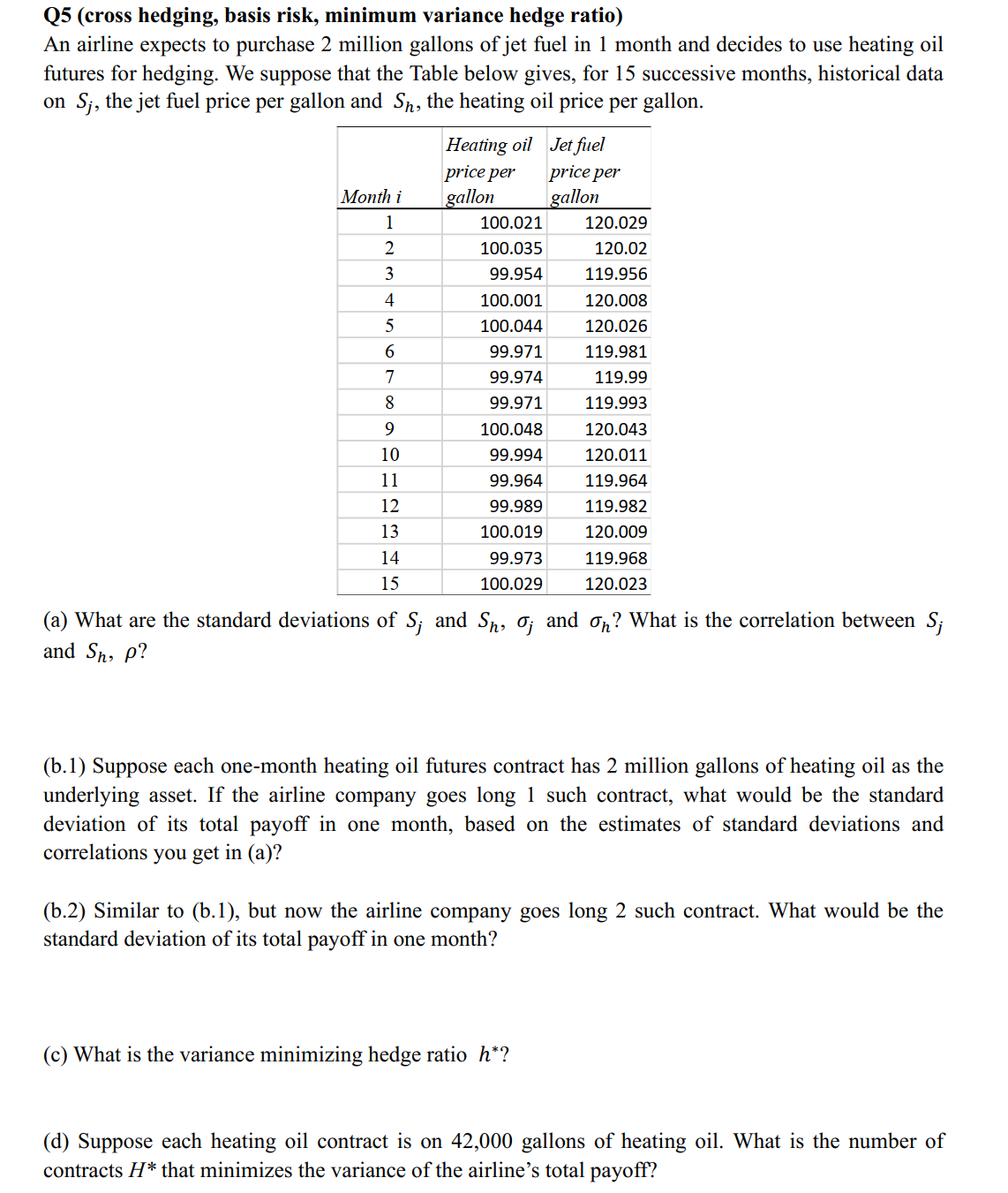

An airline expects to purchase million gallons of jet fuel in month and decides to use heating oil

futures for hedging. We suppose that the Table below gives, for successive months, historical data

on the jet fuel price per gallon and the heating oil price per gallon.

a What are the standard deviations of and and What is the correlation between

and

b Suppose each onemonth heating oil futures contract has million gallons of heating oil as the

underlying asset. If the airline company goes long such contract, what would be the standard

deviation of its total payoff in one month, based on the estimates of standard deviations and

correlations you get in a

b Similar to b but now the airline company goes long such contract. What would be the standard deviation of its total payoff in one month?

c What is the variance minimizing hedge ratio

d Suppose each heating oil contract is on gallons of heating oil. What is the number of contracts that minimizes the variance of the airline's total payoff?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock