Question: Q 5 . Use Comparables Valuation excel example shown in class and replicate that example using a real public firm of your choice fro Borsa

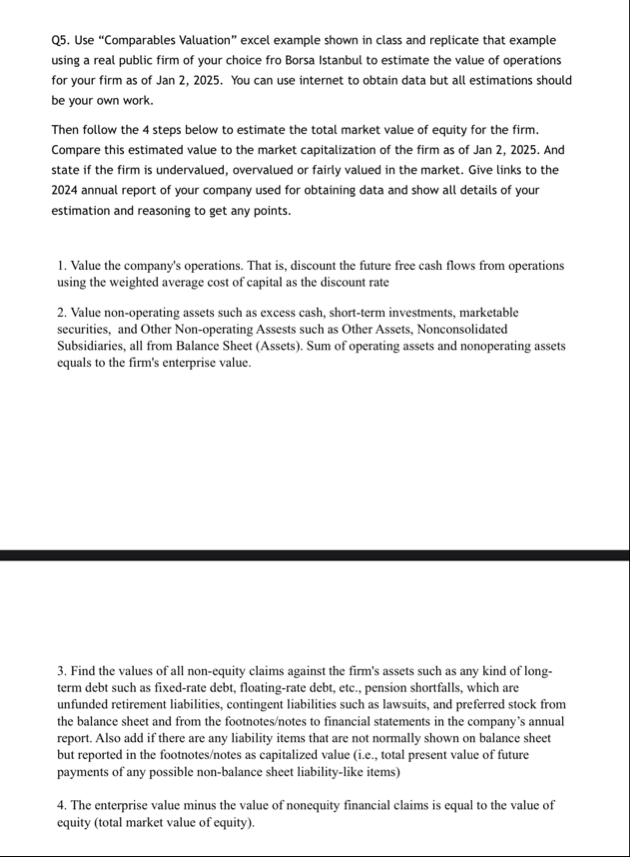

Q Use "Comparables Valuation" excel example shown in class and replicate that example using a real public firm of your choice fro Borsa Istanbul to estimate the value of operations for your firm as of Jan You can use internet to obtain data but all estimations should be your own work.

Then follow the steps below to estimate the total market value of equity for the firm. Compare this estimated value to the market capitalization of the firm as of Jan And state if the firm is undervalued, overvalued or fairly valued in the market. Give links to the annual report of your company used for obtaining data and show all details of your estimation and reasoning to get any points.

Value the company's operations. That is discount the future free cash flows from operations using the weighted average cost of capital as the discount rate

Value nonoperating assets such as excess cash, shortterm investments, marketable securities and Other Nonoperating Assests such as Other Assets, Nonconsolidated Subsidiaries, all from Balance Sheet Assets Sum of operating assets and nonoperating assets equals to the firm's enterprise value.

Find the values of all nonequity claims against the firm's assets such as any kind of longterm debt such as fixedrate debt, floatingrate debt, etc., pension shortfalls, which are unfunded retirement liabilities, contingent liabilities such as lawsuits, and preferred stock from the balance sheet and from the footnotesnotes to financial statements in the company's annual report. Also add if there are any liability items that are not normally shown on balance sheet but reported in the footnotesnotes as capitalized value ie total present value of future payments of any possible nonbalance sheet liabilitylike items

The enterprise value minus the value of nonequity financial claims is equal to the value of equity total market value of equity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock