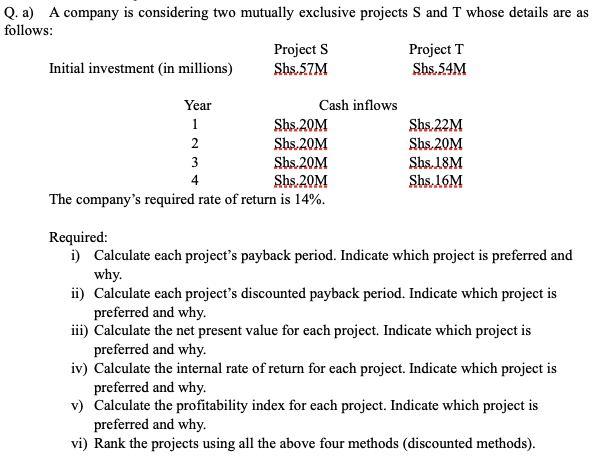

Question: Q. a) A company is considering two mutually exclusive projects S and T whose details are as follows: Projects Project T Initial investment in millions)

Q. a) A company is considering two mutually exclusive projects S and T whose details are as follows: Projects Project T Initial investment in millions) Shs 57M Shs 54M Year Cash inflows 1 Shs.20M 2 Shs.20M 3 Shs.20M 4 Shs.20M The company's required rate of return is 14%. Shs.22M Shs.20M Shs.18M Shs.16M Required: i) Calculate each project's payback period. Indicate which project is preferred and why. ii) Calculate each project's discounted payback period. Indicate which project is preferred and why. iii) Calculate the net present value for each project. Indicate which project is preferred and why. iv) Calculate the internal rate of return for each project. Indicate which project is preferred and why. v) Calculate the profitability index for each project. Indicate which project is preferred and why. vi) Rank the projects using all the above four methods (discounted methods)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts