Question: Q: - a) For (i) to (vi) Leave your answer with 3 sig. fig. and in decimals, e.g. 6.12% = 0.0612. - b) Consider the

Q:

Q:

-

a)

For (i) to (vi) Leave your answer with 3 sig. fig. and in decimals, e.g. 6.12% = 0.0612.

-

b)

Consider the 9-month oil swap. 3 months later, the oil price is $61/barrel. If cash settlement occurs, what is the payoff of the floating price payer at t=3 months on a 1,000-barrel swap agreement?

Leave 2 d.p. for the answer

-

c)

After the settlement above, what is the value of the swap? Given that the 3-month and 6-month interest rate at that time is 2% and 4.5% effectively. Assume the dividend yield (lease rate) of oil is negligible.

Leave 2 d.p. for the answer

-

Thanks!

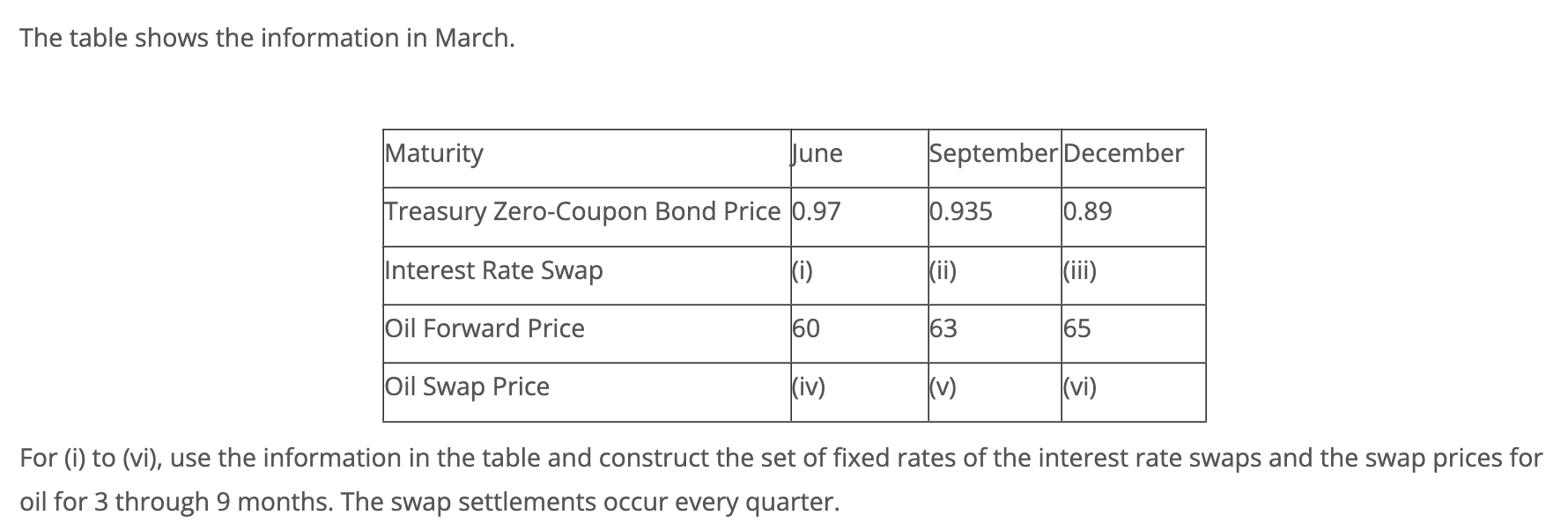

The table shows the information in March. Maturity June September December Treasury Zero-Coupon Bond Price 0.97 0.935 0.89 Interest Rate Swap (0) (ii) (iii) Oil Forward Price 60 63 65 Oil Swap Price (iv) (v) (vi) For (i) to (vi), use the information in the table and construct the set of fixed rates of the interest rate swaps and the swap prices for oil for 3 through 9 months. The swap settlements occur every quarter. The table shows the information in March. Maturity June September December Treasury Zero-Coupon Bond Price 0.97 0.935 0.89 Interest Rate Swap (0) (ii) (iii) Oil Forward Price 60 63 65 Oil Swap Price (iv) (v) (vi) For (i) to (vi), use the information in the table and construct the set of fixed rates of the interest rate swaps and the swap prices for oil for 3 through 9 months. The swap settlements occur every quarter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts