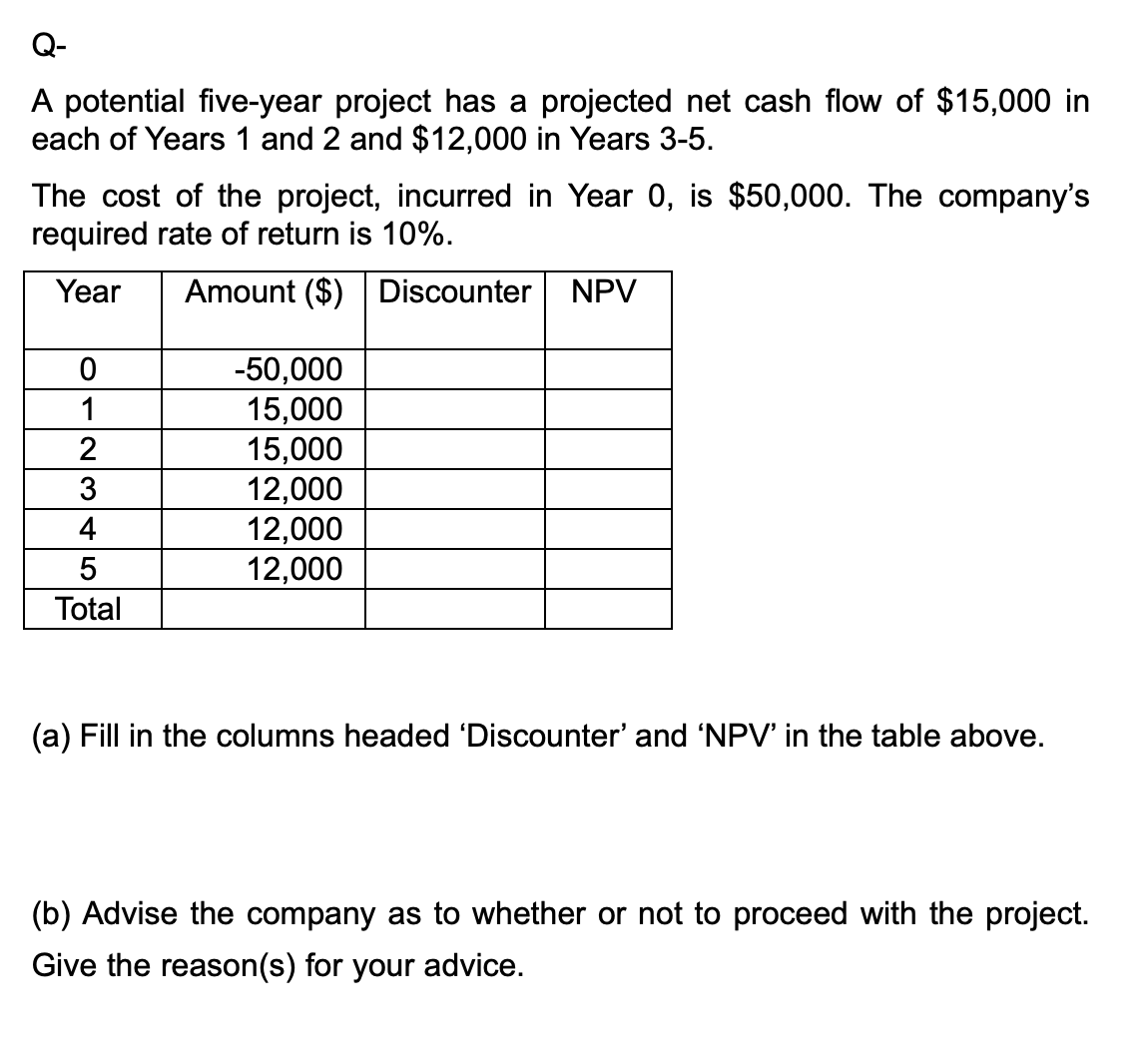

Question: Q- A potential ve-year project has a projected net cash flow of $15,000 in each of Years 1 and 2 and $12,000 in Years 3-5.

Q- A potential ve-year project has a projected net cash flow of $15,000 in each of Years 1 and 2 and $12,000 in Years 3-5. The cost of the project, incurred in Year 0, is $50,000. The company's required rate of return is 10%. W'$' W- \" -50.000 _- - 15.000 _- 15.000 _- __- __- \"_- __- (a) H\" in the columns headed 'Discounter' and 'NPV' in the table above. (b) Advise the company as to whether or not to proceed with the project. Give the reason(s) for your advice

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock