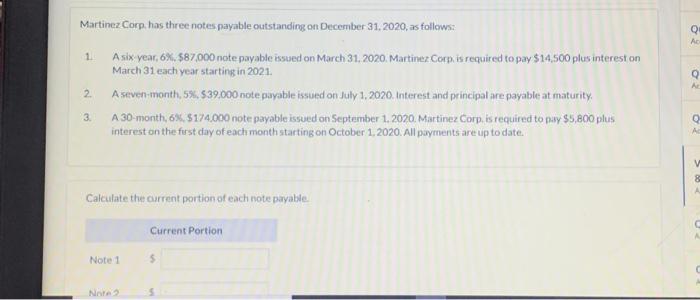

Question: Q Ac 1 Martinez Corp, has three notes payable outstanding on December 31, 2020, as follows: Asix year, 6%. $87,000 nate payable issued on March

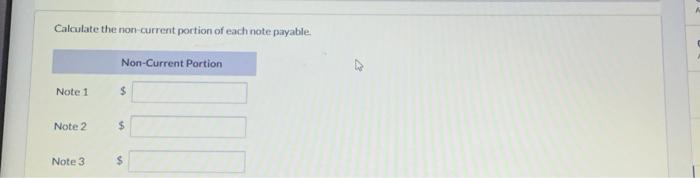

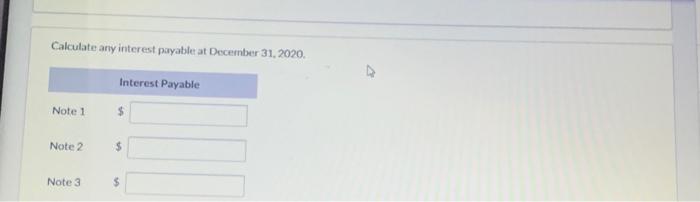

Q Ac 1 Martinez Corp, has three notes payable outstanding on December 31, 2020, as follows: Asix year, 6%. $87,000 nate payable issued on March 31, 2020. Martinez Corp. is required to pay $14,500 plus interest on March 31 each year starting in 2021. A seven-month, 5%, 539.000 note payable issued on July 1, 2020. Interest and principal are payable at maturity A 30-month, 6%, $174.000 note payable issued on September 1, 2020. Martinez Corp, is required to pay $5,800 plus interest on the first day of each month starting on October 1, 2020. All payments are up to date. AR 2 3 o A V 8 Calculate the current portion of each note payable Current Portion Note 1 5 NATA 5 Calculate the non current poction of each note payable. Non-Current Portion Note 1 $ Note 2 $ Note 3 Calculate any interest payable at December 31, 2020 Interest Payable Note 1 $ Note 2 $ Note 3 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts