Question: Q, Answer The below Question in Details from the lessons learnt from Cost Accounting A, B, C, The Answer Should be Accurate for the Question

Q, Answer The below Question in Details from the lessons learnt from Cost Accounting

A,

B,

C,

The Answer Should be Accurate for the Question at each Part.

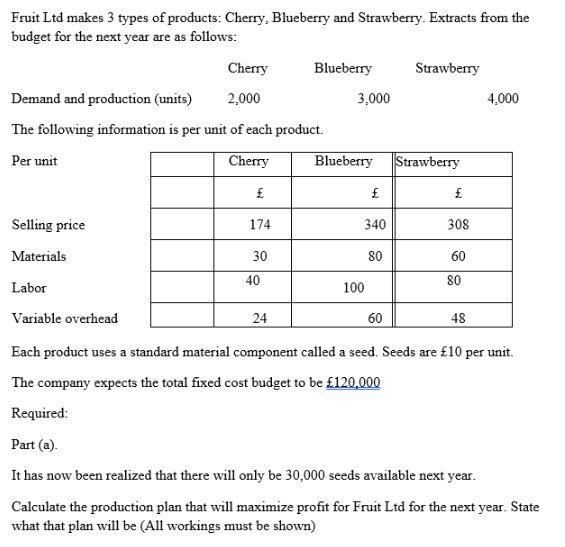

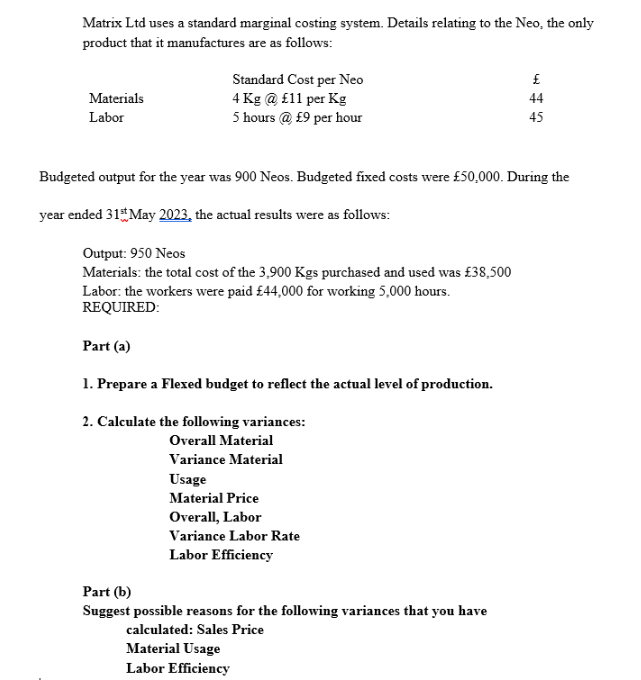

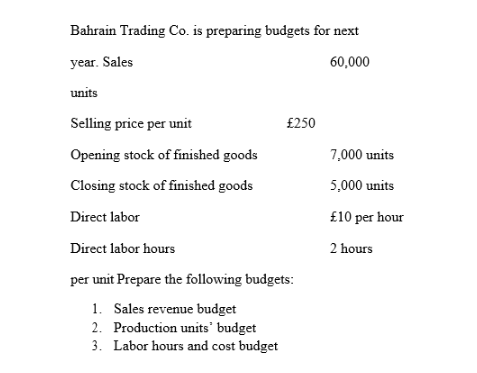

Fruit Ltd makes 3 types of products: Cherry, Blueberry and Strawberry. Extracts from the budget for the next year are as follows: The following information is per unit of each product. Per unit Selling price Materials Labor Variable overhead Each product uses a standard material component called a seed. Seeds are 10 per unit. The company expects the total fixed cost budget to be 120,000 Required: Part (a). It has now been realized that there will only be 30,000 seeds available next year. Calculate the production plan that will maximize profit for Fruit Ltd for the next year. State what that plan will be (All workings must be shown) Matrix Ltd uses a standard marginal costing system. Details relating to the Neo, the only product that it manufactures are as follows: Budgeted output for the year was 900 Neos. Budgeted fixed costs were 50,000. During the year ended 31wst May 2023 , the actual results were as follows: Output: 950 Neos Materials: the total cost of the 3,900Kg purchased and used was 38,500 Labor: the workers were paid /44,000 for working 5,000 hours. REQUIRED: Part (a) 1. Prepare a Flexed budget to reflect the actual level of production. 2. Calculate the following variances: Overall Material Variance Material Usage Material Price Overall, Labor Variance Labor Rate Labor Efficiency Part (b) Suggest possible reasons for the following variances that you have calculated: Sales Price Material Usage Labor Efficiency Bahrain Trading Co. is preparing budgets for next year. Sales 60,000 units Selling price per unit 250 Opening stock of finished goods 7,000 units Closing stock of finished goods 5,000 units Direct labor 10 per hour Direct labor hours 2 hours per unit Prepare the following budgets: 1. Sales revenue budget 2. Production units' budget 3. Labor hours and cost budget

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts