Question: Q b and c Given below is the post-closing trial balance of Super Sales, Inc, as of November 30, 2021- The December transactions were as

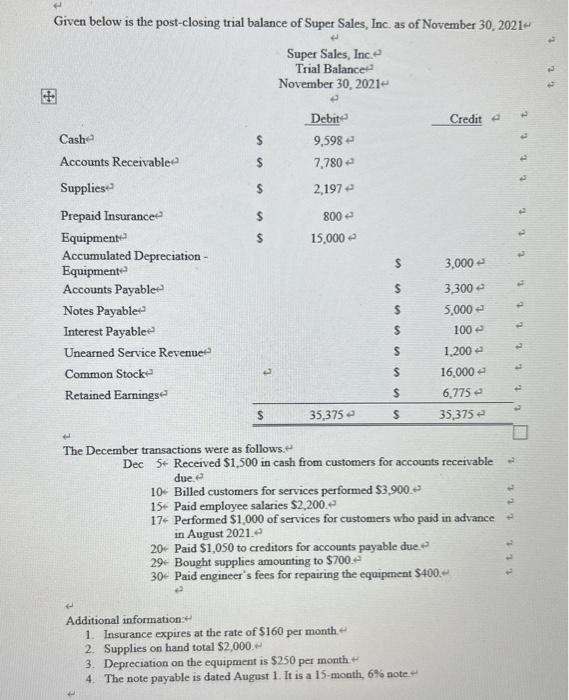

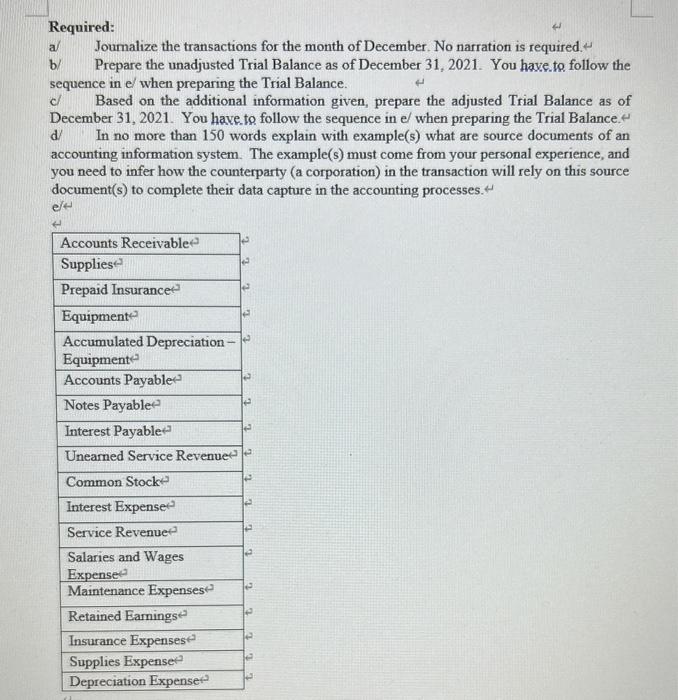

Given below is the post-closing trial balance of Super Sales, Inc, as of November 30, 2021- The December transactions were as follows. Dec 5+ Received \$1,500 in cash from customers for accounts receivable duee e 10* Billed customers for services performed $3,900. 15 Paid employee salaries $2,200. 174. Performed $1,000 of services for customers who paid in advance in August 2021 204. Paid $1,050 to creditors for accounts payable due 4 29 - Bought supplies amounting to $700.2 30+ Paid engineer's fees for repairing the equipment $400. Additional information: 1. Insurance expires at the rate of $160 per month 2. Supplies on hand total $2,000. 3. Depreciation on the equipment is $250 per month 4. The note payable is dated August 1 . It is a 15 -month, 6% notet Required: a) Joumalize the transactions for the month of December. No narration is required, b/ Prepare the unadjusted Trial Balance as of December 31, 2021. You have.to follow the sequence in e/ when preparing the Trial Balance. c) Based on the additional information given, prepare the adjusted Trial Balance as of December 31, 2021. You have.to follow the sequence in e/ when preparing the Trial Balance. d/ In no more than 150 words explain with example(s) what are source documents of an accounting information system. The example(s) must come from your personal experience, and you need to infer how the counterparty (a corporation) in the transaction will rely on this source document(s) to complete their data capture in the accounting processes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts