Question: Q B1. Valuing a Bond Issue Information Alpha is a property manager. On 1 June 2018, it listed 1,000 bonds carrying a coupon of 4.2

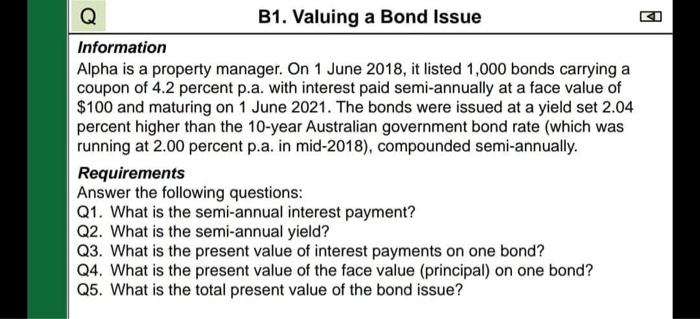

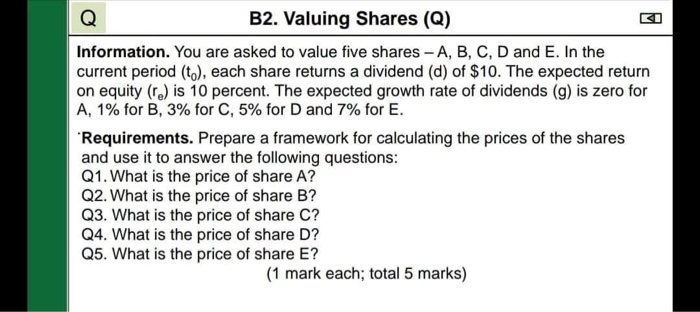

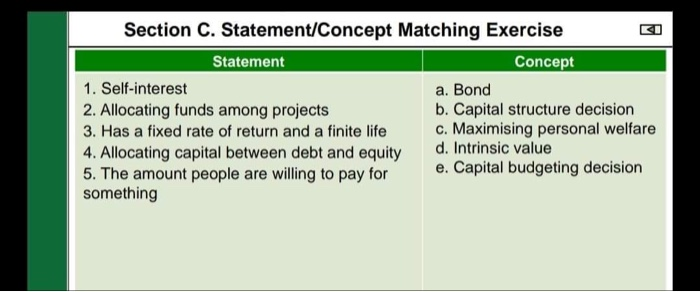

Q B1. Valuing a Bond Issue Information Alpha is a property manager. On 1 June 2018, it listed 1,000 bonds carrying a coupon of 4.2 percent p.a. with interest paid semi-annually at a face value of $100 and maturing on 1 June 2021. The bonds were issued at a yield set 2.04 percent higher than the 10-year Australian government bond rate (which was running at 2.00 percent p.a. in mid-2018), compounded semi-annually. Requirements Answer the following questions: Q1. What is the semi-annual interest payment? Q2. What is the semi-annual yield? Q3. What is the present value of interest payments on one bond? Q4. What is the present value of the face value (principal) on one bond? Q5. What is the total present value of the bond issue? Q B2. Valuing Shares (Q) Information. You are asked to value five shares - A, B, C, D and E. In the current period (to), each share returns a dividend (d) of $10. The expected return on equity (re)is 10 percent. The expected growth rate of dividends (g) is zero for A, 1% for B, 3% for C, 5% for D and 7% for E. 'Requirements. Prepare a framework for calculating the prices of the shares and use it to answer the following questions: Q1. What is the price of share A? Q2. What is the price of share B? Q3. What is the price of share C? Q4. What is the price of share D? Q5. What is the price of share E? (1 mark each; total 5 marks) Section C. Statement/Concept Matching Exercise Statement Concept 1. Self-interest a. Bond 2. Allocating funds among projects b. Capital structure decision 3. Has a fixed rate of return and a finite life c. Maximising personal welfare 4. Allocating capital between debt and equity d. Intrinsic value 5. The amount people are willing to pay for e. Capital budgeting decision something

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts