Question: Q for Decument the Decument answer all Q please A) Record the necessary adjusting and correcting journal entries for the year ended December You must

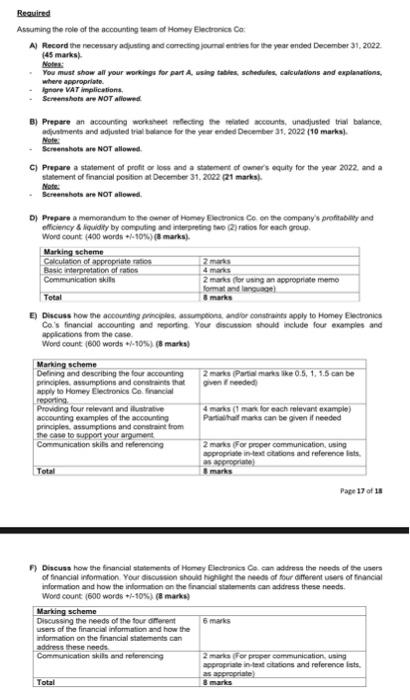

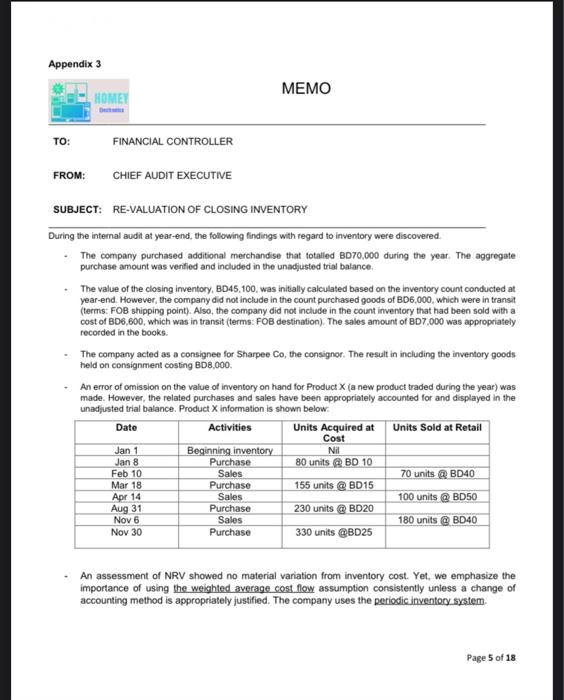

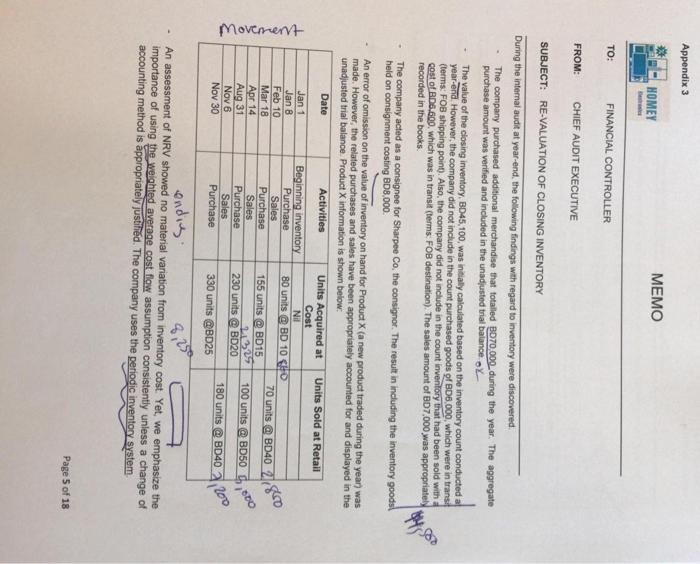

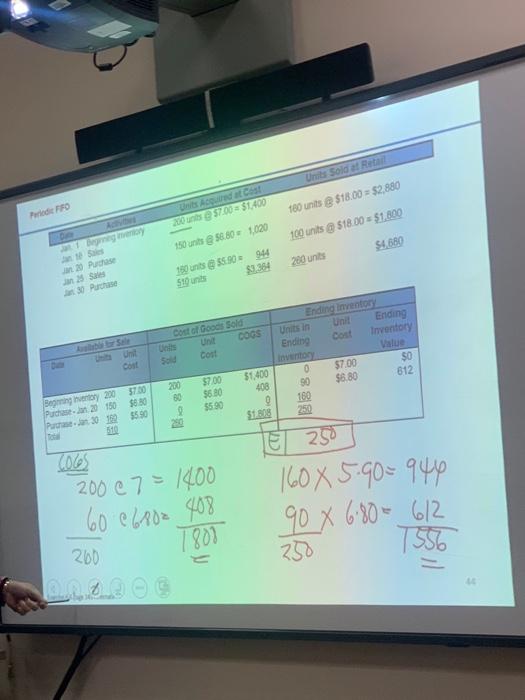

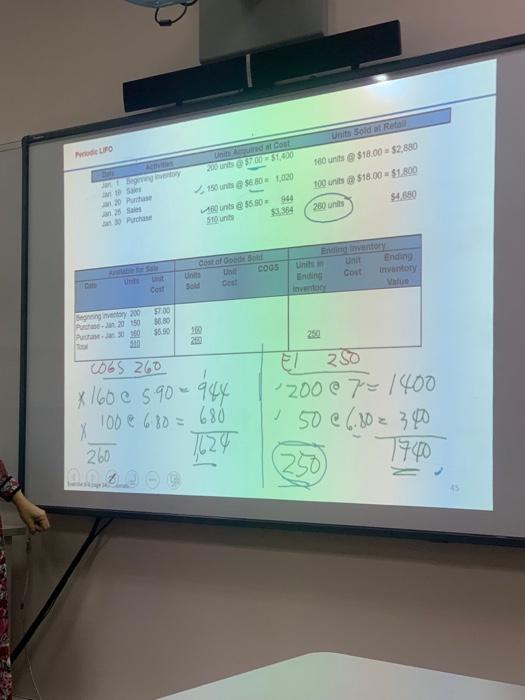

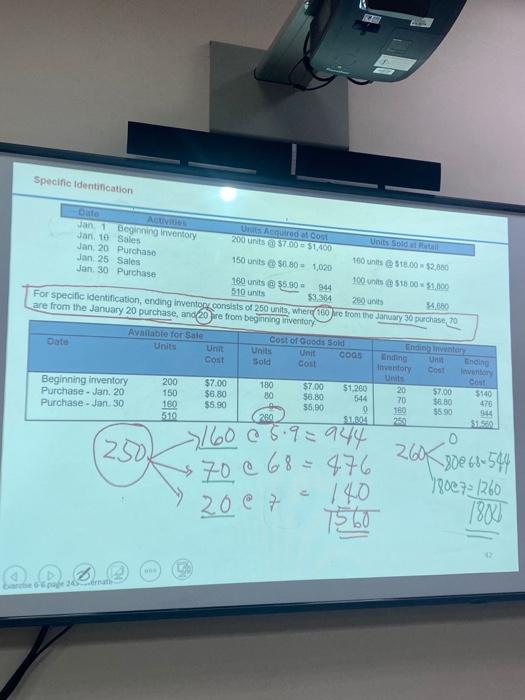

Reavired Astuming the role of the accounting team of Homey Electronics Co: A) Record the necessary adiusting and conecting journal enties for ithe year ended December 31, 2022. (45 marks). Nofes: - You must show alf your workings for part 2 , wsing tabies, schedules, calculations and explanations, where appropriate. - lgnare VAT implieentions. - Servenshons are NOT afliownd. B) Prepare an accounting worksheet refectirg the related acceunts, unadjusied trai balance. adivitments and adjusied trial bdance for the yew ended December 31, 2022 (10 marhs). Mofe: - Servenahots are NOT allowed. C) Prepare a statement of profit or loss and a statement of owner's equity for the year 2022. and a statement of francial position at December 31, 2022 (2z1 marks). Nate: - Sereenahete are NOT allewed. D) Prepare a memorandum to the ownor of Hamey Riectronks Ce on the company's profitabilly and efliciency 4 liquidity by computing and irterpeeting two (2) ratios for each greup. Word count (400 words +1+1016) (s marks). E) Discuss how the acoounting principies, assumgtions, andor constraints apply to Homey Electronics Ca's financial accounting and reporting. Yeur discussion should include four examples and applications from the case. Wors count (600 words + 105 ) (8 marks) F) Discuss how the financial statiments of Homey Electonics Ce. can adirnss the noeds of the users of financial infomation. Your diwcustion should highilgh the nawos of four arferent users of fnancial information and how the infomation on the financial stalements can address these needs. Word count ( 600 words +i10%) (8 marks) Appendix 3 TO: FINANCIAL CONTROLLER FROM: CHIEF AUDIT EXECUTIVE SUBJECT: RE-VALUATION OF CLOSING INVENTORY During the internal audit at year -end, the following findings with regard to inventory were discovered. - The company purchased additional merchandise that totalled BD70,000 during the year. The aggregate purchase amount was verified and included in the unadjusted trial balance. - The value of the closing inventory, BD45, 100, was initially calculated based on the inventory count conducted at year-end. However, the company did not include in the count purchased goods of BD6,000, which were in transit (terms: FOB shipping point). Also, the company did not include in the count inventory that had been sold with a cost of BD6, 600 , which was in transit (terms: FOB destination). The sales amount of BD7,000 was appropriately recorded in the books. - The company acted as a consignee for Sharpee Co, the consignor. The result in including the inventory goods held on consignment costing BD8,000. - An error of omission on the value of inventory on hand for Product X (a new product traded during the year) was made. However, the related purchases and sales have been appropriately accounted for and displayed in the unadjusted trial balance. Product X information is shown below: - An assessment of NRV showed no material variation from inventory cost. Yet, we emphasize the importance of using the weighted average cost. flow assumption consistently uniess a change of accounting method is appropriately justified. The company uses the periodic inventory system. During the intemal audit at year-end. the following findings with regard to inventory were discovered. - The company purchased additional merchandise that fotalled B070.000_during the year. The aggregate purchase amount was verified and included in the unadiusted trial balance. oY - The value of the closing inventory, BD45, 100, was inicaly calculated based on the inventory count conducted a year-end. However, the company did not inctude in the count purchased goods of BD6.000, which were in transi. (terms: FOB shipping poing. Also, the company did not include in the count inventory that had been sold with a cost of BDS.600, which was in transit (terms. FOB destination). The sales amount of BD7,000 was appropriately recorded in the books. - The company acted as a consignee for Sharpee Co, the consignor. The result in including the inventory goodsi held on consignment costing BD8,000. - An error of omission on the value of inventory on hand for Product X (a new product traded during the year) was made. However, the relaled purchases and sales have been appropriately accounted for and displayed in the unadiusted trial balance. Product X information is shown below: - An assessment of NRV showed no material variation from inventory cost. Yet, we emphasize the importance of using the weiahted average cost flow assumption consistently unless a change of accounting method is appropriately justified. The company uses the periodic inventory system. E) 25 20060657=140020060600=18014081605.90=944250906.80=1556612= mosecuro cobs260160

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts