Question: q , From Your Notes Using the information provided here and in your text, complete the following. The original legislation, the federal government tax businesses

From Your Notes

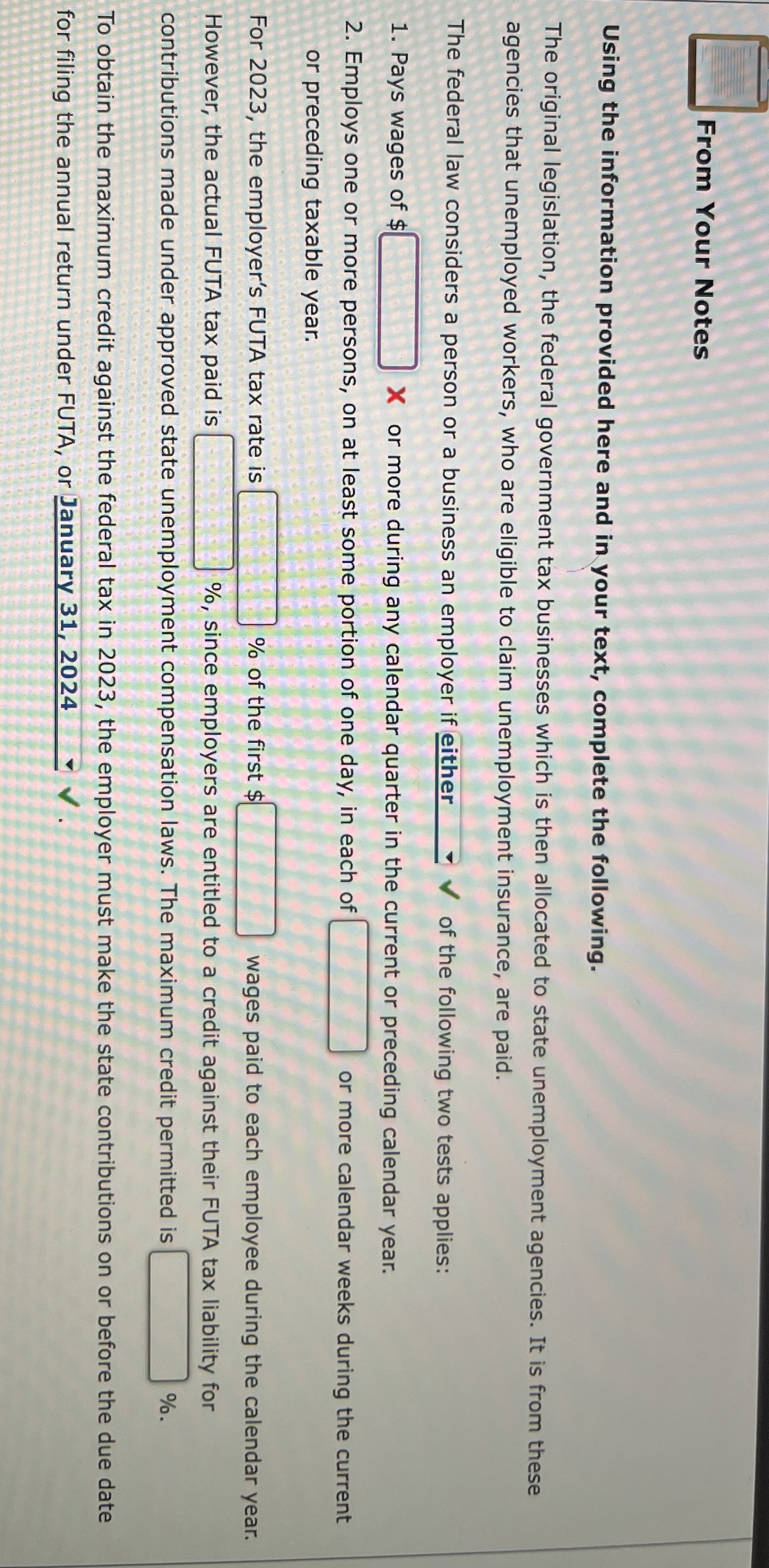

Using the information provided here and in your text, complete the following.

The original legislation, the federal government tax businesses which is then allocated to state unemployment agencies. It is from these agencies that unemployed workers, who are eligible to claim unemployment insurance, are paid.

The federal law considers a person or a business an employer if either of the following two tests applies:

Pays wages of $ X or more during any calendar quarter in the current or preceding calendar year.

Employs one or more persons, on at least some portion of one day, in each of or more calendar weeks during the current or preceding taxable year.

For the employer's FUTA tax rate is of the first $ wages paid to each employee during the calendar year. However, the actual FUTA tax paid is since employers are entitled to a credit against their FUTA tax liability for contributions made under approved state unemployment compensation laws. The maximum credit permitted is

To obtain the maximum credit against the federal tax in the employer must make the state contributions on or before the due date for filing the annual return under FUTA, or January

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock