Question: Q NA G + CLO E-2 E.72 Comprehensive Attributes Sampling. Audra Dodge, CPA. is performing an attributes sampling plan for her audit of Truck Company.

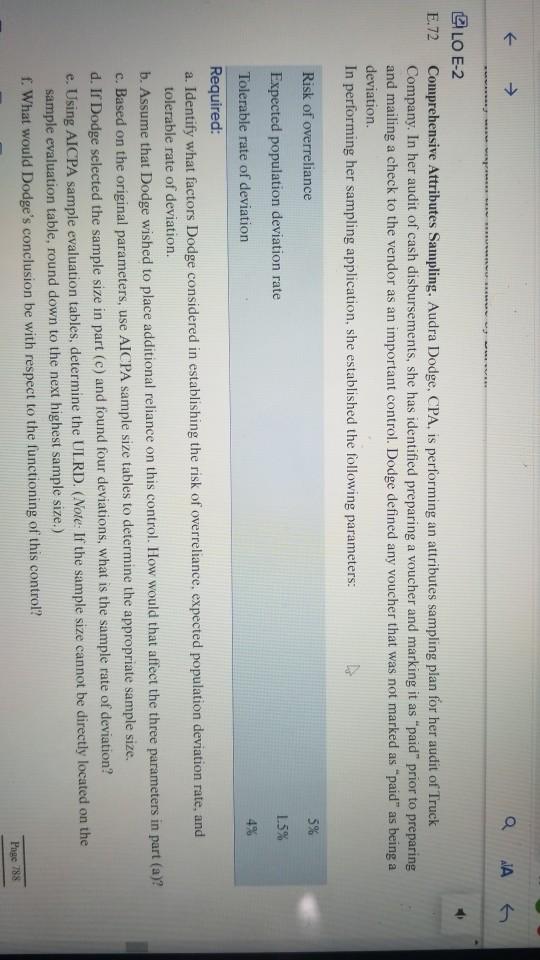

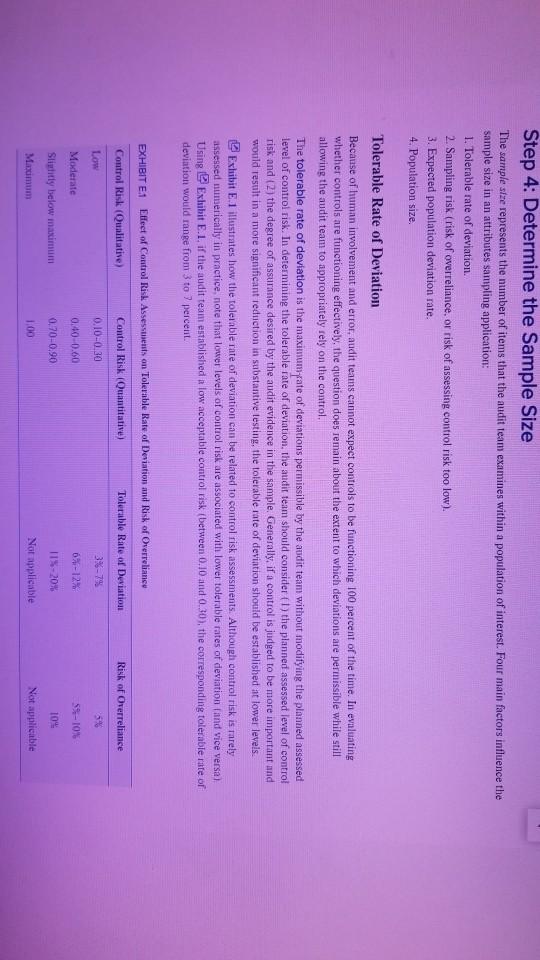

Q NA G + CLO E-2 E.72 Comprehensive Attributes Sampling. Audra Dodge, CPA. is performing an attributes sampling plan for her audit of Truck Company. In her audit of cash disbursements, she has identified preparing a voucher and marking it as "paid prior to preparing and mailing a check to the vendor as an important control. Dodge defined any voucher that was not marked as "paid" as being a deviation In performing her sampling application, she established the following parameters: Risk of overreliance 5% Expected population deviation rate 1.5% Tolerable rate of deviation 4% Required: a. Identify what factors Dodge considered in establishing the risk of overreliance, expected population deviation rate, and tolerable rate of deviation. b. Assume that Dodge wished to place additional reliance on this control. How would that affect the three parameters in part (a)? c. Based on the original parameters, use AICPA sample size tables to determine the appropriate sample size. d. If Dodge selected the sample size in part (c) and found four deviations, what is the sample rate of deviation? e. Using AICPA sample evaluation tables, determine the ULRD. (Note: If the sample size cannot be directly located on the sample evaluation table, round down to the next highest sample size.) f. What would Dodge's conclusion be with respect to the functioning of this control? Page 788 Step 4: Determine the Sample Size The sample size represents the number of items that the audit team examines within a population of interest. Four main factors influence the sample size in an attributes sampling application: 1. Tolerable rate of deviation. 2. Sampling risk risk of overreliance, or risk of assessing control risk too low). 3. Expected population deviation rate. 4. Population size. Tolerable Rate of Deviation Because of human involvement and error, audit teams cannot expect controls to be functioning 100 percent of the time. In evaluating whether controls are functioning effectively, the question does remain about the extent to which deviations are permissible while still allowing the audit team to appropriately rely on the control. The tolerable rate of deviation is the maximum yate of deviations permissible by the audit team without modifying the planned assessed level of control risk. In determining the tolerable rate of deviation, the audit team should consider (1) the planned assessed level of control risk and (2) the degree of assurance desired by the audit evidence in the sample. Generally, if a control is judged to be more important and would result in a more significant reduction in substantive testing, the tolerable rate of deviation should be established at lower levels Exhibit E1 illustrates how the tolerable rate of deviation can be related to control risk assessments. Although control risk is rarely assessed numerically in practice, note that lower levels of control risk are associated with lower tolerable rates of deviation (and vice versa) Using Exhibit E.1. if the audit team established a low acceptable control risk (between 0.10 and 0.30), the corresponding tolerable rate of deviation would range from 3 to 7 percent. EXHIBIT E.1 Effect of Control Risk Assessments on Tolerable Rate of Deviation and Risk of Overreliance Control Risk (Qualitative) Control Risk (Quantitative) Tolerable Rate of Deviation Risk of Overreliance Low 0,10-0.30 3%-7% Moderate 0.40-0.60 55-10% Sligtitly below maximum 0.70-0,90 TIS-20% 10% Maximum 1.00 Not applicable Not applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts