Question: Q. No. 3 Max Marks 15 A. Define payback period and its decision criteria. B. List down the decision criteria for Net Present Value and

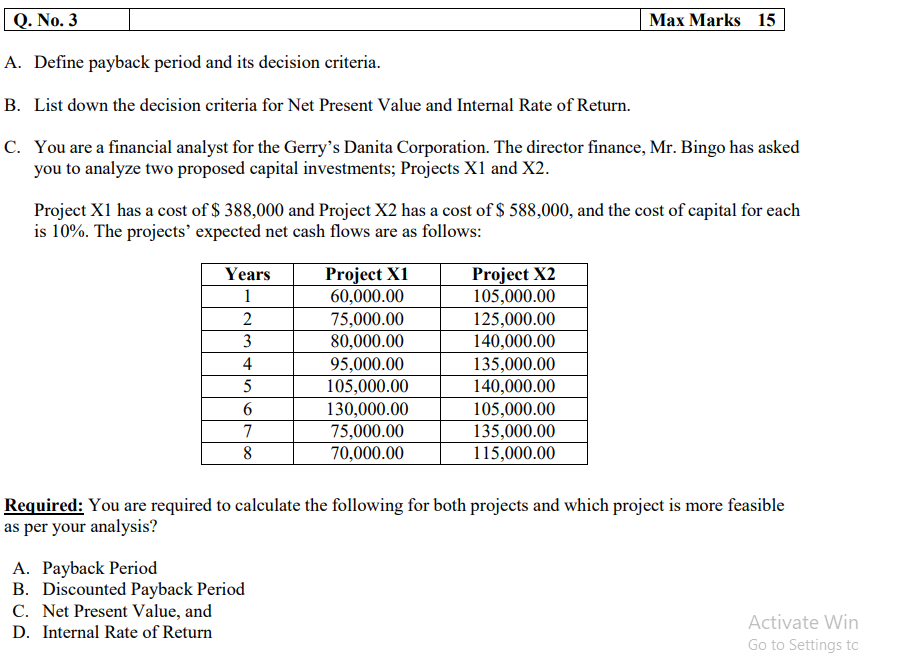

Q. No. 3 Max Marks 15 A. Define payback period and its decision criteria. B. List down the decision criteria for Net Present Value and Internal Rate of Return. C. You are a financial analyst for the Gerry's Danita Corporation. The director finance, Mr. Bingo has asked you to analyze two proposed capital investments; Projects X1 and X2. Project X1 has a cost of $ 388,000 and Project X2 has a cost of $ 588,000, and the cost of capital for each is 10%. The projects' expected net cash flows are as follows: Years 1 2 3 4 5 6 7 8 Project X1 60,000.00 75,000.00 80,000.00 95,000.00 105,000.00 130,000.00 75,000.00 70,000.00 Project X2 105,000.00 125,000.00 140,000.00 135,000.00 140,000.00 105,000.00 135,000.00 115,000.00 Required: You are required to calculate the following for both projects and which project is more feasible as per your analysis? A. Payback Period B. Discounted Payback Period C. Net Present Value, and Activate Win D. Internal Rate of Return Go to Settings to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts