Question: Q. No.3 Max Marks - 08 BUDGETED INCOME STATEMENT The President of a ABC - Cement manufacturing company has asked the controller to prepare an

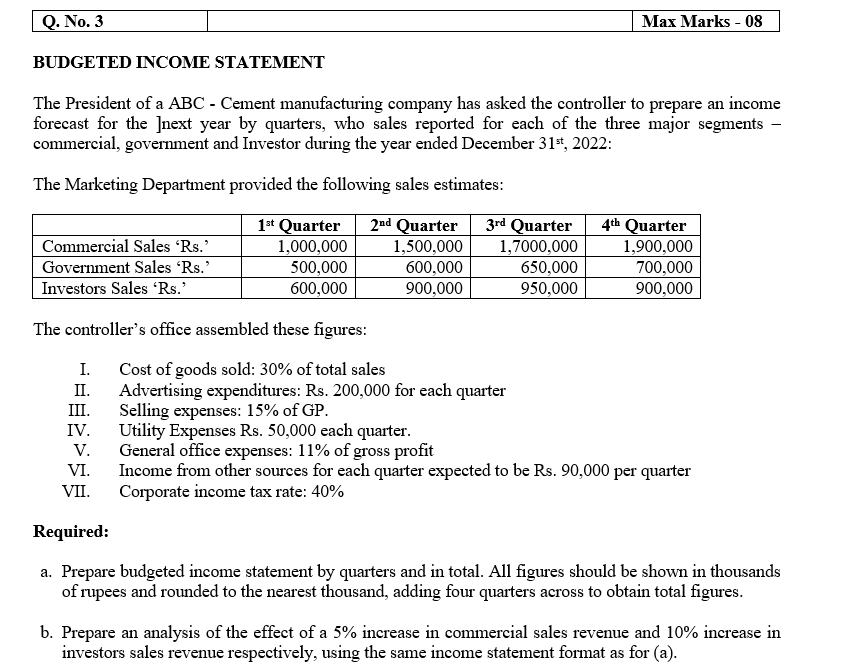

Q. No.3 Max Marks - 08 BUDGETED INCOME STATEMENT The President of a ABC - Cement manufacturing company has asked the controller to prepare an income forecast for the ]next year by quarters, who sales reported for each of the three major segments - commercial, government and Investor during the year ended December 31st, 2022: The Marketing Department provided the following sales estimates: Commercial Sales 'Rs.' Government Sales 'Rs.' Investors Sales Rs. 1st Quarter 1,000,000 500,000 600,000 2nd Quarter 1,500,000 600,000 900,000 3rd Quarter 1,7000,000 650,000 950.000 4th Quarter 1,900,000 700,000 900,000 The controller's office assembled these figures: I. Cost of goods sold: 30% of total sales II. Advertising expenditures: Rs. 200,000 for each quarter III. Selling expenses: 15% of GP. IV. Utility Expenses Rs. 50,000 each quarter. V. General office expenses: 11% of gross profit VI. Income from other sources for each quarter expected to be Rs. 90,000 per quarter VII. Corporate income tax rate: 40% Required: a. Prepare budgeted income statement by quarters and in total. All figures should be shown in thousands of rupees and rounded to the nearest thousand, adding four quarters across to obtain total figures. b. Prepare an analysis of the effect of a 5% increase in commercial sales revenue and 10% increase in investors sales revenue respectively, using the same income statement format as for (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts