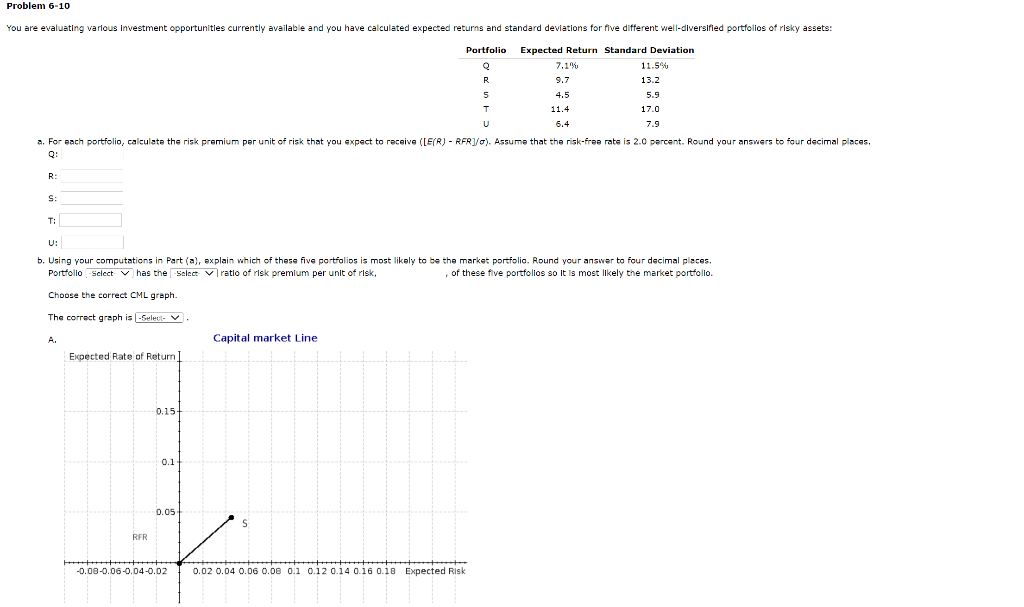

Question: Q: R : S: T: U: b. Using your computations in Part (a), explain which of these five portfolips is most likely to be the

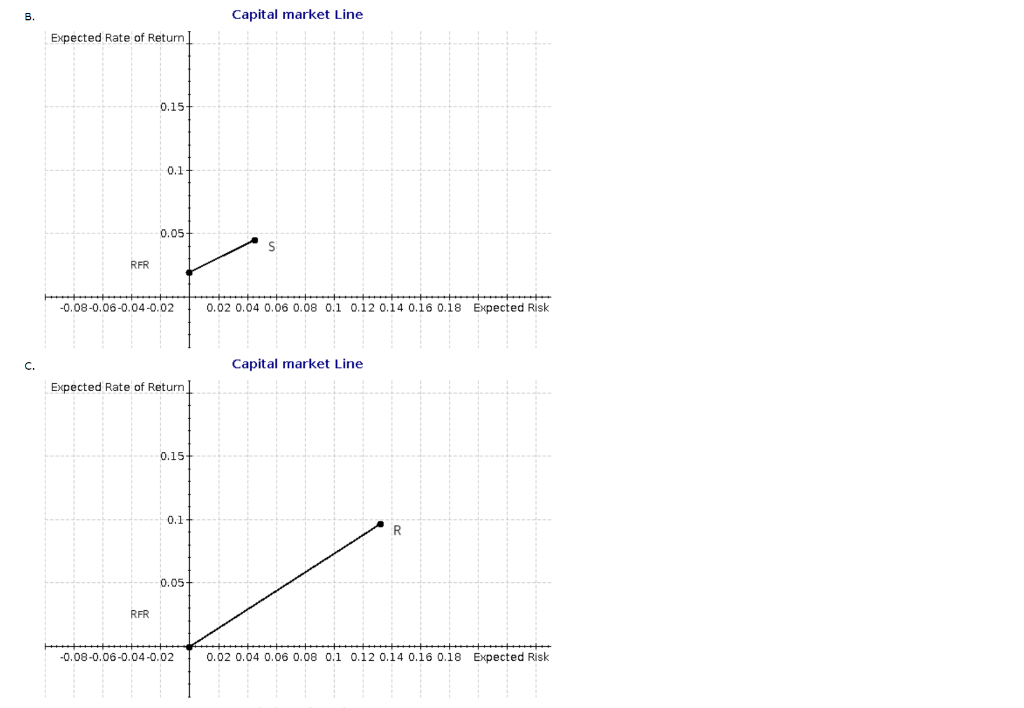

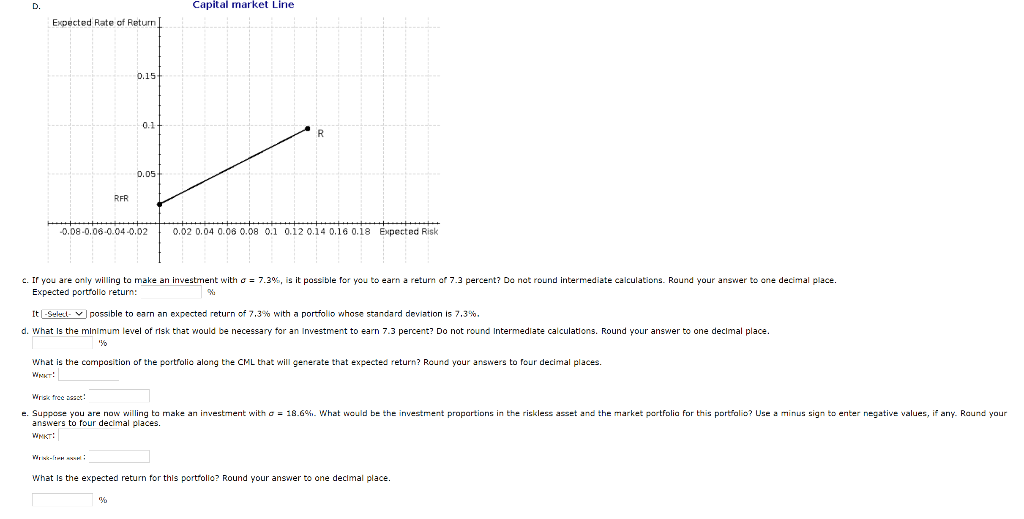

Q: R : S: T: U: b. Using your computations in Part (a), explain which of these five portfolips is most likely to be the market portfolio. Round your answer to four decimal places. Portfollo has the -Sclect Vlratlo of risk premium per unit of rlsk, of these five portfolios so it is most ilkely the market portfollo. Choose the correct CML graph. The correct graph is B. Capital market Line c. Capital market Line Expected portfolio return: jossible to earn an expected return of 7,3% with a portfolio whose standard deviation is 7,3%. What is the composition of the portfolio alang the CML that will generate that expected return? Round your answers to four decimal places. Wket: Wrick froe zass: answers to four decimal places. Whkt: What is the expected return for this portfolio? Round your answer to one decimal place. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts