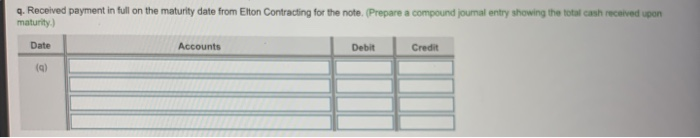

Question: q. Received payment in full on the maturity date from Elton Contracting for the note. (Prepare a compound joumal entry showing the total cash received

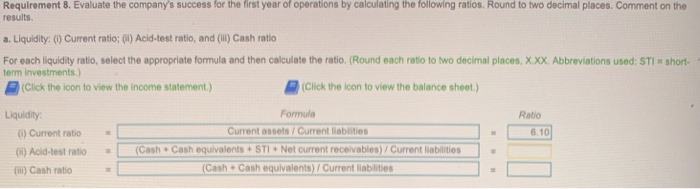

q. Received payment in full on the maturity date from Elton Contracting for the note. (Prepare a compound joumal entry showing the total cash received upon maturity.) Date Accounts Debit Credit Requirement 8. Evaluate the company's success for the first year of operations by calculating the following ratios. Round to two decimal places. Comment on the results a. Liquidity: ()Current ratio; () Acid-test ratio, and (il) Cash ratio For each liquidity ratio, select the appropriate formula and then calculate the ratio. (Round each ratio to two decimal places, X.XX. Abbreviations used: STI short- term investments.) (Click the icon to view the income statement) (Click the icon to view the balance sheet) Liquidity Formula Ratio Current assets/Current liablities 6.10 ) Current ratio (i) Acid-test ratio(Cash Cash equivalents+ STI+Net current receivables)/Current liablities (i) Cash ratio (Cash Cash equivalents)/Current liabilities q. Received payment in full on the maturity date from Elton Contracting for the note. (Prepare a compound joumal entry showing the total cash received upon maturity.) Date Accounts Debit Credit Requirement 8. Evaluate the company's success for the first year of operations by calculating the following ratios. Round to two decimal places. Comment on the results a. Liquidity: ()Current ratio; () Acid-test ratio, and (il) Cash ratio For each liquidity ratio, select the appropriate formula and then calculate the ratio. (Round each ratio to two decimal places, X.XX. Abbreviations used: STI short- term investments.) (Click the icon to view the income statement) (Click the icon to view the balance sheet) Liquidity Formula Ratio Current assets/Current liablities 6.10 ) Current ratio (i) Acid-test ratio(Cash Cash equivalents+ STI+Net current receivables)/Current liablities (i) Cash ratio (Cash Cash equivalents)/Current liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts