Question: Q: Repeat Problem 1 assuming the corporation is an S corporation ????????????. :Problem. 01 You are a shareholder in a C corporation. The corporation earns

Q: Repeat Problem 1 assuming the corporation is an S corporation ????????????.

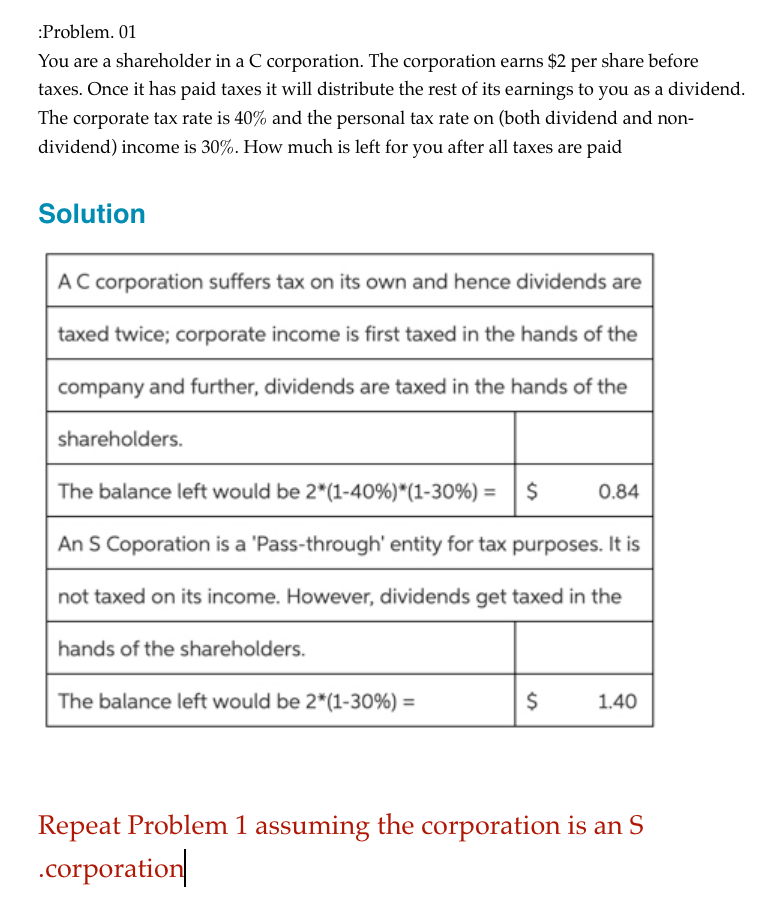

:Problem. 01 You are a shareholder in a C corporation. The corporation earns $2 per share before taxes. Once it has paid taxes it will distribute the rest of its earnings to you as a dividend. The corporate tax rate is 40% and the personal tax rate on (both dividend and non- dividend) income is 30%. How much is left for you after all taxes are paid Solution AC corporation suffers tax on its own and hence dividends are taxed twice; corporate income is first taxed in the hands of the company and further, dividends are taxed in the hands of the shareholders. The balance left would be 2*(1-40%)*(1-30%) = $ 0.84 An S Coporation is a 'Pass-through' entity for tax purposes. It is not taxed on its income. However, dividends get taxed in the hands of the shareholders. The balance left would be 2*(1-30%) = $ 1.40 Repeat Problem 1 assuming the corporation is an S .corporation :Problem. 01 You are a shareholder in a C corporation. The corporation earns $2 per share before taxes. Once it has paid taxes it will distribute the rest of its earnings to you as a dividend. The corporate tax rate is 40% and the personal tax rate on (both dividend and non- dividend) income is 30%. How much is left for you after all taxes are paid Solution AC corporation suffers tax on its own and hence dividends are taxed twice; corporate income is first taxed in the hands of the company and further, dividends are taxed in the hands of the shareholders. The balance left would be 2*(1-40%)*(1-30%) = $ 0.84 An S Coporation is a 'Pass-through' entity for tax purposes. It is not taxed on its income. However, dividends get taxed in the hands of the shareholders. The balance left would be 2*(1-30%) = $ 1.40 Repeat Problem 1 assuming the corporation is an S .corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts