Question: Q ~ Search Sheet Share Good Neutral Calculation _ AutoSum AY atory T... Followed Hyp.. Hyperlink Input Insert Delete Format Fill X Clear v

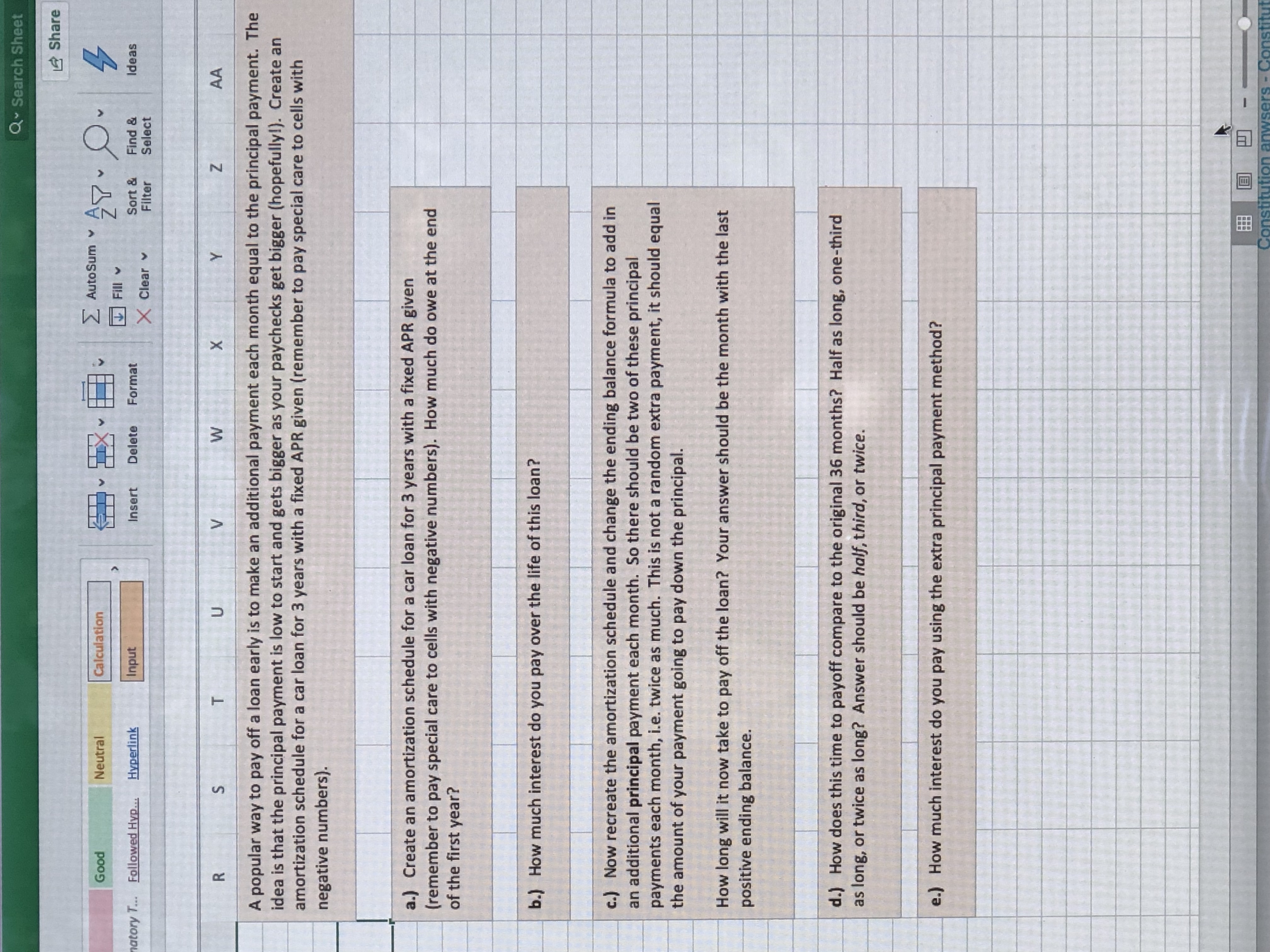

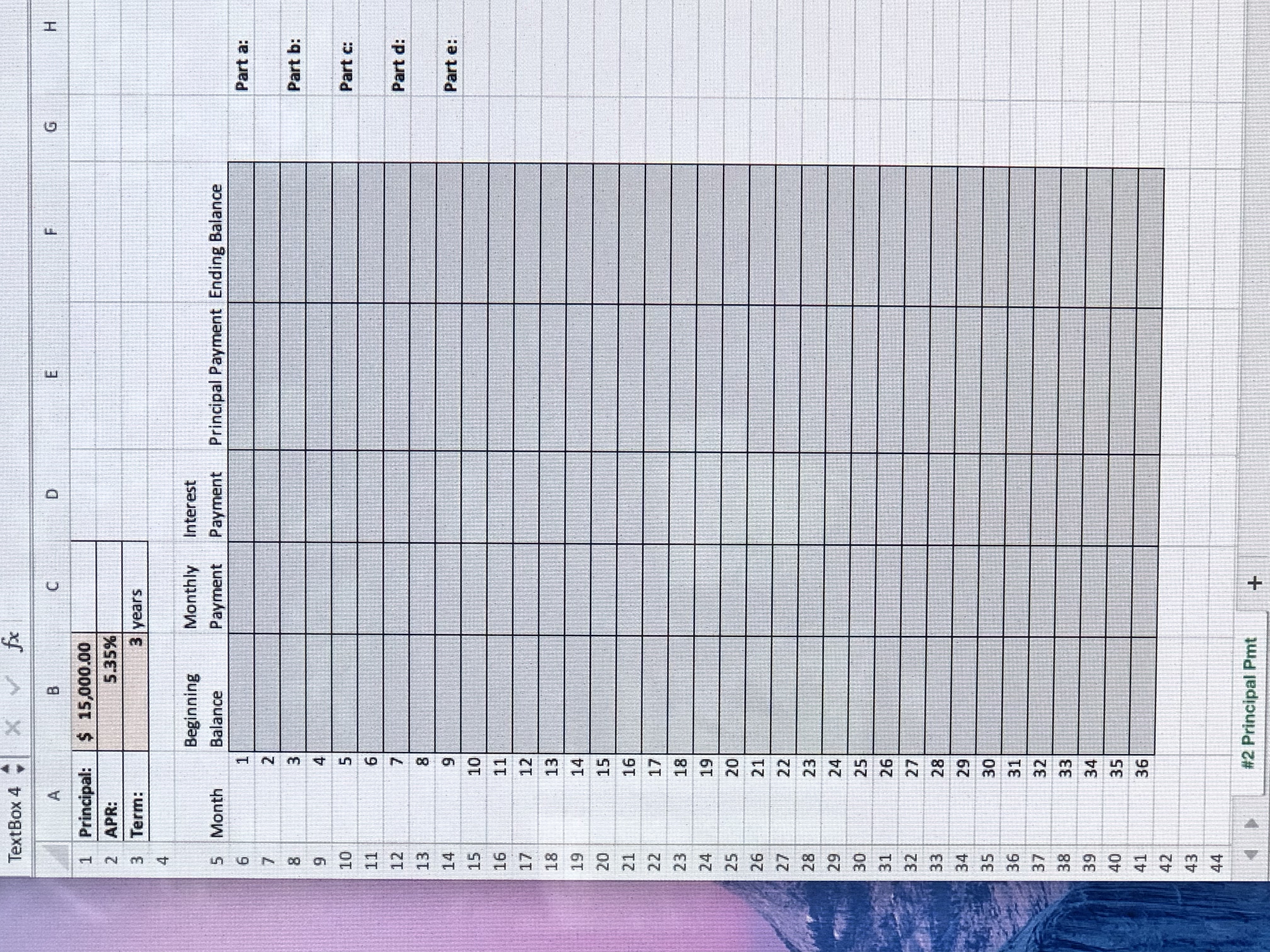

Q ~ Search Sheet Share Good Neutral Calculation _ AutoSum AY " atory T... Followed Hyp.. Hyperlink Input Insert Delete Format Fill X Clear v Sort & Find & Ideas Filter Select R V W X Z AA A popular way to pay off a loan early is to make an additional payment each month equal to the principal payment. The idea is that the principal payment is low to start and gets bigger as your paychecks get bigger (hopefully!). Create an amortization schedule for a car loan for 3 years with a fixed APR given (remember to pay special care to cells with negative numbers). a.) Create an amortization schedule for a car loan for 3 years with a fixed APR given (remember to pay special care to cells with negative numbers). How much do owe at the end of the first year? b.) How much interest do you pay over the life of this loan? c.) Now recreate the amortization schedule and change the ending balance formula to add in an additional principal payment each month. So there should be two of these principal payments each month, i.e. twice as much. This is not a random extra payment, it should equal the amount of your payment going to pay down the principal. How long will it now take to pay off the loan? Your answer should be the month with the last positive ending balance. d.) How does this time to payoff compare to the original 36 months? Half as long, one-third as long, or twice as long? Answer should be half, third, or twice. e.) How much interest do you pay using the extra principal payment method?TextBox 4 " X \\ fx H D m F G A B C 1 Principal: $ 15,000.00 APR: 5.35% Term: 3 years Beginning Monthly Interest Month Payment Principal Payment Ending Balance Balance Payment Part a: Part b: Part c: 10 Part d: Part e: 20 16 18 19 25 20 21 22 23 24 30 25 26 27 28 34 29 30 36 31 32 38 33 39 34 40 35 41 36 42 43 44 #2 Principal Pmt +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts