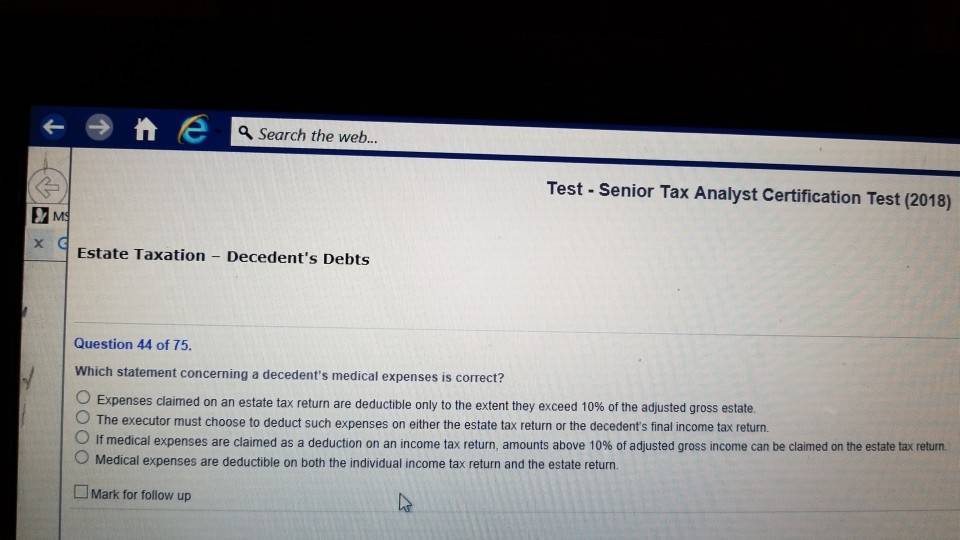

Question: Q Search the web Test - Senior Tax Analyst Certification Test (2018) Estate Taxation Decedent's Debts Question 44 of 75. Which statement concerning a decedent's

Q Search the web Test - Senior Tax Analyst Certification Test (2018) Estate Taxation Decedent's Debts Question 44 of 75. Which statement concerning a decedent's medical expenses is correct? Expenses claimed on an estate tax return are deductible only to the extent they exceed 10% of the adjusted gross estate. The executor must choose to deduct such expenses on either the estate tax return or the decedent's final income tax return. O lf medical expenses are claimed as a deduction on an income tax return amounts above 10% of adjusted gross income can be claimed on the estate tax return. O Medical expenses are deductible on both the individual income tax return and the estate return. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts