Question: Q Search this cours Chapter 9 Assignment Chance Co., the parent of a US-based MNC, uses fundamental forecasting to estimate future values of exchange rates

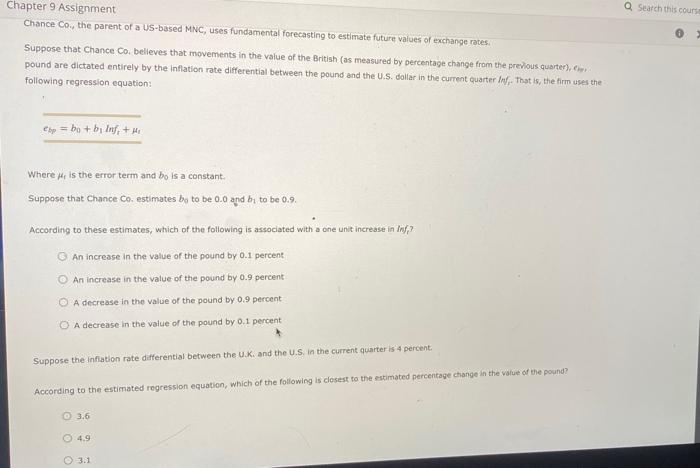

Q Search this cours Chapter 9 Assignment Chance Co., the parent of a US-based MNC, uses fundamental forecasting to estimate future values of exchange rates Suppose that Chance Co. believes that movements in the value of the British (as measured by percentage change from the previous quarter), pound are dictated entirely by the inflation rate differential between the pound and the U.S. dollar in the current quarter Ind. That is, the firm uses the following regression equation: ey=bo+hi Inf, + Where is the error term and bo is a constant. Suppose that chance Co. estimates bo to be 0.0 and b to be 0.9. According to these estimates, which of the following is associated with a one unit increase in Iny? An increase in the value of the pound by 0.1 percent An increase in the value of the pound by 0.9 percent o A decrease in the value of the pound by 0.9 percent A decrease in the value of the pound by 0.1 percent Suppose the inflation rate differential between the UK, and the U.S. In the current quarter is 4 percent According to the estimated regression equation, which of the following is closest to the estimated percentage change in the value of the pound? O 3.6 4.9 3.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts