Question: Q Search this course Assignment: Chapter 15 Assignment Score: 40.00% Questions Problem 15-09 (Residual Distribution Policy) Save Submit Assignment for Grading 3. Question 5 of

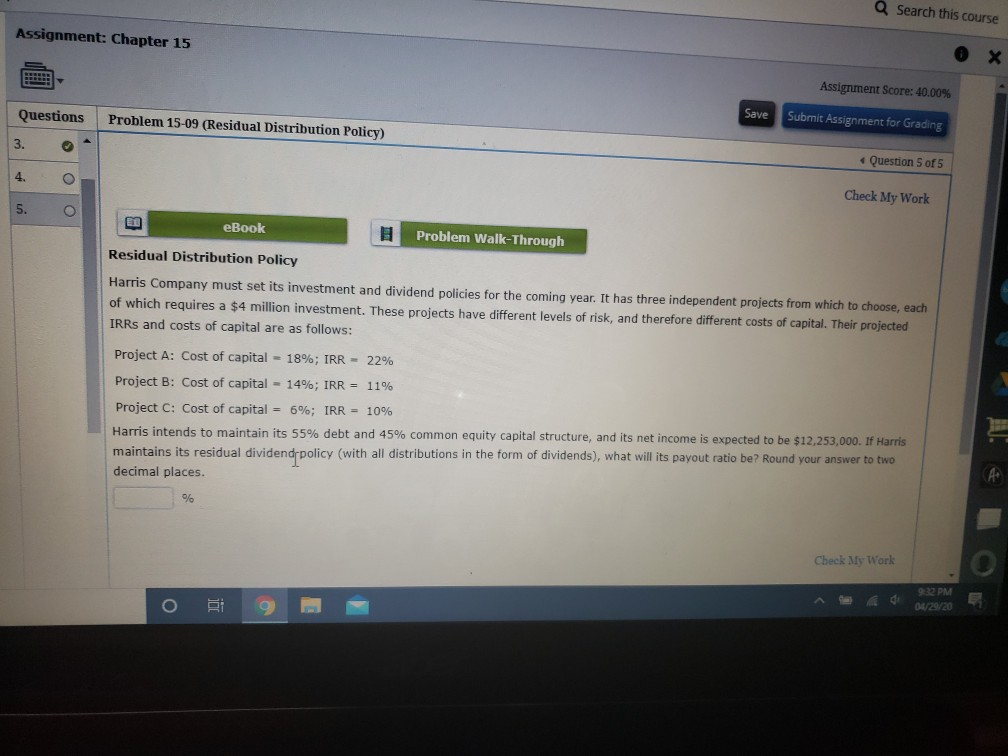

Q Search this course Assignment: Chapter 15 Assignment Score: 40.00% Questions Problem 15-09 (Residual Distribution Policy) Save Submit Assignment for Grading 3. Question 5 of 5 Check My Work eBook Problem Walk-Through Residual Distribution Policy Harris Company must set its investment and dividend policies for the coming year. It has three independent projects from which to choose, each of which requires a $4 million investment. These projects have different levels of risk, and therefore different costs of capital. Their projected IRRs and costs of capital are as follows: Project A: Cost of capital = 18%; IRR - 22% Project B: Cost of capital = 14%; IRR = 11% Project C: Cost of capital = 6%; IRR = 10% Harris intends to maintain its 55% debt and 45% common equity capital structure, and its net income is expected to be $12,253,000. If Harris maintains its residual dividend policy (with all distributions in the form of dividends), what will its payout ratio be? Round your answer to two decimal places. Check My Work o 9 ^ e d 932 PM u /28/20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts