Question: Q: Summarize this in one page 3. Big Data - the Supply-Side of the Industry An overall view on the Big Data industry provides the

Q: Summarize this in one page

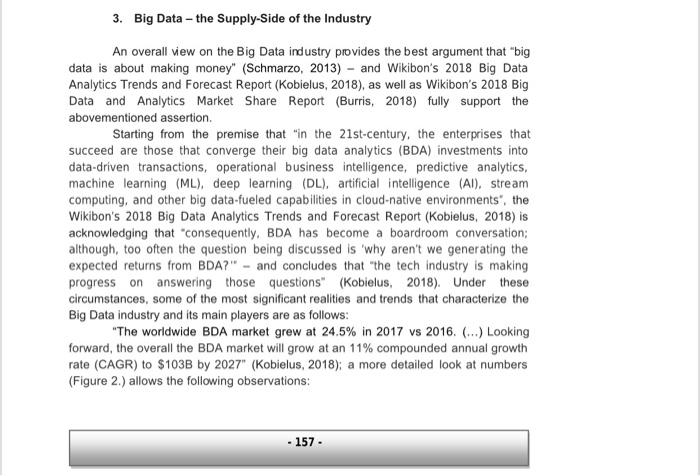

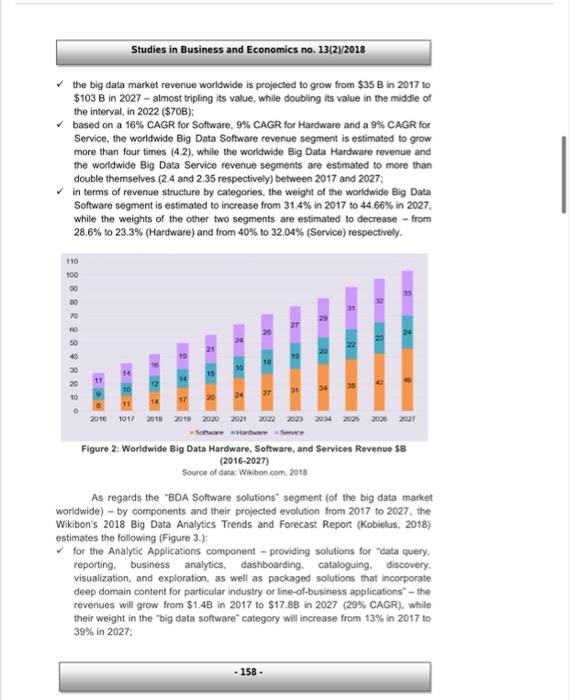

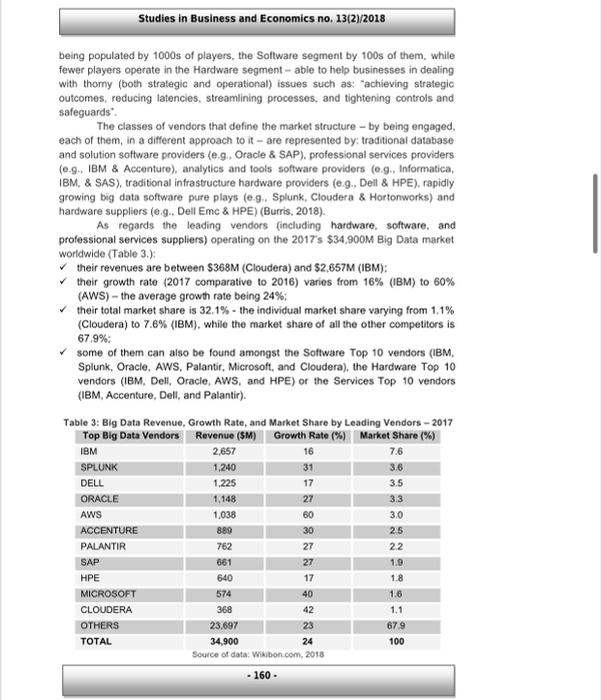

3. Big Data - the Supply-Side of the Industry An overall view on the Big Data industry provides the best argument that "big data is about making money" (Schmarzo, 2013) - and Wikibon's 2018 Big Data Analytics Trends and Forecast Report (Kobielus, 2018), as well as Wikibon's 2018 Big Data and Analytics Market Share Report (Burris, 2018) fully support the abovementioned assertion Starting from the premise that in the 21st-century, the enterprises that succeed are those that converge their big data analytics (BDA) investments into data-driven transactions, operational business intelligence, predictive analytics, machine learning (ML), deep learning (DL), artificial intelligence (AI), stream computing, and other big data-fueled capabilities in cloud-native environments, the Wikibon's 2018 Big Data Analytics Trends and Forecast Report (Kobielus, 2018) is acknowledging that consequently, BDA has become a boardroom conversation; although, too often the question being discussed is 'why aren't we generating the expected returns from BDA?" - and concludes that "the tech Industry is making progress on answering those questions" (Kobielus, 2018). Under these circumstances, some of the most significant realities and trends that characterize the Big Data industry and its main players are as follows: "The worldwide BDA market grew at 24.5% in 2017 vs 2016. (...) Looking forward, the overall the BDA market will grow at an 11% compounded annual growth rate (CAGR) to $103B by 2027" (Kobielus, 2018); a more detailed look at numbers (Figure 2.) allows the following observations: - 157 Studies in Business and Economics no. 13/2/2018 the big data market revenue worldwide is projected to grow from $35 B in 2017 to $103 B in 2027 - almost tripling its value, while doubling its value in the middle of the interval, in 2022 ($70B); based on a 16% CAGR for Software, 9% CAGR for Hardware and a 9% CAGR for Service, the worldwide Big Data Software revenue segment is estimated to grow more than four times (4.2), while the worldwide Big Data Hardware revenue and the worldwide Big Data Service revenue segments are estimated to more than double themselves (2.4 and 2,35 respectively) between 2017 and 2027 in terms of revenue structure by categories, the weight of the worldwide Big Data Software segment is estimated to increase from 31.4% in 2017 to 44.66% in 2027 while the weights of the other two segments are estimated to decrease - from 28.6% to 23.3% (Hardware) and from 40% to 32.04% (Service) respectively. 110 100 00 8RE8%8820 11 2016 2017 2018 2019 2020 2021 2022 2023 204 2005 2006 2021 Sow we mie Figure 2: Worldwide Big Data Hardware, Software, and Services Revenue SB (2016-2027) Source of data Wabon.com. 2018 As regards the BDA Software solutions segment of the big data market worldwide) - by components and their projected evolution from 2017 to 2027. the Wikibon's 2018 Big Data Analytics Trends and Forecast Report (Kobiolus, 2018) estimates the following (Figure 3.): for the Analytic Applications component - providing solutions for "data query, reporting, business analytics, dashboarding cataloguing. discovery visualization, and exploration, as well as packaged solutions that incorporate deep domain content for particular industry or line-of-business applications - the revenues will grow from $1.4B in 2017 to $17.88 in 2027 (29% CAGR), while their weight in the "big data software category will increase from 13% in 2017 to 39% in 2027 - 158 Studies in Business and Economics no. 13/21/2018 for the Data-Science Pipelines component - providing solutions for "ML, DL, AI. data modeling, data preparation, data mining, predictive analytics, and text analytics tools and platforms - the revenues will grow from $0.38 in 2017 to $2.8B in 2027 (26% CAGR), while their weight in the big data software category will increase from 3% in 2017 to 6% in 2027 for the Stream-Computing component - providing solutions for real-time. streaming, low-latency data acquisition, movement, ingest, processing, analytics, query. and other approaches for managing data in motion - the revenues will grow from $0.38 in 2017 to $1.2B in 2027 (32% CAGR), while their weight in the "big data software" category will decrease from 12% in 2017 to 6% in 2027: for the Application Infrastructure component - providing solutions for data integration, transformation, augmentation, governance, and movement in BDA architectures - the revenues will grow from $2.4B in 2017 to $7.4B in 2027 (12% CAGR), while their weight in the "big data software" category will decrease from 22% in 2017 to 16% in 2027 for the Analytic And Application Databases component - which includes any of several data platforms (relational, OLAP, in memory. Hadoop, NoSQL file systems, etc.) for storing, processing, and managing data for delivering actionable insights - the revenues will grow from $6.4B in 2017 to 512.0B in 2027 (6% CAGR), while their weight in the big data software" category will decrease from 60% in 2017 to 26% in 2027. 2027 2005 2005 2034 2023 2022 Atayde Acciaio Data Science Pipeline She Processes 2021 2020 2019 2018 Polician and readytic Database 1017 2018 0 10 Figure 3: Worldwide Big data Software Revenue (SB) by Category Source of data: Wikibon.com, 2018 On the other hand, according to the Wikibon's 2018 Big Data and Analytics Market Share Report (Burris, 2018), the supply-side of the Big Data market worldwide is composed of a variety of tools and solution providers - the Services segment 159 - Studies in Business and Economics no. 13(2)/2018 being populated by 1000s of players, the Software segment by 100s of them, while fewer players operate in the Hardware segment - able to help businesses in dealing with thomy (both strategic and operational) issues such as: 'achieving strategic outcomes, reducing latencies, streamlining processes, and tightening controls and safeguards The classes of vendors that define the market structure - by being engaged, each of them in a different approach to it-are represented by: traditional database and solution software providers (e.g. Oracle & SAP), professional services providers (0.9. IBM & Accenture), analytics and tools software providers (0.9., Informatica, IBM, & SAS), traditional infrastructure hardware providers (e.g., Dell & HPE), rapidly growing big data software pure plays (e-g.. Splunk, Cloudera & Hortonworks) and hardware suppliers (e.g., Dell Emc & HPE) (Burris, 2018). As regards the leading vendors (including hardware, software, and professional services suppliers) operating on the 2017's $34,900M Big Data market worldwide (Table 3.); their revenues are between $368M (Cloudera) and $2,657M (IBM): their growth rate (2017 comparative to 2016) varies from 16% (IBM) to 60% (AWS) - the average growth rate being 24%; their total market share is 32.1% - the individual market share varying from 1.1% (Cloudera) to 7.6% (IBM), while the market share of all the other competitors is 67.9% some of them can also be found amongst the Software Top 10 vendors (IBM, Splunk, Oracle, AWS, Palantir, Microsoft, and Cloudera), the Hardware Top 10 vendors (IBM, Dell, Oracle, AWS, and HPE) or the Services Top 10 vendors (IBM. Accenture, Dell, and Palantir). Table 3: Big Data Revenue, Growth Rate, and Market Share by Leading Vendors - 2017 Top Big Data Vendors Revenue (SM) Growth Rate(%) Market Share (%) IBM 2,657 16 7.6 SPLUNK 1.240 31 3.6 DELL 1.225 17 3.5 ORACLE 1,148 27 3.3 AWS 1.038 60 3.0 ACCENTURE 889 30 PALANTIR 762 27 22 SAP 661 27 HPE 640 17 1.8 MICROSOFT 574 40 1.6 CLOUDERA 368 42 1.1 OTHERS 23,697 23 67.9 TOTAL 34,900 Source of data: Wikibon.com, 2018 - 160 - 25 1.9 24 100