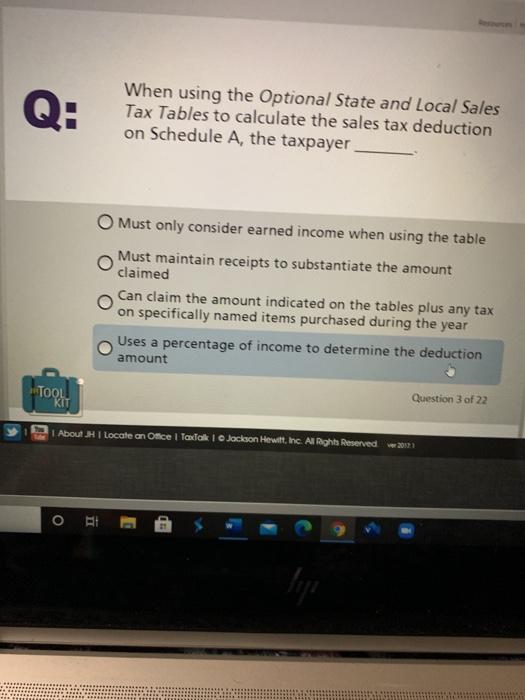

Question: Q: When using the Optional State and Local Sales Tax Tables to calculate the sales tax deduction on Schedule A, the taxpayer O Must only

Q: When using the Optional State and Local Sales Tax Tables to calculate the sales tax deduction on Schedule A, the taxpayer O Must only consider earned income when using the table Must maintain receipts to substantiate the amount claimed Can claim the amount indicated on the tables plus any tax on specifically named items purchased during the year Uses a percentage of income to determine the deduction amount TOOL KIT Question 3 of 22 About Locate an Office TaxFolk 1 Jackson Hewitt, Inc. All Rights Reserved o Et

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts