Question: Q) Would you please explain the difference between answers D and E for M1-1, question 17? A) Corporate profits are taxed twice. While the dividends

Q) Would you please explain the difference between answers D and E for M1-1, question 17?

A) Corporate profits are taxed twice. While the dividends paid to shareholders are taxed at the personal rate, corporate income is taxed at the corporate rate (i.e. at the corporate level when profits are earned and at the personal level when profits are paid out).

So the right answer is E.

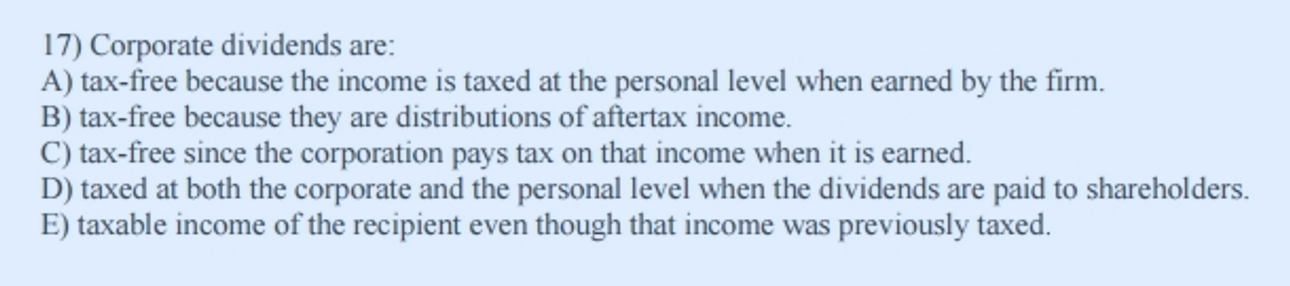

17) Corporate dividends are: A) tax-free because the income is taxed at the personal level when earned by the firm. B) tax-free because they are distributions of aftertax income. C) tax-free since the corporation pays tax on that income when it is earned. D) taxed at both the corporate and the personal level when the dividends are paid to shareholders. E) taxable income of the recipient even though that income was previously taxed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts