Question: Q1. (16 points) This summer you work as an intern at the equity research team of Goldman Sachs, Hong Kong. In this team, your role

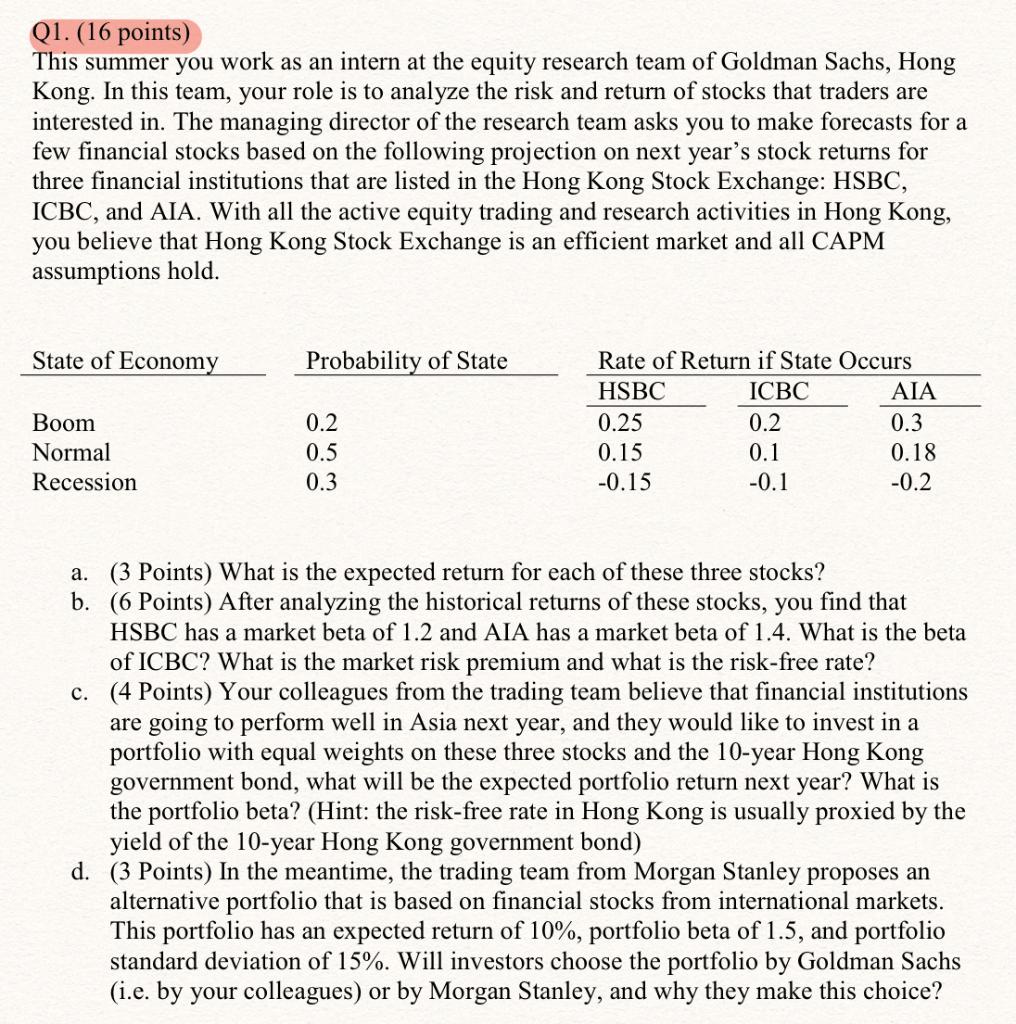

Q1. (16 points) This summer you work as an intern at the equity research team of Goldman Sachs, Hong Kong. In this team, your role is to analyze the risk and return of stocks that traders are interested in. The managing director of the research team asks you to make forecasts for a few financial stocks based on the following projection on next year's stock returns for three financial institutions that are listed in the Hong Kong Stock Exchange: HSBC, ICBC, and AIA. With all the active equity trading and research activities in Hong Kong, you believe that Hong Kong Stock Exchange is an efficient market and all CAPM assumptions hold. State of Economy Probability of State Boom Normal Recession 0.2 0.5 0.3 Rate of Return if State Occurs HSBC ICBC AIA 0.25 0.2 0.3 0.15 0.1 0.18 -0.15 -0.1 -0.2 a. (3 Points) What is the expected return for each of these three stocks? b. (6 Points) After analyzing the historical returns of these stocks, you find that HSBC has a market beta of 1.2 and AIA has a market beta of 1.4. What is the beta of ICBC? What is the market risk premium and what is the risk-free rate? c. (4 Points) Your colleagues from the trading team believe that financial institutions are going to perform well in Asia next year, and they would like to invest in a portfolio with equal weights on these three stocks and the 10-year Hong Kong government bond, what will be the expected portfolio return next year? What is the portfolio beta? (Hint: the risk-free rate in Hong Kong is usually proxied by the yield of the 10-year Hong Kong government bond) d. (3 Points) In the meantime, the trading team from Morgan Stanley proposes an alternative portfolio that is based on financial stocks from international markets. This portfolio has an expected return of 10%, portfolio beta of 1.5, and portfolio standard deviation of 15%. Will investors choose the portfolio by Goldman Sachs (i.e. by your colleagues) or by Morgan Stanley, and why they make this choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts