Question: Q1. (20%) A power utility feels that energy production capacity must be expanded to meet future anticipated demands in its service region. Three alternatives are

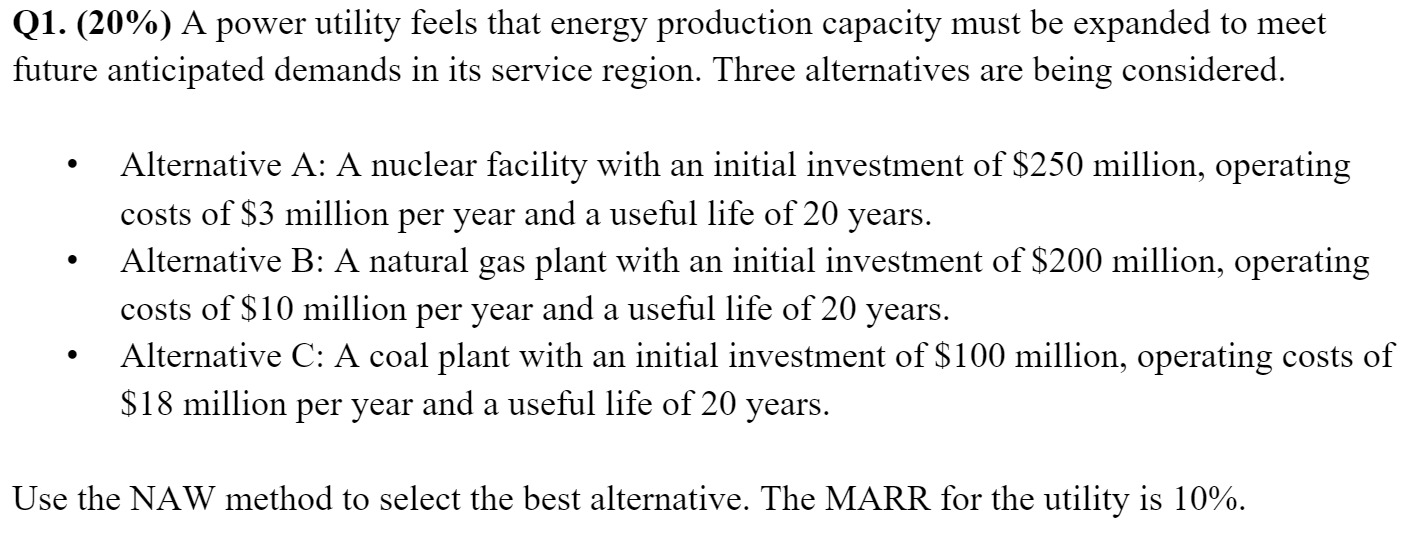

Q1. (20%) A power utility feels that energy production capacity must be expanded to meet future anticipated demands in its service region. Three alternatives are being considered. Alternative A: A nuclear facility with an initial investment of $250 million, operating costs of $3 million per year and a useful life of 20 years. Alternative B: A natural gas plant with an initial investment of $200 million, operating costs of $10 million per year and a useful life of 20 years. Alternative C: A coal plant with an initial investment of $100 million, operating costs of $18 million per year and a useful life of 20 years. Use the NAW method to select the best alternative. The MARR for the utility is 10%. Q1. (20%) A power utility feels that energy production capacity must be expanded to meet future anticipated demands in its service region. Three alternatives are being considered. Alternative A: A nuclear facility with an initial investment of $250 million, operating costs of $3 million per year and a useful life of 20 years. Alternative B: A natural gas plant with an initial investment of $200 million, operating costs of $10 million per year and a useful life of 20 years. Alternative C: A coal plant with an initial investment of $100 million, operating costs of $18 million per year and a useful life of 20 years. Use the NAW method to select the best alternative. The MARR for the utility is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts