Question: Q1 (25 points) Using the information below please state the appropriate cost of equity you would use to value the FCFE of a Utopian company

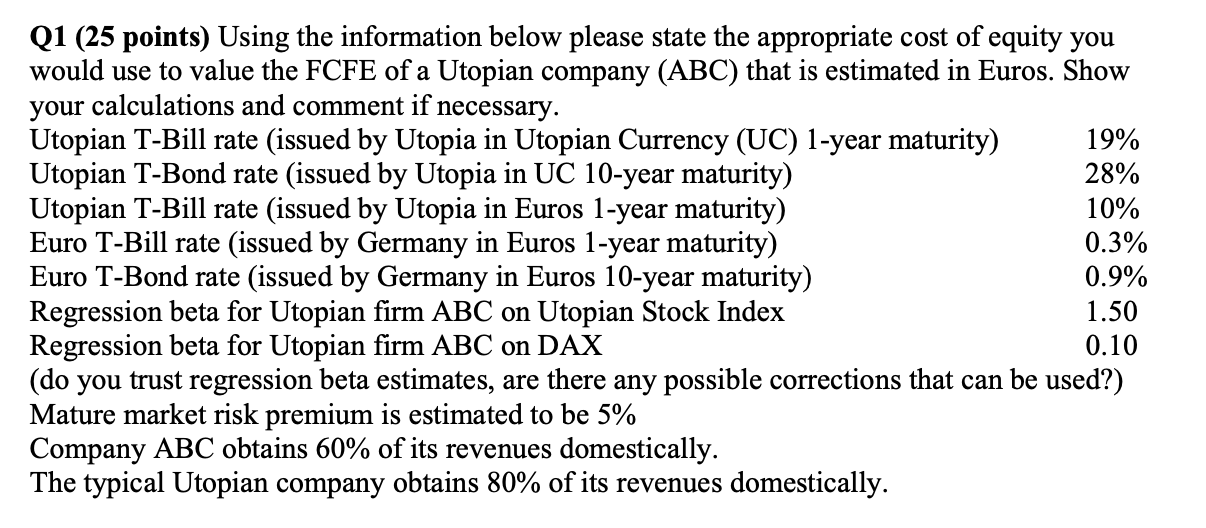

Q1 (25 points) Using the information below please state the appropriate cost of equity you would use to value the FCFE of a Utopian company (ABC) that is estimated in Euros. Show your calculations and comment if necessary. Utopian T-Bill rate (issued by Utopia in Utopian Currency (UC) 1-year maturity) 19% Utopian T-Bond rate (issued by Utopia in UC 10-year maturity) Utopian T-Bill rate (issued by Utopia in Euros 1-year maturity) 28% Euro T-Bill rate (issued by Germany in Euros 1-year maturity) 10% Euro T-Bond rate (issued by Germany in Euros 10-year maturity) 0.3% Regression beta for Utopian firm ABC on Utopian Stock Index 0.9% Regression beta for Utopian firm ABC on DAX 1.50 (do you trust regression beta estimates, are there any possible corrections that can be used?) Mature market risk premium is estimated to be 5% Company ABC obtains 60% of its revenues domestically. The typical Utopian company obtains 80% of its revenues domestically

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts