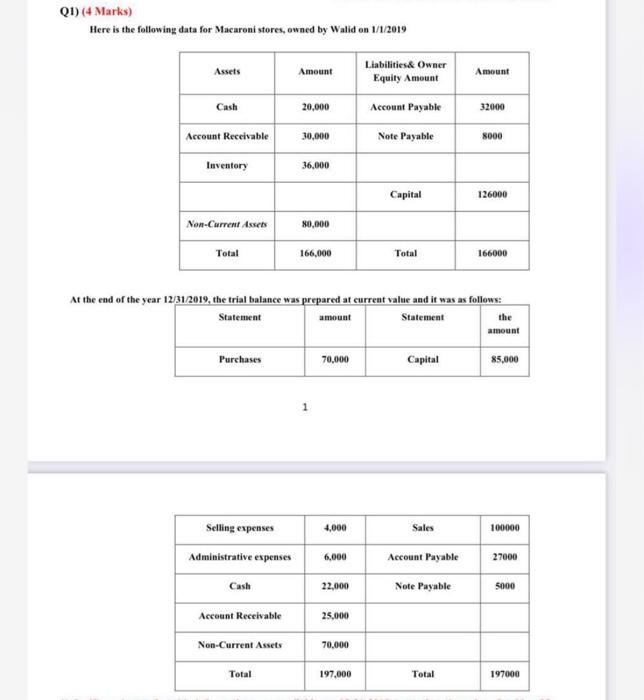

Question: Q1) (4 Marks) Here is the following data for Macaroni stores, owned by Walid on 1/1/2019 At the end of the year 12/31/2019, the trial

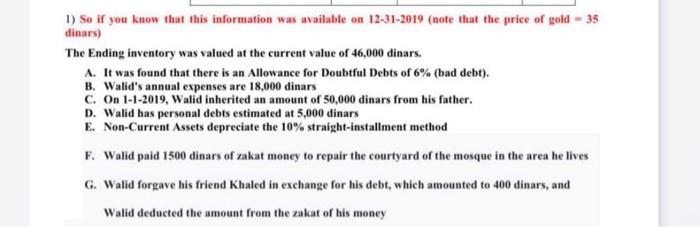

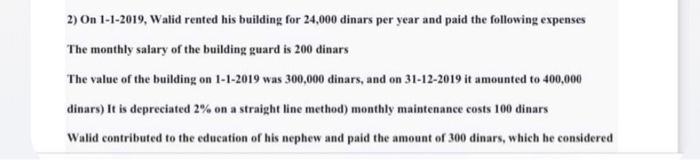

Q1) (4 Marks) Here is the following data for Macaroni stores, owned by Walid on 1/1/2019 At the end of the year 12/31/2019, the trial balance was prepared at curreat value and it was as follows: 1) So if you know that this information was available on 12-31-2019 (note that the price of gold = 35 dinars) The Ending inventory was valued at the current value of 46,000 dinars. A. It was found that there is an Allowance for Doubtful Debts of 6% (bad debt). B. Walid's annual expenses are 18,000 dinars C. On 1-1-2019, Walid inherited an amount of 50,000 dinars from his father. D. Walid has personal debts estimated at 5,000 dinars E. Non-Current Assets depreciate the 10\% straight-installment method F. Walid paid 1500 dinars of zakat money to repair the courtyard of the mosque in the area he lives G. Walid forgave his friend Khaled in exchange for his debt, which amounted to 400 dinars, and Walid deducted the amount from the zakat of his money 2) On 1-1-2019, Walid rented his building for 24,000 dinars per year and paid the following expenses The monthly salary of the building guard is 200 dinars The value of the building on 1-1-2019 was 300,000 dinars, and on 31-12-2019 it amounted to 400,000 dinars) It is depreciated 2% on a straight line method) monthly maintenance costs 100 dinars Walid contributed to the education of his nephew and paid the amount of 300 dinars, which he considere Q1) (4 Marks) Here is the following data for Macaroni stores, owned by Walid on 1/1/2019 At the end of the year 12/31/2019, the trial balance was prepared at curreat value and it was as follows: 1) So if you know that this information was available on 12-31-2019 (note that the price of gold = 35 dinars) The Ending inventory was valued at the current value of 46,000 dinars. A. It was found that there is an Allowance for Doubtful Debts of 6% (bad debt). B. Walid's annual expenses are 18,000 dinars C. On 1-1-2019, Walid inherited an amount of 50,000 dinars from his father. D. Walid has personal debts estimated at 5,000 dinars E. Non-Current Assets depreciate the 10\% straight-installment method F. Walid paid 1500 dinars of zakat money to repair the courtyard of the mosque in the area he lives G. Walid forgave his friend Khaled in exchange for his debt, which amounted to 400 dinars, and Walid deducted the amount from the zakat of his money 2) On 1-1-2019, Walid rented his building for 24,000 dinars per year and paid the following expenses The monthly salary of the building guard is 200 dinars The value of the building on 1-1-2019 was 300,000 dinars, and on 31-12-2019 it amounted to 400,000 dinars) It is depreciated 2% on a straight line method) monthly maintenance costs 100 dinars Walid contributed to the education of his nephew and paid the amount of 300 dinars, which he considere

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts