Question: Q1. (a) Arif Lee Berhad are using exponential smoothing on an annual time series concerning total revenues (in RM millions) in their company. They decide

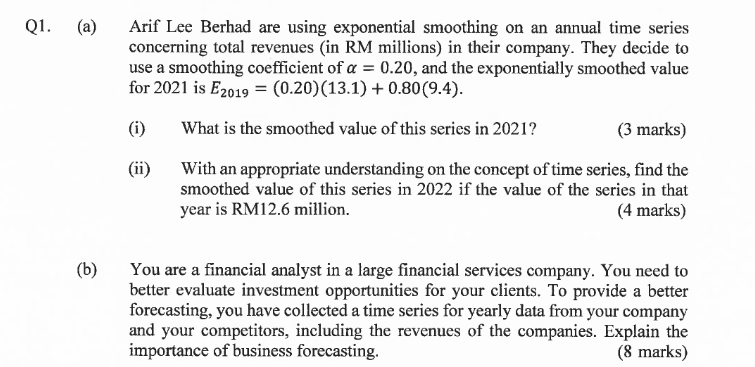

Q1. (a) Arif Lee Berhad are using exponential smoothing on an annual time series concerning total revenues (in RM millions) in their company. They decide to use a smoothing coefficient of a = 0.20, and the exponentially smoothed value for 2021 is E2019 = (0.20) (13.1) +0.80(9.4). (i) What is the smoothed value of this series in 2021? (3 marks) (ii) With an appropriate understanding on the concept of time series, find the smoothed value of this series in 2022 if the value of the series in that year is RM12.6 million. (4 marks) (b) You are a financial analyst in a large financial services company. You need to better evaluate investment opportunities for your clients. To provide a better forecasting, you have collected a time series for yearly data from your company and your competitors, including the revenues of the companies. Explain the importance of business forecasting. (8 marks) Q1. (a) Arif Lee Berhad are using exponential smoothing on an annual time series concerning total revenues (in RM millions) in their company. They decide to use a smoothing coefficient of a = 0.20, and the exponentially smoothed value for 2021 is E2019 = (0.20) (13.1) +0.80(9.4). (i) What is the smoothed value of this series in 2021? (3 marks) (ii) With an appropriate understanding on the concept of time series, find the smoothed value of this series in 2022 if the value of the series in that year is RM12.6 million. (4 marks) (b) You are a financial analyst in a large financial services company. You need to better evaluate investment opportunities for your clients. To provide a better forecasting, you have collected a time series for yearly data from your company and your competitors, including the revenues of the companies. Explain the importance of business forecasting. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts