Q1

A colleague asks for your help in finding the discount rate where the NPV=0 for a set of cash flows. You quickly recall that this is the IRR for a project. Answer in %, rounding to 2 decimals.

Year 0 cash flow = -109,000

Year 1 cash flow = 43,000

Year 2 cash flow = 35,000

Year 3 cash flow = 36,000

Year 4 cash flow = 37,000

2) A colleague asks for your help in finding the discount rate where the NPV=0 for a set of cash flows. You quickly recall that this is the IRR for a project. Answer in %, rounding to 2 decimals.

Year 0 cash flow = -101,000

Year 1 cash flow = 33,000

Year 2 cash flow = 40,000

Year 3 cash flow = 38,000

Year 4 cash flow = 42,000

3) Your firm has limited capital to invest and is therefore interested in comparing projects based on the profitability index (PI), as well as other measures. What is the PI of the project with the estimated cash flows below? The required rate of return is 16.2%. Round to 3 decimals.

Year 0 cash flow = -810,000

Year 1 cash flow = -160,000

Year 2 cash flow = 400,000

Year 3 cash flow = 430,000

Year 4 cash flow = 470,000

Year 5 cash flow = 370,000

4) The secondary industrial robot on line 3 broke down again today. The production engineer got it back on line, but says it needs a major overhaul or replacing. Should we fix or replace it? Another analyst is getting quotes and other information about potential replacements, while you analyze the expected repair cash flows.

Working with the production engineer, you estimate that the cost to repair will be $138,000 and that the remaining life of the machine would be about 3 years. The cost to maintain and operate the machine for those 3 years is expected to increase over time. The $ amounts below are the expected after-tax cash flows for the existing machine (including the overhaul cost), if it is repaired.

Its replacement would have a longer expected life than 3 years. Therefore, you plan to evaluate fix versus replace using EAC (equivalent annual cost). The discount rate for the analysis is 10.6%. Assume 3 years is the "best life" for EAC evaluation of the existing machine. Enter your answer (the EAC) as a positive number, rounded to 2 places.

Year 0 cash flow = -138,000

Year 1 cash flow = -74,000

Year 2 cash flow = -94,000

Year 3 cash flow = -103,000.

Q2.

You are analyzing the Photon project, which has the expected cash flows below. The Photon project has a 4 year life (assume "best life") and is competing against another project for funding (the Warp project). That is, the two projects are mutually exclusive. The Warp project has an 8 year life (assume "best life"; cash flows not provided).

You notice that the projects have lives of different lengths, so you ask whether the Photon project can be repeated at the end of 4 years. The answer is that it can be. To adjust for the differing lives, you decide to use the NPV replacement chain method. For your initial analysis, you are to assume that Photon can be duplicated exactly.

Using the replacement chain method and a discount rate of 13.5%, compute Photon's NPV, in a way that would be appropriate to compare to the NPV of the Warp project. Round to nearest penny.

Year 0 cash flow = -163,000

Year 1 cash flow = 71,000

Year 2 cash flow = 71,000

Year 3 cash flow = 71,000

Year 4 cash flow = 71,000.

Section two.

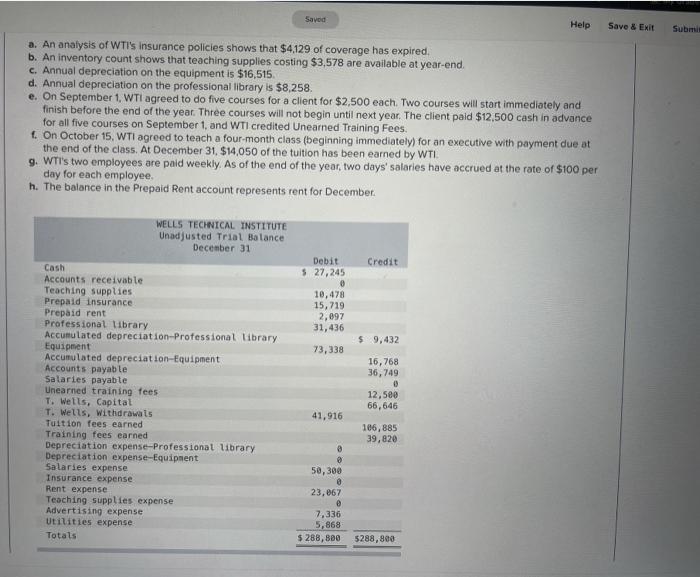

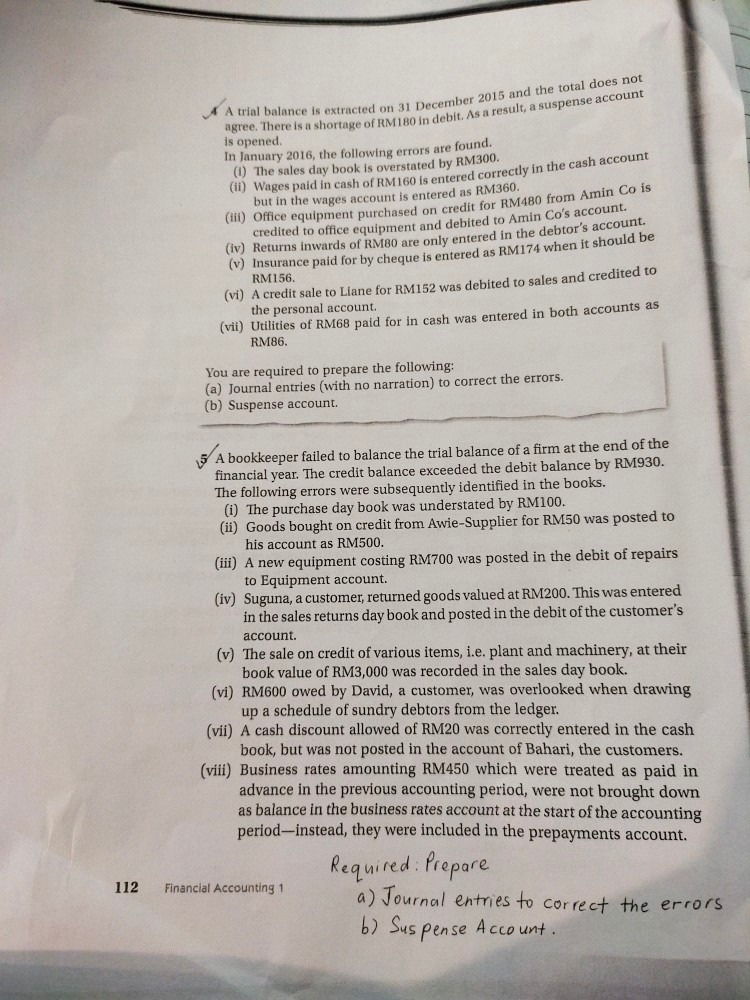

Saved Help Save & Exit Submit a. An analysis of WTI's insurance policies shows that $4.129 of coverage has expired. b. An inventory count shows that teaching supplies costing $3,578 are available at year-end. c. Annual depreciation on the equipment is $16,515. d. Annual depreciation on the professional library is $8,258 e. On September 1, WTI agreed to do five courses for a client for $2,500 each. Two courses will start immediately and finish before the end of the year. Three courses will not begin until next year. The client paid $12.500 cash in advance for all five courses on September 1, and WTI credited Unearned Training Fees. f. On October 15, WTI agreed to teach a four-month class (beginning immediately) for an executive with payment due at the end of the class. At December 31, $14,050 of the tuition has been earned by WTI g. WTI's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $100 per day for each employee. h. The balance in the Prepaid Rent account represents rent for December. WELLS TECHNICAL INSTITUTE Unadjusted Trial Balance December 31 Debit Credit Cash $ 27,245 Accounts receivable Teaching supplies 10,478 Prepaid insurance 15, 719 Prepaid rent 2, 097 Professional Library 31,436 Accumulated depreciation Professional library $ 9,432 Equipment 73, 338 Accumulated depreciation Equipment 16, 768 Accounts payable 36, 749 Salaries payable Unearned training fees 12, see T. Wells, Capital 66, 646 T. Wells, Withdrawals 41, 916 Tuition fees earned 186, 885 Training fees earned 39, 820 Depreciation expense Professional library Depreciation expense Equipment Salaries expense 50,300 Insurance expense Rent expense" 23,067 Teaching supplies expense B Advertising expense 7,336 Utilities expense 5,868 Totals $ 288, 880 5288, 804A A trial balance is extracted on 31 December 2015 and the total does not agree. There is a shortage of RM180 in debit. As a result, a suspense account is opened. In January 2016, the following errors are found. (1) The sales day book is overstated by RM300. (ii) Wages paid in cash of RM160 is entered correctly in the cash account but in the wages account is entered as RM360. (iii) Office equipment purchased on credit for RM480 from Amin Co is credited to office equipment and debited to Amin Co's account. (iv) Returns inwards of RM80 are only entered in the debtor's account. (v) Insurance paid for by cheque is entered as RM174 when it should be RM156. (vi) A credit sale to Liane for RM152 was debited to sales and credited to the personal account. (vil) Utilities of RM68 paid for in cash was entered in both accounts as RM86. You are required to prepare the following: (a) Journal entries (with no narration) to correct the errors. (b) Suspense account. 5 A bookkeeper failed to balance the trial balance of a firm at the end of the financial year. The credit balance exceeded the debit balance by RM930. The following errors were subsequently identified in the books. (i) The purchase day book was understated by RM100. (ii) Goods bought on credit from Awie-Supplier for RM50 was posted to his account as RM500. (iii) A new equipment costing RM700 was posted in the debit of repairs to Equipment account. (iv) Suguna, a customer, returned goods valued at RM200. This was entered in the sales returns day book and posted in the debit of the customer's account. (v) The sale on credit of various items, i.e. plant and machinery, at their book value of RM3,000 was recorded in the sales day book. (vi) RM600 owed by David, a customer, was overlooked when drawing up a schedule of sundry debtors from the ledger. (vii) A cash discount allowed of RM20 was correctly entered in the cash book, but was not posted in the account of Bahari, the customers. (vili) Business rates amounting RM450 which were treated as paid in advance in the previous accounting period, were not brought down as balance in the business rates account at the start of the accounting period-instead, they were included in the prepayments account. Required : Prepare 112 Financial Accounting 1 a ) Journal entries to correct the errors 6 ) Suspense Account.PART 21 Planning AATE of growers is not simply a matter of improving supply-chain These plans revolve around the three manufacturing efficiency: It also reflects the principle that the power of a plants that Mondelez operates in Ireland, and the imme- big company to contribute to global sustainability can be diate focus will be on the supply chain-in particular, the harnessed most effectively when it's extended to the activi- sourcing of raw materials. The company is already com- ties of the smaller organizations with which it does business. mitted to local sourcing. At one plant, for example, 37 per- "We can have real impact on the ground," says Weening cent of all raw materials originate locally. another plant uses As of 2013, Weening's division was sustainably soure- 21 million gallons of milk from local cooperatives that have ing 56 percent of its coffee and was well on its way to its adopted sustainable farming practices. Origin Green will add goal of 70 percent by 2015. As a matter of fact, Mondelez independent verification of farmers' and food suppliers' suc- is big on goal setting in all of its sustainability initiatives. In cess in setting and achieving measurable sustainability goals. wheat, for example, which is a core ingredient in the com- Sustainable sourcing, however, is only one aspect of Mon- pany's line of biscuits, Mondelez established the Harmony delez Ireland's sustainability strategy. In terms of organiza- Charter, a partnership with members of its wheat supply tional planning. sustainable-sourcing programs reflect a set of chain designed to encourage "more respectful agricultural carefully developed tactical plans designed to further a larger practices, which include wheat variety selection, soil man- strategic plan. Sustainability goals, for example, also include the agement, limiting fertilizers and pesticides, and smart water protection of Ireland's rich natural resources and a reduction use." The company has set a goal of using Harmony wheat in of the company's overall environmental impact. Between 2005 75 percent of its total biscuit volume by 2015. According to and 2010, the company reduced waste at all three Irish plants its 2013 report, it has reached a volume of 44 percent and is by 42 percent, and the largest of the three has already met its on target to meet that goal. goal of diverting all of its waste from Irish landfills by 2014. Mondelez is also a member of the Roundtable on Sus- Mondelez Ireland also plans to reduce carbon emissions tainable Palm Oil (RSPO), which was established in 2004 from natural gas consumption by 15 percent by 2016, and to promote the production of sustainable oil palm products like most sustainability-conscious organizations, Mondelez through the certification of industry practices. The com- International regards its various sustainability plans as part pany set a goal of having 100 percent of its palm oil supply of an overarching strategy to reduce its carbon footprint- RSPO certified by 2015, and in 2013, Mondelez announced the total of greenhouse gas (GHG) emissions for which it's that the goal had been reached two years ahead of schedule. responsible. Between 2005 and 2010, the company reduced Now that the goal has been attained, says Dave Brown, VP GHG emissions by 18 percent and then set a goal of another of global commodities and strategic sourcing, we recognize 15 percent reduction by 2015. As of 2013, it had attained a the need to go further, so we also challenged our palm oil 9 percent reduction and considered itself on target. As for suppliers to provide transparency on the levels of traceabil- reducing energy use, Mondelez admits that "more improve- ity in their palm oil supply chains. Knowing the sources of ment is needed" if it's to meet its goal of a 15 percent reduc- palm oil supplies is an essential first step to enable scrutiny tion by 2015; as of 2013, it had cut energy use by only and promote improvements in practice on the ground. 6 percent. On the upside, the company has exceeded its Not surprisingly, Mondelez set a goal for ensuring 2015 goal of reducing manufacturing waste by 15 percent, acceptable levels of supply-chain traceability-the ability to having achieved a 46 percent reduction by 2013. trace an ingredient through every stage of production and distribution. The company plans to review suppliers' trace- ability practices and then publish an action plan for giving Case Questions priority to suppliers whose practices are consistent with companywide sustainability principles. The goal is to elimi- 1. Here are a series of Mondelez's publicly announced nate all supplies that don't meet standards by 2020. objectives for enhancing sustainability; To understand how Mondelez wants to coordinate the Reducing production waste to landfill sites by entire range of its sustainability efforts, we might take a look 60 percent at one of its most recent initiatives. In 2014, Mondelez Ire- Reducing our energy and GHG in manufacturing land announced a partnership with Bord Bia Origin Green, Educating employees to reuse water and improve a nationwide Irish food-related sustainability program, to processes promote sustainability throughout the country's food sector. Reducing the impact of our operations "We have already achieved significant positive change in Ire- Addressing child labor in the cocoa supply chain land," explains Patrick Miskelly, manufacturing director of Reducing packaging material Mondelez Ireland, "but we have a lot more goals to achieve," Eliminating 50 million pounds of packaging and the company sees the Origin Green partnership as the material means of taking its sustainability plans to the next level. Buying certified commodities