Question: Q.1 ABC corp, is considering a new machine that costs $250,000 and would reduce pretax manufacturing costs by S130.000 annually. ABC would use the 3-year

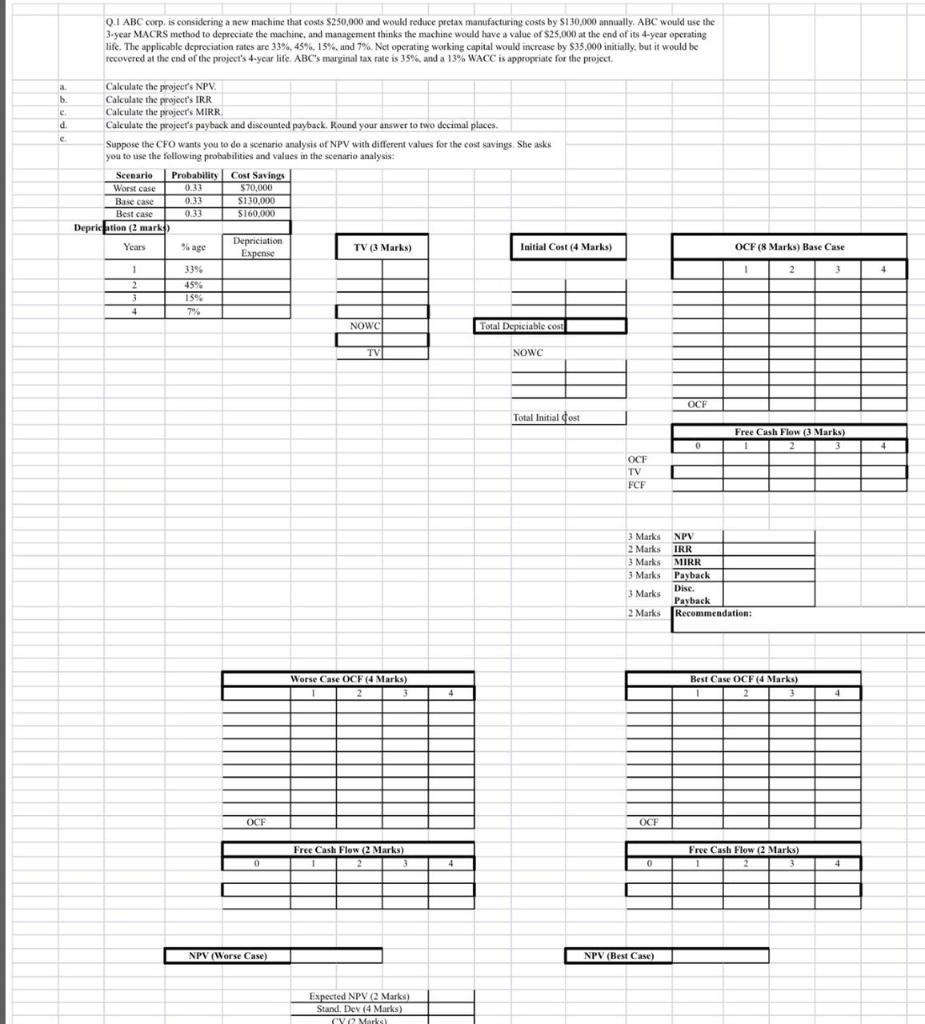

Q.1 ABC corp, is considering a new machine that costs $250,000 and would reduce pretax manufacturing costs by S130.000 annually. ABC would use the 3-year MACRS method to depreciate the machine, and management thinks the machine would have a value of $25,000 at the end of its 4-year operating life. The applicable depreciation rates are 33% 45%, 15% and 7% Net operating working capital would increase by $35.000 initially, but it would be recovered at the end of the project's 4-year lifc. ABC's marginal tax rate is 35% and a 13% WACC is appropriate for the project. b. c d. e Calculate the project's NPV Calculate the project's IRR Calculate the projeer's MIRR Calculate the project's payback and discounted payback. Round your answer to two decimal places Suppose the CFO wants you to do a scenario analysis of NPV with different values for the cost savings She asks you to use the following probabilities and values in the scenario analysis: Scenario Probability Cost Savings Worst case 0.31 $70,000 Base case S130,000 Best case 0.33 S160.000 Deprication (2 mark Years Depriciation TV (3 Marks) Initial Cost (4 Marks) Expense 1 3394 2 45% 3 159 4 7% NOWC Total Depiciable cost 0.33 OCF (8 Marks) Base Case 1 4 TV NOWC OCH Total Initial ost Free Cash Flow (3 Marks) 4 OCF TV FCF 3 Marks NPV 2 Marks IRR 3 Marks MIRR 9 Marks Payback Dise. 3 Marks Payback 2 Marks Recommendation: Worse Case OCF (4 Marks) Best Case OCF (4 Marks) 4 OCH OCF Free Cash Flow (2 Marks) Free Cash Flow (2 Marks) 0 NPV (Worse Case) NPV (Best Case) Expected NPV 2 Marks) Stand. Dey (4 Marks) CV Marks Q.1 ABC corp, is considering a new machine that costs $250,000 and would reduce pretax manufacturing costs by S130.000 annually. ABC would use the 3-year MACRS method to depreciate the machine, and management thinks the machine would have a value of $25,000 at the end of its 4-year operating life. The applicable depreciation rates are 33% 45%, 15% and 7% Net operating working capital would increase by $35.000 initially, but it would be recovered at the end of the project's 4-year lifc. ABC's marginal tax rate is 35% and a 13% WACC is appropriate for the project. b. c d. e Calculate the project's NPV Calculate the project's IRR Calculate the projeer's MIRR Calculate the project's payback and discounted payback. Round your answer to two decimal places Suppose the CFO wants you to do a scenario analysis of NPV with different values for the cost savings She asks you to use the following probabilities and values in the scenario analysis: Scenario Probability Cost Savings Worst case 0.31 $70,000 Base case S130,000 Best case 0.33 S160.000 Deprication (2 mark Years Depriciation TV (3 Marks) Initial Cost (4 Marks) Expense 1 3394 2 45% 3 159 4 7% NOWC Total Depiciable cost 0.33 OCF (8 Marks) Base Case 1 4 TV NOWC OCH Total Initial ost Free Cash Flow (3 Marks) 4 OCF TV FCF 3 Marks NPV 2 Marks IRR 3 Marks MIRR 9 Marks Payback Dise. 3 Marks Payback 2 Marks Recommendation: Worse Case OCF (4 Marks) Best Case OCF (4 Marks) 4 OCH OCF Free Cash Flow (2 Marks) Free Cash Flow (2 Marks) 0 NPV (Worse Case) NPV (Best Case) Expected NPV 2 Marks) Stand. Dey (4 Marks) CV Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts