Question: Q1 Alibaba Co. consider acquiring big data facilities and supercomputers with the cost of $ 125,000. The big data facilities can be either leased or

Q1

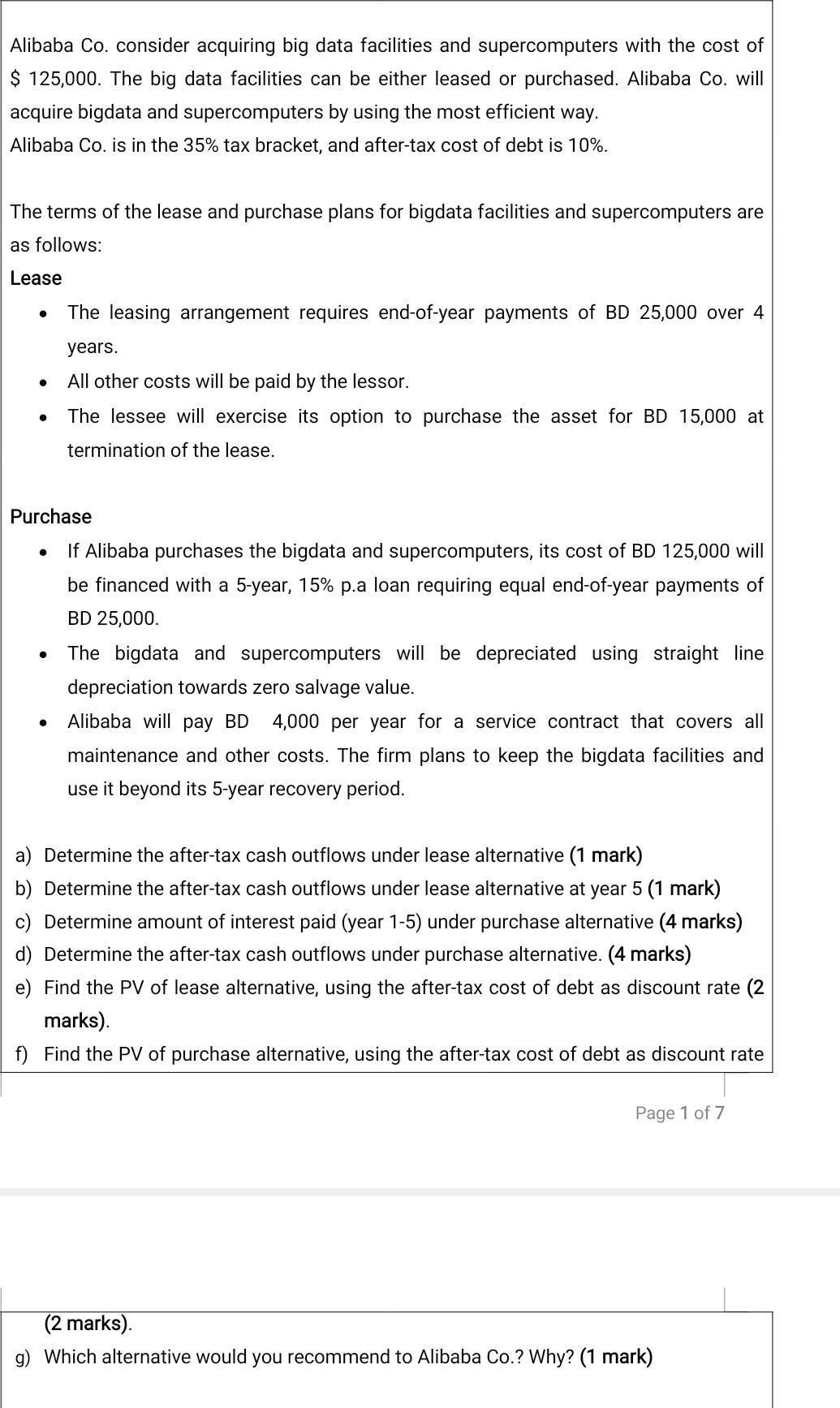

Alibaba Co. consider acquiring big data facilities and supercomputers with the cost of $ 125,000. The big data facilities can be either leased or purchased. Alibaba Co. will acquire bigdata and supercomputers by using the most efficient way. Alibaba Co. is in the 35% tax bracket, and after-tax cost of debt is 10%. The terms of the lease and purchase plans for bigdata facilities and supercomputers are as follows: Lease The leasing arrangement requires end-of-year payments of BD 25,000 over 4 years. . All other costs will be paid by the lessor. The lessee will exercise its option to purchase the asset for BD 15,000 at termination of the lease. Purchase . . If Alibaba purchases the bigdata and supercomputers, its cost of BD 125,000 will be financed with a 5-year, 15% p.a loan requiring equal end-of-year payments of BD 25,000. The bigdata and supercomputers will be depreciated using straight line depreciation towards zero salvage value. Alibaba will pay BD 4,000 per year for a service contract that covers all maintenance and other costs. The firm plans to keep the bigdata facilities and use it beyond its 5-year recovery period. a) Determine the after-tax cash outflows under lease alternative (1 mark) b) Determine the after-tax cash outflows under lease alternative at year 5 (1 mark) c) Determine amount of interest paid (year 1-5) under purchase alternative (4 marks) d) Determine the after-tax cash outflows under purchase alternative. (4 marks) e) Find the PV of lease alternative, using the after-tax cost of debt as discount rate (2 marks). f) Find the PV of purchase alternative, using the after-tax cost of debt as discount rate Page 1 of 7 (2 marks). g) Which alternative would you recommend to Alibaba Co.? Why? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts