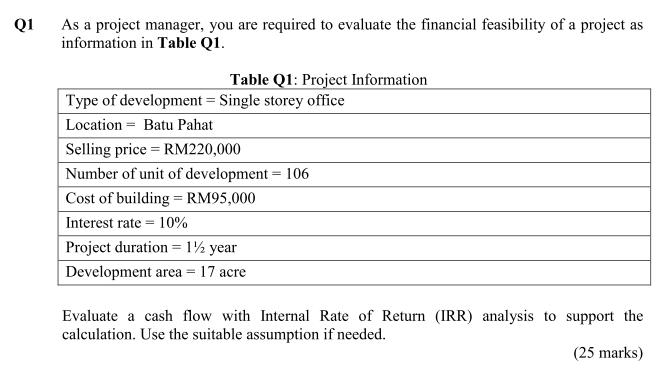

Question: Q1 As a project manager, you are required to evaluate the financial feasibility of a project as information in Table Q1. Table Q1: Project Information

Q1 As a project manager, you are required to evaluate the financial feasibility of a project as information in Table Q1. Table Q1: Project Information Type of development = Single storey office Location = Batu Pahat Selling price = RM220,000 Number of unit of development = 106 Cost of building = RM95,000 Interest rate = 10% Project duration=1/2 year Development area = 17 acre Evaluate a cash flow with Internal Rate of Return (IRR) analysis to support the calculation. Use the suitable assumption if needed. (25 marks) Q1 As a project manager, you are required to evaluate the financial feasibility of a project as information in Table Q1. Table Q1: Project Information Type of development = Single storey office Location = Batu Pahat Selling price = RM220,000 Number of unit of development = 106 Cost of building = RM95,000 Interest rate = 10% Project duration=1/2 year Development area = 17 acre Evaluate a cash flow with Internal Rate of Return (IRR) analysis to support the calculation. Use the suitable assumption if needed. (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts