Question: Q1: Current Attempt in Progress Cullumber Inc. produces three separate products from a common process costing $100,600. Each of the products can be sold at

Q1:

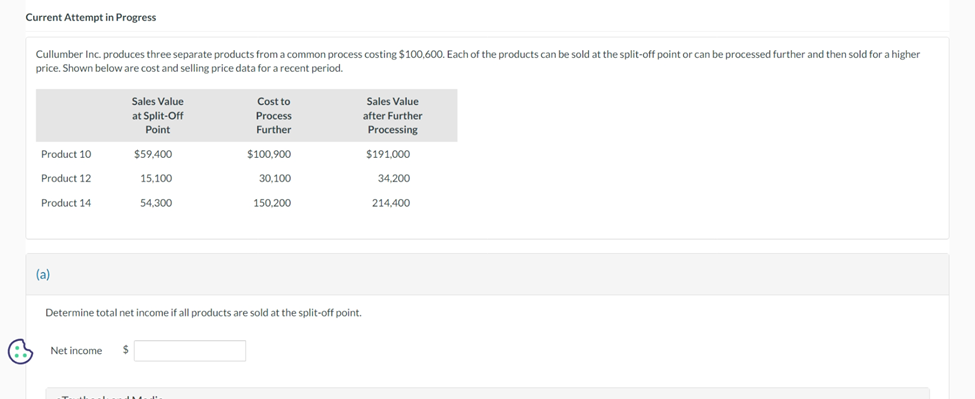

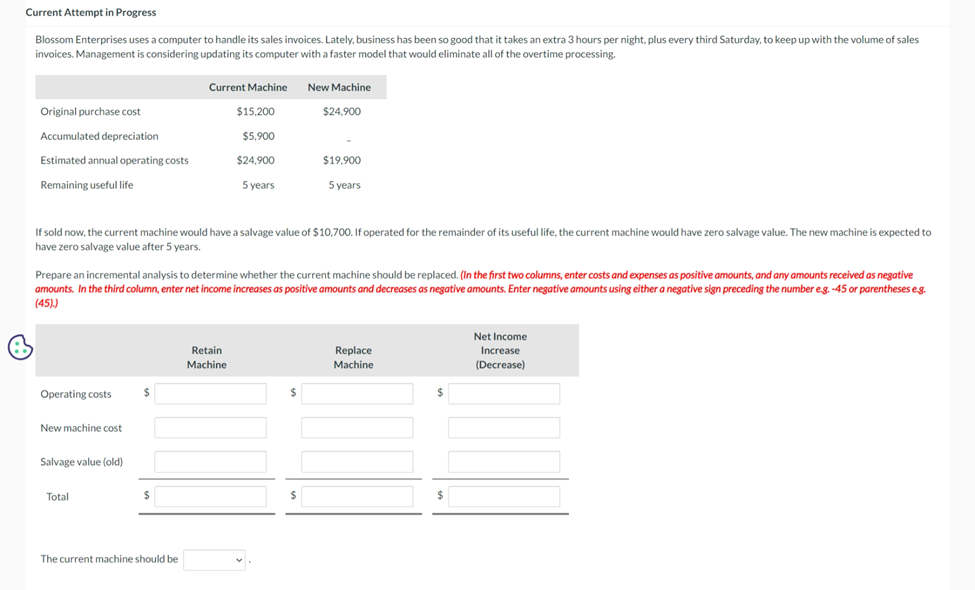

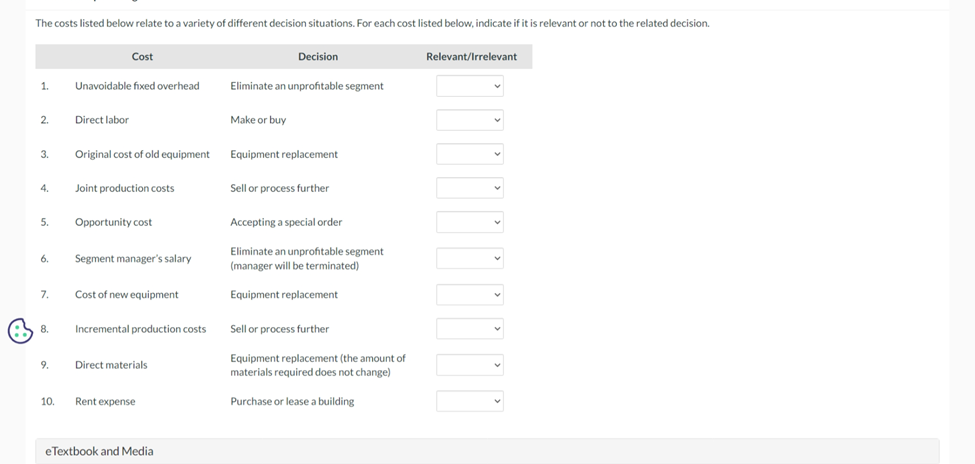

Current Attempt in Progress Cullumber Inc. produces three separate products from a common process costing $100,600. Each of the products can be sold at the split-off point or can be processed further and then sold for a higher price. Shown below are cost and selling price data for a recent period. Sales Value Cost to Sales Value at Split-Off Process after Further Point Further Processing Product 10 $59.400 $100.900 $191,000 Product 12 15.100 30.100 34.200 Product 14 54.300 150.200 214.400 (a) Determine total net income if all products are sold at the split-off point. Net incomeCurrent Attempt in Progress Blossom Enterprises uses a computer to handle its sales invoices. Lately, business has been so good that it takes an extra 3 hours per night, plus every third Saturday, to keep up with the volume of sales invoices. Management is considering updating its computer with a faster model that would eliminate all of the overtime processing. Current Machine New Machine Original purchase cost $15,200 $24.900 Accumulated depreciation $5,900 Estimated annual operating costs $24,900 $19.900 Remaining useful life 5 years 5 years If sold now, the current machine would have a salvage value of $10.700. If operated for the remainder of its useful life, the current machine would have zero salvage value. The new machine is expected to have zero salvage value after 5 years. Prepare an incremental analysis to determine whether the current machine should be replaced. (In the first two columns, enter costs and expenses as positive amounts, and any amounts received as negative amounts. In the third column, enter net income increases as positive amounts and decreases as negative amounts. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45)) Net Income Retain Replace Increase Machine Machine (Decrease) Operating costs $ $ $ New machine cost Salvage value (old) Total S S $ The current machine should beThe costs listed below relate to a variety of different decision situations. For each cost listed below, indicate if it is relevant or not to the related decision. Cost Decision Relevant/Irrelevant Unavoidable fixed overhead Eliminate an unprofitable segment 2. Direct labor Make or buy 3. Original cost of old equipment Equipment replacement 4 Joint production costs Sell or process further 5. Opportunity cost Accepting a special order Segment manager's salary Eliminate an unprofitable segment 6. (manager will be terminated) 7. Cost of new equipment Equipment replacement 8, Incremental production costs Sell or process further 9. Direct materials Equipment replacement (the amount of materials required does not change) 10. Rent expense Purchase or lease a building eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts