Question: Q1: Edward is employed as an engine driver on a tourist steam train. For the year ended 30 June 2020, he has incurred the

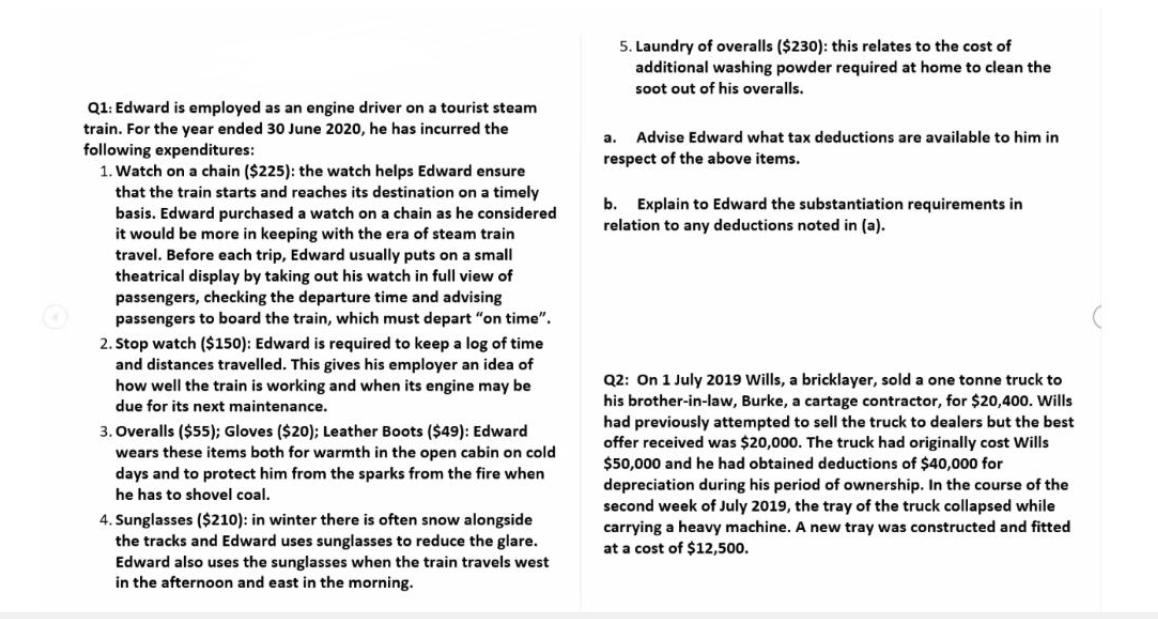

Q1: Edward is employed as an engine driver on a tourist steam train. For the year ended 30 June 2020, he has incurred the following expenditures: 1. Watch on a chain ($225): the watch helps Edward ensure that the train starts and reaches its destination on a timely basis. Edward purchased a watch on a chain as he considered it would be more in keeping with the era of steam train travel. Before each trip, Edward usually puts on a small theatrical display by taking out his watch in full view of passengers, checking the departure time and advising passengers to board the train, which must depart "on time". 2. Stop watch ($150): Edward is required to keep a log of time and distances travelled. This gives his employer an idea of how well the train is working and when its engine may be due for its next maintenance. 3. Overalls ($55); Gloves ($20); Leather Boots ($49): Edward wears these items both for warmth in the open cabin on cold days and to protect him from the sparks from the fire when he has to shovel coal. 4. Sunglasses ($210): in winter there is often snow alongside the tracks and Edward uses sunglasses to reduce the glare. Edward also uses the sunglasses when the train travels west in the afternoon and east in the morning. a. 5. Laundry of overalls ($230): this relates to the cost of additional washing powder required at home to clean the soot out of his overalls. Advise Edward what tax deductions are available to him in respect of the above items. b. Explain to Edward the substantiation requirements in relation to any deductions noted in (a). Q2: On 1 July 2019 Wills, a bricklayer, sold a one tonne truck to his brother-in-law, Burke, a cartage contractor, for $20,400. Wills had previously attempted to sell the truck to dealers but the best offer received was $20,000. The truck had originally cost Wills $50,000 and he had obtained deductions of $40,000 for depreciation during his period of ownership. In the course of the second week of July 2019, the tray of the truck collapsed while carrying a heavy machine. A new tray was constructed and fitted at a cost of $12,500.

Step by Step Solution

There are 3 Steps involved in it

Q1 a Tax deductions available to Edward 1 Watch on a chain 225 The cost of the watch can be claimed as a tax deduction as it is used for work purposes ... View full answer

Get step-by-step solutions from verified subject matter experts