Question: q1. explain why sam ltd is required to recognise the lease on its balance sheet, rather than just expensing lease payments when they are paid.

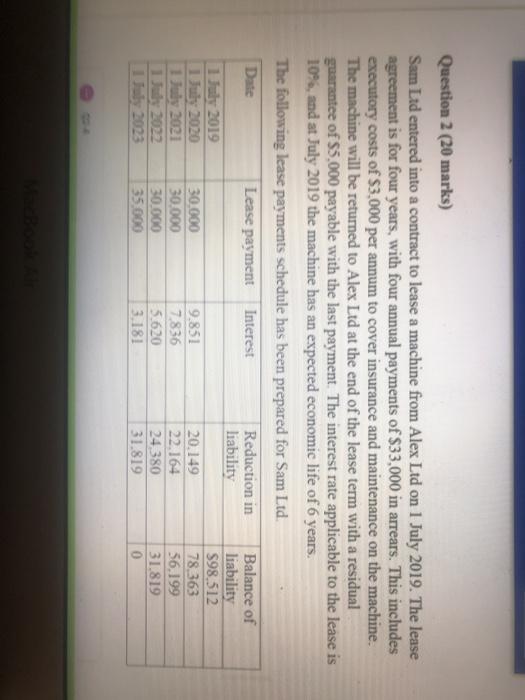

Question 2 (20 marks) Sam Lad entered into a contract to lease a machine from Alex Ltd on 1 July 2019. The lease agreement is for four years, with four annual payments of $33,000 in arrears. This includes executory costs of $3,000 per annum to cover insurance and maintenance on the machine. The machine will be returned to Alex Ltd at the end of the lease term with a residual guarantee of $5,000 payable with the last payment. The interest rate applicable to the lease is 10%, and at July 2019 the machine has an expected economic life of 6 years. The following lease payments schedule has been prepared for Sam Ltd. Date Lease payment Interest Reduction in Balance of liability liability 1 July 2019 $98.512 1 July 2020 30.000 9.851 20.149 78.363 1 July 2021 30.000 7.836 22.164 56.199 1 July 2022 30.000 5.620 24380 31.819 1 July 2023 35.000 3.181 31.819 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts