Question: Q1 - GEC (16 marks) Please do not use column A as I would like to use it to record my narking Green Energy Co.

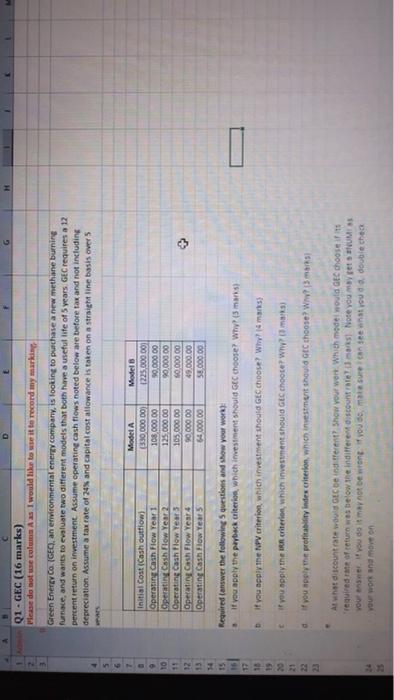

Q1 - GEC (16 marks) Please do not use column A as I would like to use it to record my narking Green Energy Co. (GEC), an environmental energy company, is looking to purchase a new methane burning furnace, and wants to evaluate two different models that both have a useful life of years. GEC requires a 12 percent return on investment. Assume operating cash flows noted below are before tax and not including depreciation. Assume a tax rate of 24 and capital cost allowance is taken on a straight line basis over 5 years. al Cost Cash outflow) Operating Cash Flow Year 1 Operatin Cash Flow Year 2 Operatin Cash Flow Year 3 Opetutiny Cash Flow Year 4 Operating Cash Flow Year Model A WVALUEI WVALUE! #VALUE! NVALUE! VALUE #VALUE! Model B WVALUE AVALUE WVALUE #VALUE! WVALUE! WVALUE > 11 Required answer the following questions and show your work): if you apply the poytack criterion, which investment should GEC choose? Why? (3 marks) if you apply the NPV aliterion, which investment should GEC choose? Why? (4 marks) you apply the criterion, which investment should GC choose? Wiw marks) you apply the profitability index criterion, which investment should GEC choose! Why? marki) 01 GEC A D H Q1. GEC (16 marks) Please do not use column A as I would like to use it to record my marking 3 Green Energy Co. (GEC), an environmental energy company is looking to purchase a new methane burning furnace, and wants to evaluate two different models that both have a useful life of 5 years GEC requires a 12 percent return on investment Assume operating cash flows noted below are before tax and not including depreciation Assume a tax rate of 24% and capital cost allowance is taken on a straight line basis over 5 Initial Cost (Cash outfiow) Operating Cash Flow Year 1 Operating Cash Flow. Year 2 Operating Cash Flow Years Operating Cash Flow Year4 Operatin Cash Flow Years Model A 1330 000 00 108.000.00 125 000.00 105 000 00 000000 64000.00 Model 1225.000.00 50.000 00 90,000.00 0.00000 49,000.00 58.900.00 I Required answer the following questions and show your work If you apply the perback criterion, which investment should GC choose? Why? (3 mans) D If you apply the NPV criterion, which investment should GEC choose? Why? Is marks you npply the criterion, which investment should GEC choose? Wnmarks If you apply the profily Index criterion, which investment should choose? Why? At what discount rate would be interent show your wont whith model would GEC choose fit required to return was below the indifferent discount rates Note you may UMI you are you do it may not be wont vous sure you a double check One more on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts