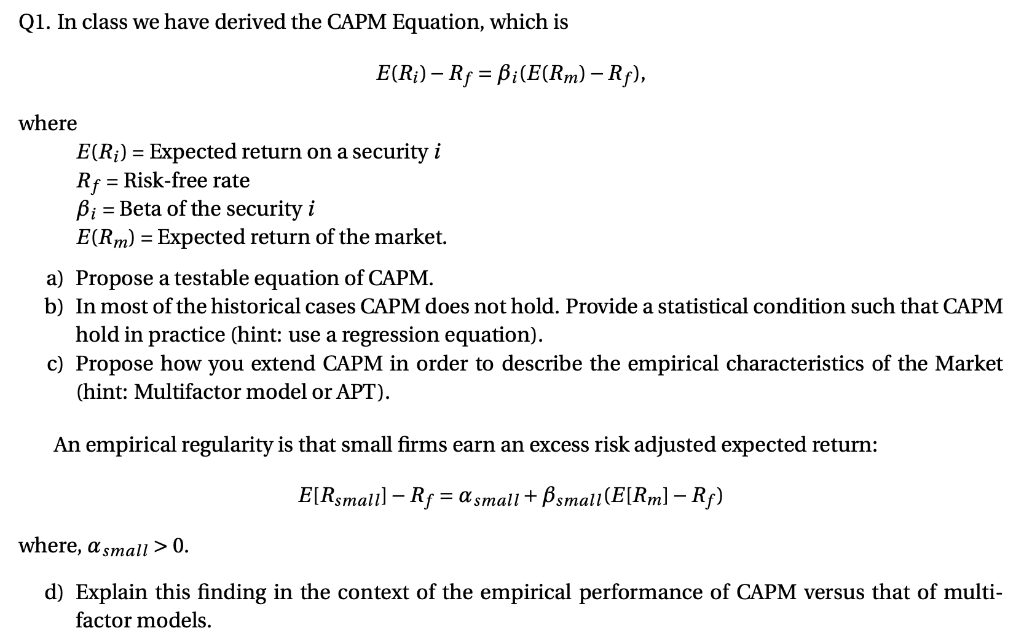

Question: Q1. In class we have derived the CAPM Equation, which is E(Ri) Rp = Bi(E(Rm) - Rf), where E(Ri) = Expected return on a security

Q1. In class we have derived the CAPM Equation, which is E(Ri) Rp = Bi(E(Rm) - Rf), where E(Ri) = Expected return on a security i Rf = Risk-free rate Bi = Beta of the security i E(Rm) = Expected return of the market. a) Propose a testable equation of CAPM. b) In most of the historical cases CAPM does not hold. Provide a statistical condition such that CAPM hold in practice (hint: use a regression equation). c) Propose how you extend CAPM in order to describe the empirical characteristics of the Market (hint: Multifactor model or APT). An empirical regularity is that small firms earn an excess risk adjusted expected return: E[Rsmalll Rp = a small +Bsmall(E[Rm] Rp) where, a small> 0. d) Explain this finding in the context of the empirical performance of CAPM versus that of multi- factor models. Q1. In class we have derived the CAPM Equation, which is E(Ri) Rp = Bi(E(Rm) - Rf), where E(Ri) = Expected return on a security i Rf = Risk-free rate Bi = Beta of the security i E(Rm) = Expected return of the market. a) Propose a testable equation of CAPM. b) In most of the historical cases CAPM does not hold. Provide a statistical condition such that CAPM hold in practice (hint: use a regression equation). c) Propose how you extend CAPM in order to describe the empirical characteristics of the Market (hint: Multifactor model or APT). An empirical regularity is that small firms earn an excess risk adjusted expected return: E[Rsmalll Rp = a small +Bsmall(E[Rm] Rp) where, a small> 0. d) Explain this finding in the context of the empirical performance of CAPM versus that of multi- factor models

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts