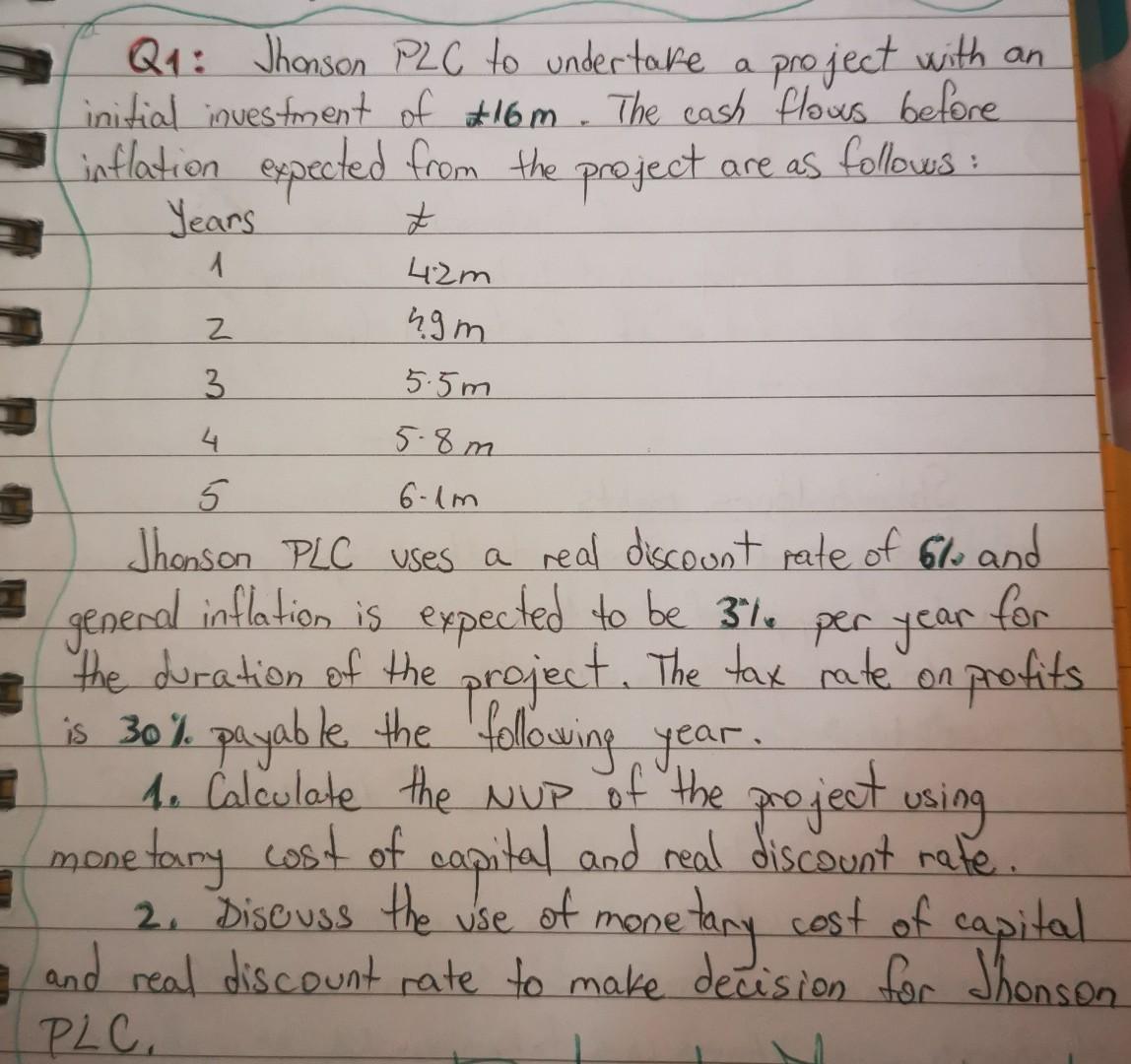

Question: Q1: Jhonson PLC to undertake a project with an initial investment of $16m. The cash flows before inflation expected from the project are as follows:

Q1: Jhonson PLC to undertake a project with an initial investment of $16m. The cash flows before inflation expected from the project are as follows: Years12345=4.2m4.9m5.5m5.8m6.1m Thonson PLC uses a real discount rate of 610 and general inflation is expected to be 3\% per year for the duration of the project. The tax rate on profits is 30% payable the following year. 1. Calculate the NUP of the project using monetary cost of casital and real discount rate. 2. Disouss the use of monetany cost of capital and real discount rate to make decision for Jhonson P) C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock