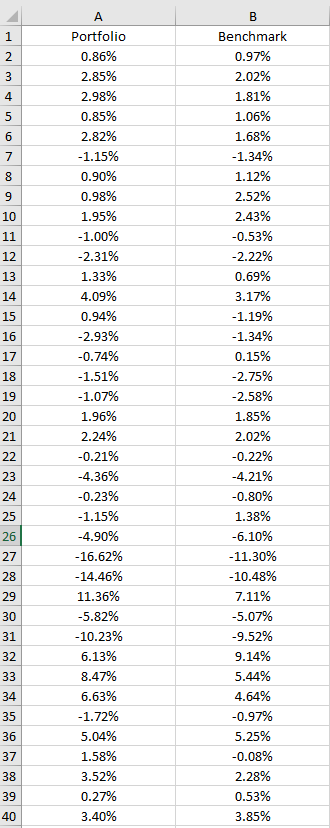

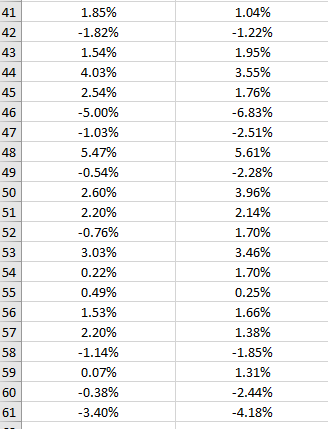

Question: Q1. Monthly return data for a portfolio and its benchmark is provided excel. Calculate the over or under performance of the portfolio against the benchmark.

Q1. Monthly return data for a portfolio and its benchmark is provided excel. Calculate the over or under performance of the portfolio against the benchmark.

1)-0.24% per month 2)-1.2% per month 3)0.18% per month

4)0.06% per month 5)-0.3%% per month

Q2.Calculate the following risk measures for the portfolio:

(i) Volatility

(ii) Probability of a return below -2% per month.

(iii) Value at Risk at 90% using the non-parametric method.

1.(i) 1.8%; (ii) 16.7%; (iii) -7.24%

2.(i) 3.89%; (ii) 23.3%; (iii) -4.29%

3.(i) 0.8%; (ii) -6.7%; (iii) -0.5%

4.(i) 4.5%; (ii) 16.7%; (iii) -4.41%

5.(i) 0.24%; (ii) 2.5%; (iii) 1.5%

Q3. Monthly returns for the portfolio and its benchmark in excel.

You are required to calculate the relative risk of the portfolio against the benchmark using an OLS regression.

1)1.58%

2)2.5%

3)0.54%

4)1.54%

5)0.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts