Question: Q#1. Problem A, Part 1 - Compute the predetermined plant-wide overhead rates using these allocation bases: (Enter them as amounts, not percentages, two decimals.) Direct

Q#1. Problem A, Part 1 - Compute the predetermined plant-wide overhead rates using these allocation bases: (Enter them as amounts, not percentages, two decimals.)

Direct Labor Cost

Direct Labor Hours

Machine Hours

Q#2. Problem A, Part 2 - Enter the over or underapplied overhead amounts for each of the allocation bases. (If any of the amounts represent overapplied overhead, enter them in parentheses. Use commas, two decimals)

Direct Labor Cost

Direct Labor Hours

Machine Hours

Q#3. Problem A, Part 3- Indicate how COGS and NOI would be affected by the over or underapplied MOH amounts calculated Part 2.

Direct Labor Cost: COGS would be ["Too high", "Too low"]; NOI would be ["Too low", "Too high"]

Direct Labor Hours: COGS would be ["Too low", "Too high"]; NOI would be ["Too high", "Too low"]

Machine Hours: COGS would be ["Too high", "Too low"]; NOI would be ["Too low", "Too high"]

Q#4. Problem A, Part 4 - Based solely on the data given in the problem, which activity seemed to be the true MOH cost driver?

Direct labor dollars

Direct labor hours

Machine hours

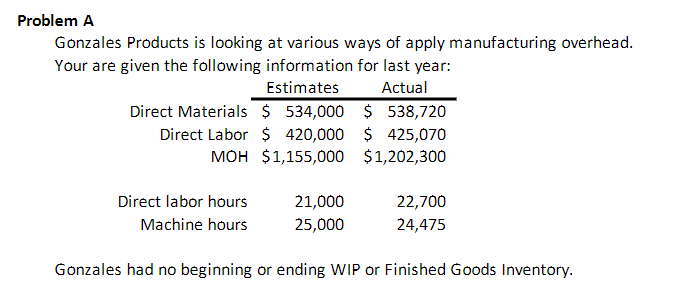

Problem A Gonzales Products is looking at various ways of apply manufacturing overhead Your are given the following information for last year: Estimates Actual Direct Materials $ 534,000 538,720 Direct Labor 420,000 425,070 MOH $1,155,000 $1,202,300 Direct labor hours 21,000 Machine hours25,000 22,700 24,475 Gonzales had no beginning or ending WIP or Finished Goods Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts